4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: -1.4194

The British pound resumed its upward movement inside the side channel, limited by the levels of 1.2200 and 1.2450 (approximately). Thus, now the GBP/USD pair is moving to the upper border of the channel, from which a rebound may follow. Fourth in a row. If this rebound occurs, the pair will start moving down to the lower border of the side channel. If the area of 1.2450-1.2470 is overcome, the upward trend may resume. The volatility of the currency pair continues to decrease, and all the news from across the ocean and from the Foggy Albion concerns mainly the epidemic of the COVID-2019 virus. Traders are still relatively calm, but the pandemic is not fading, so there are more and more cases of the virus every day. At the moment, 1,464,000 were infected and 85,000 deaths have been recorded worldwide.

Donald Trump, meanwhile, continues to look for those responsible for the spread of the "coronavirus" on the territory of the United States. It seems that the American President is not concerned about the fact that the entire planet is infected, but about the fact that the virus came from China, with which the United States has had very tense relations in recent years. "Tense" thanks to the same Donald Trump, who set out to renegotiate trade agreements with all US partners. The trade war with China lasted a year and a half and was put on pause in January this year by the signing of the "first phase" agreement. Recall that this is not the final agreement, most of the duties on both sides continue to apply. Thus, there is no question of any truce between Beijing and Washington, and the trade war continues. Negotiations on the "second phase" were supposed to start in February, but at that time, an epidemic had already started in China, and a month later, it was already raging in Europe and the United States. Trump immediately called the "coronavirus" a "Chinese virus" and accused Beijing of insufficient measures to combat the epidemic, misinformation that led to the infection of the entire world. Now the sword of Donald Trump has fallen on the World Health Organization, which, according to the American President, has done very little to prevent the spread of the virus. On Twitter, Trump wrote: "The WHO really failed everything. For some reason, the organization, which is mostly supported by the United States, has focused all its attention on China. We will carefully study this issue." The US leader also accused the WHO of incorrect advice. "Fortunately, I did not follow their recommendations to not close the border to visitors from China," Trump said. The US President also threatened to suspend payments to WHO, as he believes that America spends the most money on Turkey, and who spends the most money on China. According to official information, the number of cases in the United States has now reached 400,000, while China has stopped at 83,000.

However, the opinions of independent experts around the world regarding Trump's insinuations are divided. Someone supports the US President, someone believes that Trump just once again found a "scapegoat" in the face of the WHO. It is reported that the WHO was the first to declare an emergency situation with the COVID-2019 virus. Recall that initially, Trump regularly gave interviews in the style of the "American population has nothing to fear", "the virus will not survive the warm season". Then, when it became clear that there is still something to fear, and the virus quietly survives in the warm season, Trump abruptly changed his rhetoric, saying that "I knew everything", but "I did not want to sow panic, deprive people of hope." Now - criticism of WHO and threats to cut off funding... You should also compare all of Trump's statements over the past two months with those of doctors, immunologists, virologists, and other competent healthcare professionals. And it turns out that all the doctors warned about the danger of the epidemic, and it was Trump who did not want to take it seriously. Now it is the United States that is leading in the number of cases, and the US President urgently needs to find those responsible for what happened, as the elections are approaching and by November 2020, the reputation needs to be absolutely clean. Therefore, the odious leader of the United States continues to make comments like "if it were not for the government, the number of deaths could be 10 times higher". At WHO itself, they condemn Trump's actions and believe that cutting funding during a pandemic is stupid. It's hard to disagree with them.

Today, the report on applications for unemployment benefits in the US will be interesting, which threatens to increase by another 5.25 million. In the UK, quite important reports will also be published, however, once again, it is likely to be ignored by market participants. First, GDP data in monthly and quarterly terms will be published tomorrow. The increase is expected to be a maximum of 0.1% or zero at all. Secondly, the report on industrial production for February will become known. According to experts' forecasts, the indicator may decrease by 2.9% in annual terms. That is, at a time when there was no "coronavirus" epidemic in the Foggy Albion, industrial production was already declining at a rate of 3-4%.

Well, the key event of the day is likely to be the evening meeting of OPEC, where key market players will have to come to a common denominator. If Russia and Saudi Arabia agree to reduce the volume of production of "black gold', then we can expect an increase in oil prices in the coming weeks to the levels of $35-40 per barrel. Maybe even higher. Everything will depend on how much the parties will reduce production. The increase in oil prices will ease the fate of countries that produce and export oil a little. This list includes both the United States and the United Kingdom. It will also support commodity currencies, such as the Russian ruble. If the deal fails again, then oil prices may collapse again and update the already multi-year lows. It is obvious that the failure of the agreement will not add calm to all international markets.

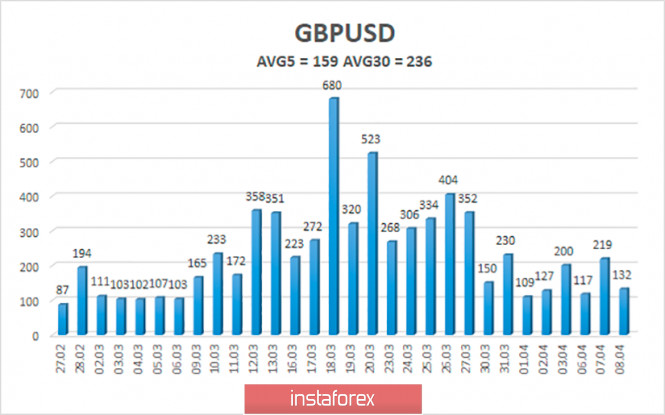

The average volatility of the GBP/USD pair continues to decline and is currently 159 points. However, the activity of traders on the pound/dollar pair is still quite high, which should be taken into account when opening any positions. On Thursday, April 9, we expect movement within the channel, limited by the levels of 1.2250 and 1.2568. However, in reality, trading is now taking place inside the side channel, limited by the Murray levels of "4/8"-1.2207 and "6/8"-1.2451. Thus, the upper limit for the pound today is seen at 1.2451. The reversal of the Heiken Ashi indicator downwards signals a turn of the downward movement inside the channel.

Nearest support levels:

S1 - 1.2329

S2 - 1.2207

S3 - 1.2085

Nearest resistance levels:

R1 - 1.2451

R2 - 1.2573

R3 - 1.2695

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to be inside the side channel. Thus, it is now recommended to trade between the upper and lower border of this channel, that is, between the levels of 1.2207 and 1.2451. Buying the pound with a target of 1.2573 is recommended after the price has fixed above the level of 1.2451. It is recommended to open new sell positions if the bears overcome the moving average and the level of 1.2207 with the first target level of 1.2085.

The material has been provided by InstaForex Company - www.instaforex.com