The market took a short break yesterday and decided to stand still amid a completely empty macroeconomic calendar. At the same time, the market ignored even the coronavirus epidemic. But all the talk at the beginning of the week that the peak of the epidemic has already passed is now in the past. The number of new cases of coronavirus infection is increasing for the second day in a row. So it is premature to relax since the situation continues to be critical.

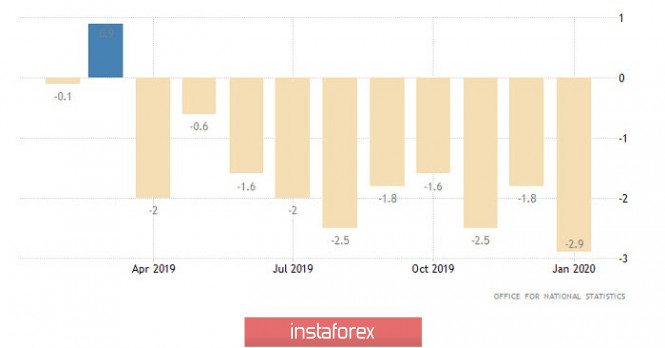

In contrast to yesterday, a lot of interesting macroeconomic data will be released today, so the market may well revive. However, these statistics themselves are purely negative. For example, the rate of decline in industrial production in the UK should accelerate from -2.9% to -3.0%. And at the same time, this data for February isn't even that important. After all, industrial production was already experiencing serious problems even before the coronavirus epidemic hit Europe, thereby, implying that the data for March will show a catastrophic drop. So this data will be able to bring the pound out of stagnation. However, it will move in the direction of weakening the British currency.

Industrial production (great Britain):

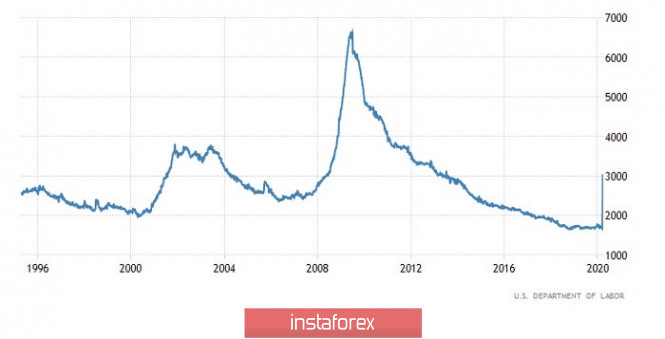

But US data are much more important today. Especially for applications for unemployment benefits. The number of primary applications is breaking all imaginable records for two consecutive weeks, which means that a real disaster is coming to the US labor market. And most likely, this trend will only continue, since the number of initial applications should be 5,150 thousand. It's not as much as last week, but it's still a lot. At the same time, both previous times, the actual data was several times higher than the forecasts, so there is a risk that this situation will repeat today. Repeated applications can set an absolute record, as they should be as much as 6,990 thousand. So just a week after the record for the number of initial applications was set, repeat applications will set their own record. And in theory, this is very bad for the dollar. However, the greenback did not fall for two weeks amid the unprecedented increase in unemployment, but rather it showed a desire to strengthen. This is caused by a banal flight from risk. That is, if things are so bad in the United States, then other countries are about to get terrible. And it is very likely that today we will see exactly the same picture.

Number of repeated applications for unemployment benefits (United States):

In terms of technical analysis, we see that the price movement is made inside a wide side channel for the second week, where there is a local upward movement relative to the current fluctuation. In fact, the values 1.2150; 1.2350; 1.2480 (1.2500) remain as the coordinates of the interaction of trading forces.

Considering the trading chart in general terms, we see two consecutive inertia, where a slowdown was formed relative to the peak of the second, within which the current oscillation is produced.

We can assume that the framework of the main flat will remain in the market, where you should work on local fluctuations. So, considering the hour period, we see that as early as 20 hours, the quote has a fluctuation within the variable band of 1.2370/1.2420, where the accumulation is fixed. The work tactics in this case are chosen by the method of breaking the established boundaries.

We will specify all of the above into trading signals:

- We consider long positions higher than 1.2420, with the prospect of a move to 1.2450-1.2480.

- Short positions are considered lower than 1.2365, with the prospect of a move to 1.2325-1.2280.

From the point of view of complex indicator analysis, we see that minute intervals signal a variable signal, due to price fluctuations in a relatively narrow band. Hourly and daily periods reflect a local buy signal due to a round of long operations from the beginning of the trading week.