Wave pattern

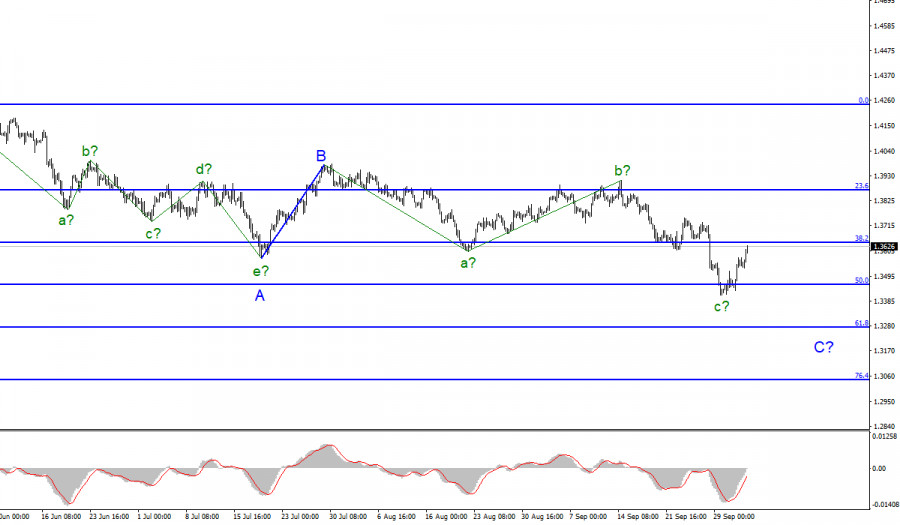

The wave counting for GBP/USD has become more complicated and now it is expected to continue building a downward trend section. The instrument has declined by 300 basis points in recent days, and also made a successful attempt to break through the low of the previous waves a and e. Thus, adjustments were made to the wave pattern and now it has acquired the form of a downward trend section, which can also be corrective in nature. This assumption is prompted by the internal structure of the proposed wave A, which cannot be called impulsive. Also, an absolutely non-impulsive form is taken by the assumed wave C from this section of the trend. However, given the length of each wave in the composition of C, it can be assumed that it will turn out to be very long. If this assumption is correct, then the British pound gets a high probability of continuing the decline with the nearest target located near the level of 61.8%. The exit of quotes from the reached lows today may be a wave d in the composition of C.

The pound experienced a "fuel shock"

The exchange rate of the Pound/Dollar instrument increased by 90 basis points on Monday. Thus, the pound's rapid recovery continues after it experienced a "fuel shock" last week. There were no other visible reasons for such a strong increase in the quotes of the instrument, there was not a single important report or other events during the day. Thus, the pound rushed up, without waiting for important news this week. For the whole week, only business activity indices in the fields of manufacturing and construction will be released in the UK. I do not expect the markets to work them out, as the movement on Monday showed that they are concerned about completely different news and topics at the current time.

At the weekend, Boris Johnson said that the fuel shortage situation was improving, and the military joined the cause, which will now deliver fuel to gas stations. In addition, the government is now resolving the issue of temporary visas and their extension for drivers from EU countries. The markets, having learned this news, were able to breathe more freely, so the pound strengthened its positions well on Monday. Now the most important event -- Nonfarm Payrolls and unemployment data in the United States, will be released on Friday.

The growth of the British pound in the last few days was quite strong and it may not affect the current wave counting in the best way. A successful attempt to break through the level of 1.3639 may lead to the completion of the construction of a corrective wave in the composition of C. A successful one may lead to an even greater complication of the current wave structure since wave C will take on an even more complex form.

General conclusions

The wave pattern has changed dramatically after yesterday's decline. Now the wave pattern has received a downward view, but not an impulse one. Therefore, now I advise you to sell the instrument for each MACD signal based on the construction of wave C, which can get quite long, with targets located near the calculated mark of 1.3273, which corresponds to 61.8% Fibonacci level. For some time, the instrument may continue to increase within the framework of the expected corrective wave d in C.

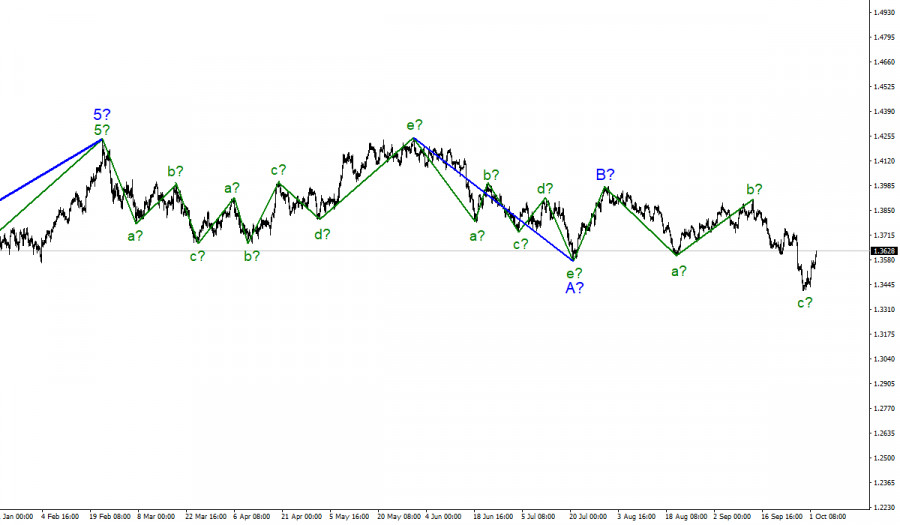

The upward section of the trend, which began its construction a couple of months ago, has taken a rather ambiguous form and has already been completed. The construction of the upward trend section has been canceled and now we can assume that on January 6, the construction of a new downward trend section began, which can turn out to be almost any size.

The material has been provided by InstaForex Company - www.instaforex.com