4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: 23.8793

The EUR/USD currency pair failed to develop an upward movement yesterday and the new trading day starts below the moving average line. Thus, formally, the trend is now again downward. However, we continue to consider the "correction against correction" option, which provides for an upward movement to approximately the level of 1.10, as the main one. Thus, today, we expect a new overcoming of the moving average and the resumption of the upward movement. The overall volatility of the currency pair continues to decline, which is very good, as it suggests that market participants continue to calm down. The main thing is that there are no new "storm warnings".

The big disappointment of the last day was the video conference of the Eurogroup (Council of 19 Finance Ministers of the European Union), which was analogous to a regular meeting, at which the Ministers failed to reach an agreement on financing the European economy for 500 billion euros in aid from the impact of the "coronavirus" pandemic. This was stated by the Chairman of the Eurogroup Mario Centeno at the end of the meeting. According to Mr. Centeno, the meeting online lasted 16 hours, the parties came as close as possible to an agreement, but still could not conclude it. Thus, the new meeting will be held on Thursday, April and negotiations will continue. "The aim of the negotiations is to create a reliable safety cushion for the EU economy in response to the crisis caused by the pandemic. To protect workers, businesses and states, we must adopt a plan that will help the EU economy", said Centeno. However, we believe that the decision to finance 500 billion euros in the economy will still be made. The only reason for the slight delays is that the EU has 27 states and 19 ministers are taking part in the meeting. Thus, it is necessary to protect the interests of at least 19 EU member states. And in any case, it is much more difficult for 19 countries to agree than, for example, it was for the US Congress to adopt a 2-trillion package of measures to help the American economy. However, without this money, the EU economy may collapse even more rapidly. It is no secret that the process has already started. We often talk about the US economy recently and draw parallels with the great depression of the 30s of the last century. So the situation in the European Union is no better. This package must therefore be approved. Mr. Centeno himself understands this, and even before the video conference, he distributed a video speech in which he promised that the Eurogroup would approve the aid package. "I expect EU Finance Ministers to approve a strong response to the pandemic. This will be the largest aid program in the history of the Eurogroup. We need a plan that will help protect the most vulnerable states and guarantee the exit of the European single market from this crisis without losses," Centeno said. Well, the differences, as always in the European Union, consist of the unequal position of all participants. For example, assistance will be provided, of course, to the most affected states. For example, Italy and Spain. However, those states that do not require special assistance will have to "pay" for this assistance. For example, Germany, Austria and the Netherlands oppose the so-called "coronabond". Germany is the most stable state in the European Union in economic terms, the most reliable debtor and quite logically does not want to take on debt obligations for the entire eurozone. "Coronabonds" are government debt securities that are proposed to be issued on behalf of the entire European Union, that is, on behalf of all 27 member states. Accordingly, the debt will be distributed among all participants, and the funds raised will be directed to the most problematic sectors and countries. In our case, this is Italy, Spain, and France. It turns out that the latter will be financed on very favorable terms, and their debts will be paid by countries that themselves cope with the "coronavirus" pandemic. The highest political circles in Germany are already dissatisfied with the current situation, and believe that the pressure on Berlin is increasing. The Germans believe that Italy and Spain are openly demanding help, and believe that it may come to open blackmail. At the same time, we should not forget that Italy already has the largest public debt in the European Union after Greece. The greater the debt, the higher the probability of default. This means that Italian securities are more difficult to place on international securities markets, and investors will have to pay more interest and dividends to get them interested in buying bonds. The joint issue of securities with Germany, Austria, and Finland will be cheaper for Italy, Spain and other countries in a weaker position. According to experts, if the overall package of measures fails, the states most affected by the pandemic will either have to turn to the financial markets for loans, which will further inflate their external debt and may lead to a new debt crisis or refuse to support their own economies in a new crisis, which will inevitably cause mass bankruptcy of companies and high unemployment.

As for the culprit of all that is happening – the "coronavirus". In Italy, the number of infected reached 136,000. In Spain - 147,000. In France - 110,000. The rate of disease growth in some countries is beginning to decline, but it is still too early to tell about the retreat of the epidemic, as well as about the end of quarantines.

On April 8, the European Union is not scheduled to publish any significant publications again. But in the United States, the next report on initial applications for unemployment benefits for the week of April 3 will be published. It is expected that the number of new requests will be 5.25 million. Recall that according to the last two reports, the number of applications for benefits was 3.3 million and 6.6 million. An additional 5.25 million requests may provoke pressure on the US currency, as they will not even allow us to conclude that the situation is improving. Such huge numbers only prove that James Bullard, a member of the Fed's Monetary Committee, was right in his forecasts of unemployment at 25-30%. For the United States, these numbers are death-like. Thus, we believe that this report may cause a sale of the US currency today. Moreover, in recent days, there has been relatively quiet trading of the pair, so a strong macroeconomic background may wake up traders. Also today, the consumer confidence index from the Michigan Institute for April will be released, which, according to experts' forecasts, may fall from 89.1 to 75.0. Until recently, this indicator was consistently above the level of 95.0.

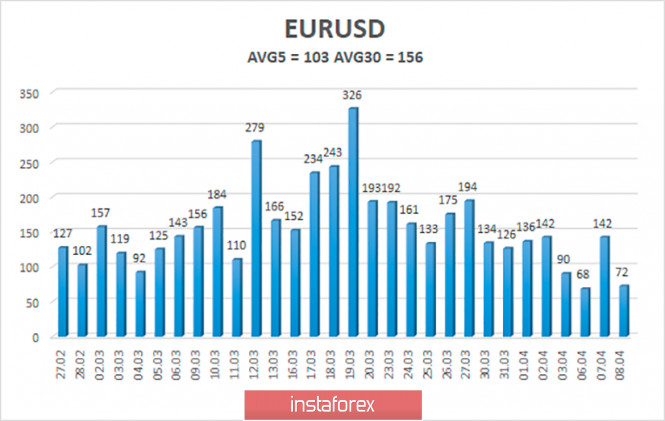

The volatility of the euro/dollar currency pair remains quite high, but continues to decline. As of April 9, the average volatility value is 103 points. We continue to believe that the markets continue to return to normal, however, there may be new outbursts of panic. Today, we expect a further decrease in volatility and price movement between the levels of 1.0761 and 1.0967. The pair is aiming for the level of 1.10, and the upward turn of the Heiken Ashi indicator will indicate a new round of upward movement.

Nearest support levels:

S1 - 1.0864

S2 - 1.0742

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1108

R3 - 1.1230

Trading recommendations:

The EUR/USD pair started an upward movement. Thus, traders are now recommended to consider purchases with the goal of the Murray level of "2/8"-1.0986, but after the reversal of the Heiken Ashi indicator to the top and reverse overcoming the moving. It is recommended to sell the euro/dollar pair not before the price is firmly fixed below the moving average line and the Murray level of "1/8"-1.864 with the first goal being the volatility level of 1.0761.

The material has been provided by InstaForex Company - www.instaforex.com