The USD/CHF pair rebounded today as the Dollar Index has escaped from a down-channel pattern signaling that the downside is over. As you already know from my analysis, we have a strong positive correlation between the DXY and USD/CHF.

When the index increases, the pair increases as well, and when the DXY drops, the USD/CHF pair could drop as well. Despite the current rebound, the pair is still under pressure.

The US dollar was boosted by Powell's hawkish remarks on Friday. Also, the United States Flash Services PMI indicator was reported 58.2 points far above 55.3 expected which means that the expansion continued. Still, the greenback needs support to be able to resume its growth. The CB Consumer Confidence could lift the dollar if it comes in better than expected.

USD/CHF oversold signs

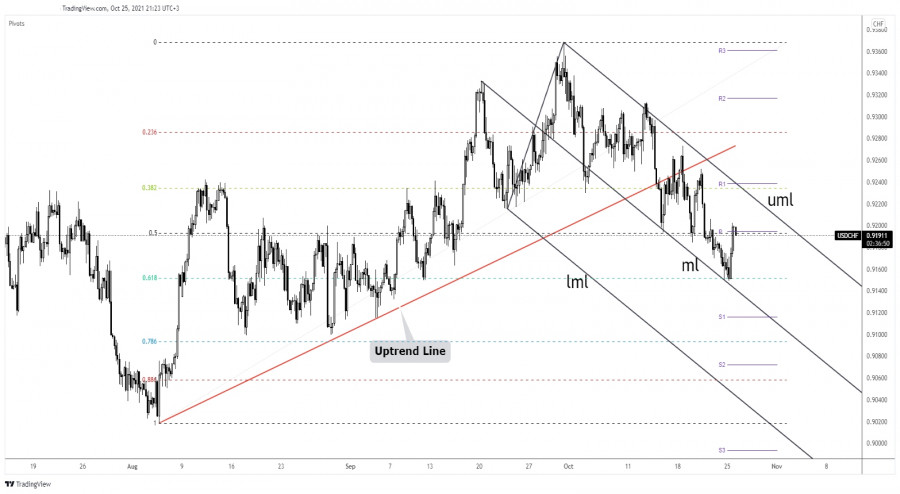

USD/CHF has found support on the 61.8% retracement level and on the median line (ml) of the Descending Pitchfork. At the moment of writing, it was traded at 0.9195 level above the 50% retracement level and above 0.9194 weekly pivot point.

Technically, the bias is bearish as long as it stays within the Descending Pitchfork's body, below the upper median line (uml). In the short term, it could move sideways before trying to make an upside breakout.

USD/CHF forecast

The pair could extend its growth if the Dollar Index jumps higher. DXY retreated a little to retest the broken levels. Further growth registered by the index should force the USD/CHF to climb higher.

Personally, I would like to see a sideways movement followed by a valid breakout above the upper median line (uml) before deciding to go long. Only a new lower low may activate a larger drop.

The bullish engulfing candlestick printed on the 61.8% retracement level signaled that the sell-off is over. A temporary retreat could bring potential new buying opportunities. Also, a valid breakout above the upper median line (uml) could represent a long signal as well.

The material has been provided by InstaForex Company - www.instaforex.com