To open long positions on EUR/USD, you need:

It was not possible to wait for a convenient signal to enter the market last Friday. Latest data on the US labor market stumped traders. On the one hand, the number of new jobs in the non-agricultural sector was much less than economists' forecasts, on the other hand, the unemployment rate fell in November, despite the fact that there is an increasing number of coronavirus cases.

But before talking about the prospects for the pair's movements, let's look at what happened in the futures market and how the Commitment of Traders (COT) positions changed. Euro buyers continue to dictate their terms. And although there were not as many of them as there could have been, especially given the latest news about the vaccine, it is clear that many market participants are still betting on the euro's appreciation, even at current annual highs. This week we may hear about the expansion of the asset repurchase program and the introduction of negative interest rates from the European Central Bank, which will limit the observed growth potential. However, the likelihood of a later introduction of quarantine measures in the United States forces traders to bypass the US dollar. The COT report for December 1 showed an increase in long positions and a reduction in short positions. Buyers of risky assets believe that the bull market will continue and they also anticipate the euro's growth, after going beyond the psychological mark in the area of the 20th figure. Thus, long non-commercial positions rose from 206,354 to 207,302, while short non-commercial positions fell to 67,407 from 68,104. The total non-commercial net position rose to 139,894 from 138,250 a week earlier. Take note of the delta's growth after its 8-week decline, which indicates a clear advantage of buyers and a possible resumption of the medium-term upward trend for the euro. We can only talk about an even bigger recovery when European leaders have negotiated a new trade deal with Britain. However, we did not receive good news last week, and we have an EU summit ahead of us, which could put the final point in this story. News that restrictive measures will be lifted for the Christmas holidays can provide support to the euro, as well as the absence of major changes in the ECB's monetary policy.

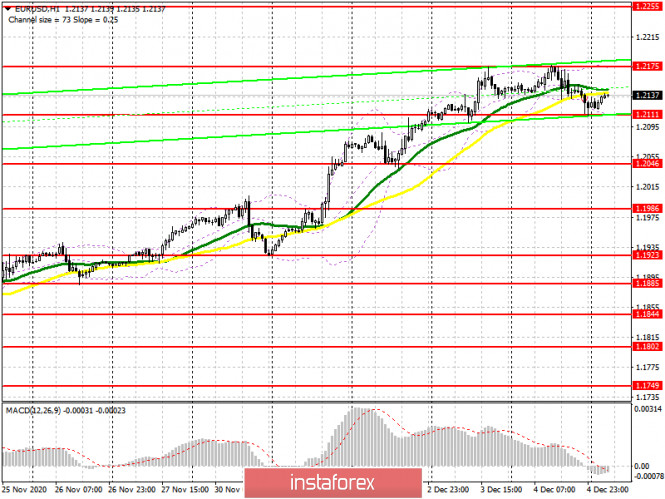

Now for the technical picture of the pair. Buyers of the euro need to take control of resistance at 1.2175, only this can lead to another upward wave for the euro and may also help in the bull market. A breakthrough and getting the pair to settle above 1.2175 and testing it from top to bottom produces a good signal to buy the euro in hopes of updating the next high in the 1.2255 area, where I recommend taking profits. We can hardly count on a breakout of 1.2255 since important fundamental statistics on the eurozone economy will not be released today. However, if this happens, I recommend building up long positions to the highs of 1.2339 and 1.2417. In case the euro falls in the first half of the day and buyers' are unable to rise above 1.2175, it is best not to rush into long positions, but to wait until a false breakout forms in the support area of 1.21111. I recommend buying EUR/USD immediately on a rebound but only from the low of 1.2046, counting on a correction of 20-25 points within the day.

To open short positions on EUR/USD, you need:

Sellers will actively defend resistance at 1.2175, which coincides with annual highs. Forming a false breakout there can result in a new downward wave, which aims to break through the 1.2111 low. Consolidation below this range will open a direct road to the 1.2046 area, where I recommend taking profits. The next target will be the 1.1986 area, testing it will mean a reversal of the current upward trend. If the bulls are strong enough and they manage to rise above the resistance of 1.2175 after receiving the report on the leading indicator of confidence of the eurozone investors, I recommend not to rush to sell. The optimal scenario would be to test the 1.2255 high, where you can sell the euro immediately on a rebound, counting on the pair's downward correction by 15-20 points. Bigger sellers will be located in the resistance area of 1.2339, from where you can also sell the euro immediately on a rebound, counting on a correction of 15-20 points within the day.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates that the pair is hanging in a horizontal channel.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

A breakout of the upper border of the indicator in the 1.2175 area will lead to a new wave of euro growth. A breakout of the lower border of the indicator in the 1.2111 area will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.