Dear colleagues!

By tradition, at the end of the outgoing year, it is customary to sum up the results and assess plans for the future. Therefore, I would like to dedicate an article on this topic. It will be all the more interesting to compare forecasts that were given last year with what we received today. Given the extraordinary circumstances in which the world economy finds itself this year, it would be at least naive to expect that December 2019 ideas can be implemented on the value of certain assets in December 2020, but at least it will be very useful.

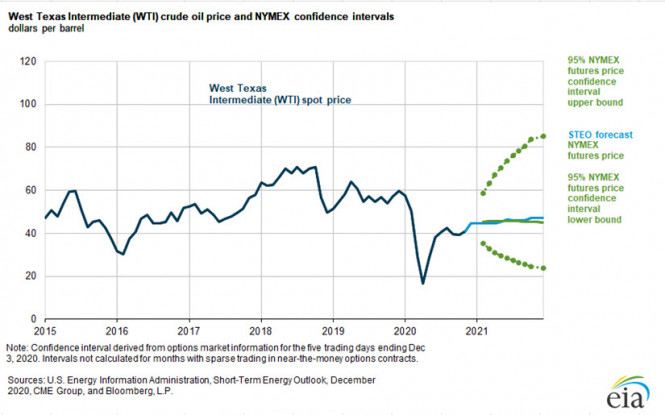

Let's start summing up the outgoing year with the oil price. In December 2019, the US Energy Information Agency - US EIA - assumed the price of North American WTI oil in December 2020 would be at $60 per barrel, however, NYMEX traders were more pessimistic and considered the most likely price of WTI #CL grade at $55. As you can see, the collective mind turned out to be stronger and more accurately determined the price than a host of analysts on the US government salary.

Figure 1: WTI #CL Oil Price Forecast for 2021

The US EIA's forecast for next year is $46 a barrel, and NYMEX traders are forecasting $45, which is not bad considering that the coronavirus hit the oil industry in 2020. Moreover, the Agency assumes that by the end of next year, WTI #CL oil will be at $47.

Naturally, if it weren't for the OPEC+ deal and the measures taken to cut production, the market situation would have been completely different. However, in fairness, take note that price planning has shown high efficiency, and the Covid-19 epidemic has dealt a heavy blow on American oil companies that did not take part in the deal. In 2019, US oil production was 12.25 million barrels per day. In 2020, production dropped to 11.34 million barrels, and in 2021 it is projected even lower, at 11.10 million. Thus, more than a million barrels of American shale oil will leave the market, and the United States will actually lose the exporter status that it received in 2019. This is a success. Moreover, the number of drilling rigs in the United States and Canada has decreased by 457 units compared to last year, more than twice, and the current price increase does not make it possible for shale oil production to recover. In this sense, investing in US shale producers is a very dubious story.

It can be assumed that the Joe Biden administration that came to power is unlikely to lobby for the interests of oil producers by introducing a ban on hydraulic fracturing technology on federal lands, which will actually put an end to the United States as an oil exporter. Thus, with the price of oil at $50 per barrel, the growth of oil consumption by the world economy will bring benefits to countries that are members of the OPEC+ agreement, as well as corporations engaged in traditional production methods. In turn, American shale producers will experience a lack of capital investment, which means that they are unlikely to be able to significantly reduce the cost of production technologies in the foreseeable future.

Given the current circumstances - falling oil consumption in the world and falling production in the United States - inflationary processes that may occur in the event of a decline in the dollar will pose as a great danger for oil producers. If OPEC+ manages to meet the interests of the parties by increasing production and preventing a sharp increase in the price of oil, then in the long term this may finally, if not bury, then significantly limit the possibilities of shale production in the United States. If oil producers prefer short-term benefits to strategic goals, they risk facing not only resurrected shale oil producers, but also competition from alternative energy sources.

The most successful prediction in 2019 was the growth in the price of gold. However, take note that since it updated the record high, the yellow metal exceeded analysts' expectations, bringing investors a yield of 20% per annum in US dollars. Given the work of the printing press on both sides of the ocean, as well as low interest rates, in 2021, we can assume a further increase in the price of gold against all currencies. In an environment where money does not generate income, and rates are close to zero or have a negative value, investors will by compulsion be forced to consider gold as an alternative to other investments.

The global economic recovery from the stress of 2020 could spur demand from the jewelry industry, pushing the price of gold and gold miners further higher. However, it is unlikely that we should assume the price will soar, rather, traders and investors can count on a 15% rise in gold quotes to the level of $2,250 per troy ounce. At the same time, one cannot exclude the possibility that next year gold will not be able to renew the current year's high and it will not bring significant returns to investors. The average return in US dollars that gold has generated over the past ten years has been around 8%. This year was an exception, so if in 2021 gold adds 10% to its value and ends the year above the $2000 level, it can already be considered a good result.

Happy New Year, be careful and follow the rules of money management, may the coronavirus pass us by!

The material has been provided by InstaForex Company - www.instaforex.com