Traders of the EUR / USD pair have two main topics on their agenda: the December ECB meeting and the US inflation. Even though the general tone of trading is more globally questions such as (coronavirus, vaccination, political bidding in the US Congress), they will move away from the shadow over the next day (approximately until the end of Thursday), serving only as an indicator of risk / anti-risk sentiment among traders. In the medium term, all the attention of market participants will be focused on the two listed fundamental factors.

So, the Central event of tomorrow will be the December meeting of the European Central Bank. Members of the regulator will hold their last meeting this year and according to the established tradition, it will determine the future prospects of monetary policy while commenting on the results of the outgoing year. Looking ahead, it is worth noting that it will be difficult for the ECB to reverse the EUR / USD trend, since many "dovish" decisions are already taken into account in current prices. And if Christine Lagarde does not go beyond the predicted scenarios, the Euro's reaction will be short-term. It is for this reason that it is not necessary to open trading positions for the pair immediately after the press conference of the head of the Central Bank, and even more so - immediately after the publication of the final communique of the December meeting. The initial market reaction may differ dramatically from the final one, so there is a risk of false price movements.

It is also worth remembering that since the last ECB meeting, the European currency has strengthened against the dollar by more than 500 points. At the end of October, the EUR / USD pair was in the area of 1.1650 and at the moment it is trading within the 21st figure. This is despite the fact that the Euro zone economy is in a state of deflation and the latest inflation figures came out worse than forecast values. At the same time, export competitiveness is declining. Therefore, there is no doubt that the inflated exchange rate of the European currency will be the subject of criticism from Lagarde and the rest of the ECB members. But will they be able to reverse the EUR / USD trend with just verbal interventions? In my opinion, members of the Central Bank will only be able to achieve a short-term "lowering" effect when they explicitly announce currency intervention. The fact is that the growth of EUR / USD is mainly due to the weakness of the dollar, so ECB members are likely to be powerless before the strength of the upward trend. Of course, we can assume that Lagarde will decide to take extraordinary measures - for example, in a hypothetical context, he can allow an interest rate cut but this scenario is too unlikely.

On the contrary, the expansion of the ECB's stimulus program is widely expected. Most likely, the regulator will increase the PEPP program by 500 billion euros tomorrow (the current level is 1.35 trillion euros), and probably extend the emergency bond purchase program immediately for a year until mid 2022. According to ECB's Chief Economist Philip Lane last week , the combination of PEPP and TLTRO programs "is very effective in a pandemic environment." At the same time, he recalled that the regulator has other tools but by judging the previous comments of his colleagues, the Central Bank will prefer to focus on the calibration of these programs at the December meeting. The market reaction in this case will depend on the combination of "expectation / reality". If the above scenario is implemented at the December meeting,

Another argument in favor of further growth of the Euro is related to the prospects for the adoption of the EU budget. Today it became known that Poland and Hungary agreed to abandon their intention to veto the budget process. So far, this information is exaggerated on the market in the form of rumors, but these rumors are relayed by very reputable publications. According to them, the controversial provision on the rule of law mechanism (which caused all the fuss) will still remain, but at the summit, the leaders will adopt the so-called "methodological recommendations" on this mechanism, which will take into account the comments of Poland and Hungary. The recommendations, in particular, will prescribe a step-by-step scheme for applying the rule of law mechanism, with all the conditions and time frames.

Thus, Thursday's European events are unlikely to "drown" the Euro. The market is ready to implement the ECB's "dovish" scenario, while the European regulator is too slow for unpredictable decisions. Therefore, the expansion of QE, soft rhetoric, and criticism of the overvalued EUR / USD exchange rate - all these factors are more or less taken into account in prices.

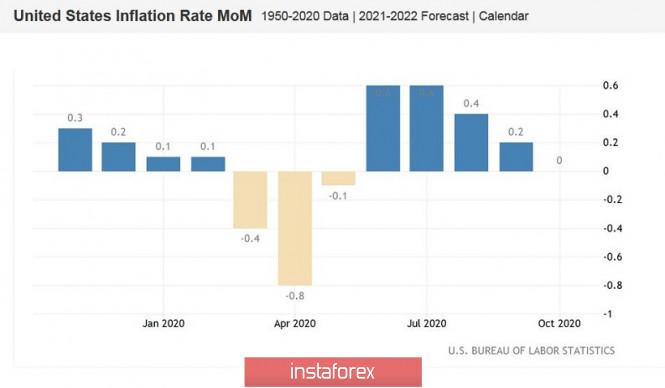

But dollar bulls can become victims of inflated expectations. At the start of the US session on Thursday, data on the growth of inflation in the US will be published. According to most experts, the main indicators will show positive dynamics. According to forecasts, the overall consumer price index on a monthly basis in November should reach 0.1% (after falling to zero), and in annual terms - increase to 1.3%. Core inflation should show similar dynamics: 0.2% on a monthly basis and growth to 1.6% on an annual basis. Such expectations are associated, in particular, with good "salary" indicators, which were published last Friday. For example, the average monthly hourly wage was expected to fall to zero in November, while traders saw an increase of up to 0.4%. In annual terms, the index remained in October at the level of (4.4%).

As you can see, the forecasts for the growth of US inflation are optimistic. But if they are not met, the dollar will be under significant pressure including due to inflated expectations of most investors.

It is necessary to make trading decisions on the EUR / USD pair based on the results of tomorrow. For me, neither the ECB nor US inflation will be able to reverse the trend by 180 degrees, which means that any large-scale corrective drawdowns should be used as a reason to open long positions. The first goal is 1.2150 (today's high), the main goal is 1.2200. The relevance of the upward trend scenario will be lost only if the pair fixes below the 1.1950 mark (the middle line of the Bollinger Bands on D1), diving to the base of the 19th figure or lower.

The material has been provided by InstaForex Company - www.instaforex.com