The US dollar reacted late to the release of US labor market growth data. Last Friday, the indicated currency actually ignored Nonfarm and strengthened its position amid massive profit taking. As this week started, the dollar returned to its usual weakening. During the Asian session, the major dollar pairs did not continue Friday's trend towards the dollar's strengthening. And although we are talking about minimal price fluctuations of a flat nature, we can conclude that the US dollar is still a vulnerable currency, and the market has not yet recovered the NonFarms in November.

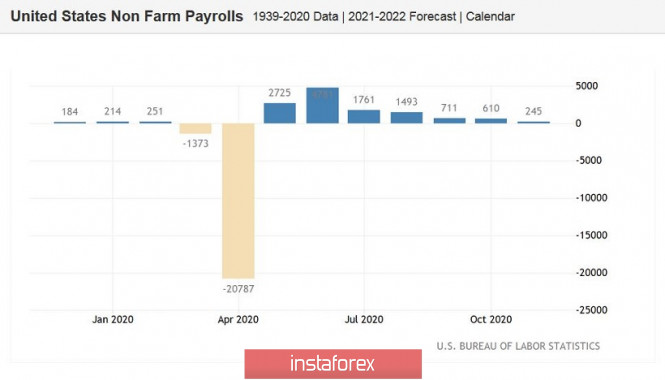

In general, Friday's data release was weaker than expected, reflecting a stronger slowdown in the US labor market. The report was controversial, with its own strengths and weaknesses. On one hand, the unemployment rate declined, while salary indicators increased. On the other hand, there are other data that are below than the predicted values. In this regard, the number of people employed in the non-agricultural sector rose by 245 thousand, but experts expected to see this indicator much higher – almost at the level of half a million (480 thousand). The growth in the number of people employed in the manufacturing sector was also disappointing. It rose by only 27 thousand, instead of the forecasted growth of 53 thousand. There is also a similar situation in the private sector of the economy, where experts expected to see an increase of almost 600 thousand jobs, but in reality, the indicator grew by only 344 thousand.

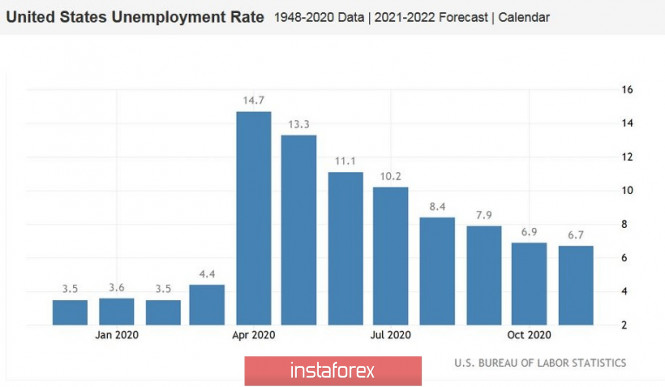

Nevertheless, Friday's release also had a positive side. For example, salaries turned out to be slightly better than predicted values. Traders saw that the average hourly wages on a monthly basis rose by 0.4%, although it is expected to decline to zero. In annual terms, the index remained at the October level (4.4%). The unemployment rate, which dropped to 6.7%, was also pleasant. However, it is necessary to consider that the unemployment rate does not react so quickly to the current situation, as it is one of the lagging economic indicators. Therefore, some traders' optimism about reducing unemployment is still early, since more operational indicators are not so optimistic – all components came out below the forecast values.

In particular, the growth employment rate in the non-agricultural sector has been declining for five consecutive months. The number of initial applications for unemployment benefits does not fall below 700 thousand, although this indicator showed a steady decline at the beginning of autumn. All this suggests that the autumn surge amid COVID-19 situation in the US has not yet fully manifested itself, although the weak growth in the number of employees should serve as a warning for both the Fed members and USD bulls.

Last Friday, some Fed officials have already commented on the release. Thus, the Fed's President of Chicago, Charles Evans, said that he was slightly disappointed with the key report on the labor market. In his opinion, the US economic recovery is uneven, as the situation in different sectors is dissimilar. He also emphasized that he does not expect rates to grow earlier than 2023 or even 2024. At the same time, a more pessimistic position was voiced out by the Fed's President of Minneapolis, Neel Kashkari (who is a representative of the "dovish" camp). According to him, the real unemployment rate is about 10%, while the full recovery of the economy is still far away. Thus, he expects that the situation may not improve until the second half of next year.

It is noteworthy that all the FRS representatives who spoke last week (with both "dovish" and "hawkish" rhetoric) pointed to the necessity of passing a law on the allocation of additional assistance to the US economy. In particular, Evans said that the most important type of stimulation for the country's economy in the coming months will be fiscal stimulation as he assessed the medium-term prospects.

In fact, this issue will soon be among the priorities for dollar bulls in general, and for EUR/USD traders in particular, although this week will be filled with other events. For example, ECB's last meeting results this year and key indicators of US inflation will be known on Thursday. Moreover, Brexit will also influence the Euro, which negotiation process is reaching and end. Also this week, the US Food and Drug Administration is due to make its decision on the coronavirus vaccine, particularly the two drugs produced by Pfizer and BioNTech, as well as by the pharmaceutical company Moderna. As stated by Mr. Trump yesterday, vaccination against COVID should start by mid-December in the US. This fact may increase interest in risky assets, while the safe dollar will be out of business again.

In general, the priority for the EUR/USD pair will be long positions in the next two days (until Wednesday) – traders will use corrective recessions as an excuse to open long positions. However, it is better to leave buy deals before the ECB's December meeting. The EUR/USD pair is now at multi-month highs, and this fact is likely to be the subject of criticism from the ECB representatives. In addition, the anticipation of new measures to ease monetary policy may lead to massive profit taking.

From a technical viewpoint, the price will continue to rise, with a retest of the level of 1.2177 (this year's high, which was reached last week). The pair continues to trade in an upward trend, being in the extended channel of the Bollinger Bands indicator, while the price is located between the upper and middle lines of the indicator, which act as support (1.1930) and resistance (1.2177) levels.

The material has been provided by InstaForex Company - www.instaforex.com