The lack of clarity about how the upcoming Board meeting of the European Central Bank may end is pushing the single European currency up. It seems that the decision of the Federal Reserve System to urgently reduce the refinancing rate from 1.75% to 1.25%, forcing the European Central Bank, and other central banks, to also lower its interest rates. And for at least twenty-four hours, no one had any doubt that this would be the case. However, the rather vague position of Christine Lagarde's subordinates on this issue makes us think that the European Central Bank may take a wait-and-see position, and the decision to lower interest rates will be made not on March 12, but somewhat later. Consequently, the dollar is already under attack, since the return on investments in it only decreases, not in the single European currency. Thus, suspicions that this is exactly what the European Central Bank will do contribute to the strong growth of the single European currency.

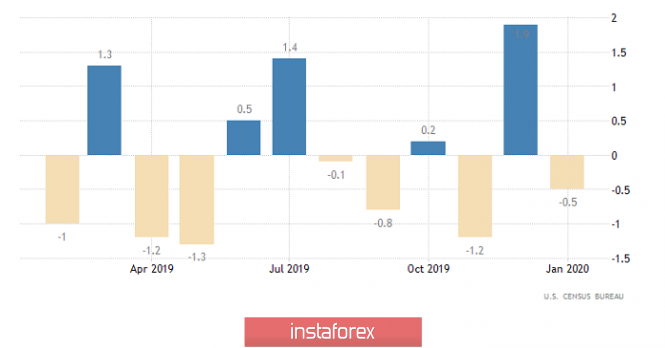

However, yesterday's US statistics clearly did not contribute to the strengthening of the dollar. Apparently, it did a bit by weakening the dollar. In particular, the total number of applications for unemployment benefits increased by 4 thousand. Moreover, the number of initial applications for unemployment benefits decreased by 3 thousand, but the number of repeated ones increased by 7 thousand. But what is more important is the fact that the volume production orders decreased by 0.5%, while the forecast was a decline of 0.3%. Well, if orders are reduced, then the industry will not grow from anything, which means that its decline will continue.

Factory Order Volume (United States):

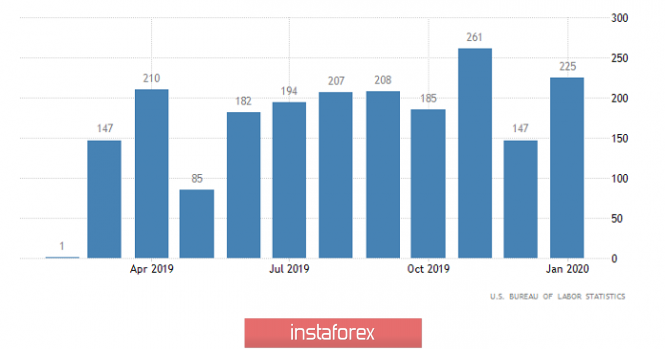

Thus, today, the focus is on the report of the United States Department of Labor. The contents of which are unlikely to help the dollar, although the unemployment rate should remain unchanged. However, it is expected that 165 thousand new jobs were created outside agriculture, against 225 thousand in the previous month. Well, this is a clear slowdown; therefore, the situation on the labor market may somewhat deteriorate soon. But more importantly, the growth rate of average hourly wages should slow down from 3.1% to 2.9%. This already suggests that we should expect a decrease in consumer activity, and retail sales.

The number of new jobs created outside agriculture (United States):

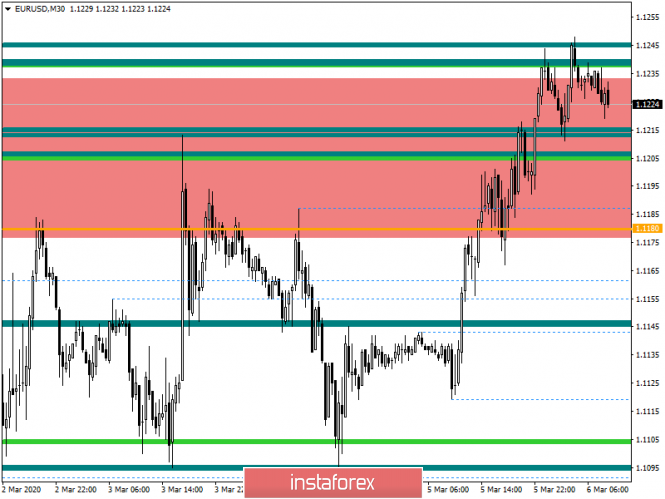

From the point of view of technical analysis, we see that the stagnation within 1.1100 / 1.1180 served to further accelerate, where the frame of 1.1180 was broken and the quote went to the maximum of the last correction of 1.1240. In fact, the second point of 1.1240 served as a kind of resistance in the area where a small stagnation of 1.1228 / 1.1248 was formed.

In terms of a general review of the trading chart, we see an almost a single upward move of more than 450 points, where the rate of growth is several times higher than the rate of decline. Such rapid activity overheats the market, where the consequences will come sooner or later.

It is likely to assume that the external background will continue to put pressure on the market, where local surges are not an exemption. In regards to fluctuations, a temporary stagnation of 1.1228 / 1.1248 can be taken, working for a local surge outside its boundaries. After which, we have a report from the Ministry of Labor, where, in case of coincidence of expectations, the dollar will continue to lose its position aside 1.1300.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments preserved a buy signal due to the rapid growth.