The data released yesterday pertaining to the US economy has triggered another boost in the growth of risky assets, especially in the euro and the pound. On the other hand, the report on US unemployment benefits showed a decrease for the first time, while other indicators, especially those related to the manufacturing sector, were in a worse position than expected. Stock indexes were also under pressure, and the price of gold has increased.

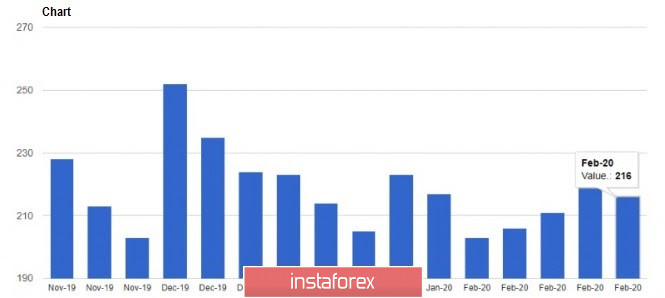

According to the US Department of Labor, the number of initial applications for unemployment benefits for the week of February 23-29 has fallen by 3,000. conomists had expected it to be 215,000, but it settled to 216,000 instead. As a result, the 4-week moving average rose by 3,250 and finally to 213,000. Meanwhile, as for the secondary applications for the period of February 16 to 22, the number has increased by 7,000 and determined to 1.729 million.

More important reports pertaining to the state of the US labor market will be released today. More important reports pertaining to the state of the US labor market will be released today. The unemployment rate, which is expected to fall to 3.5%, will be published, along with the employment rate in the non-agricultural sector, which is expected to increase by 175,000 in February, after its 225,000 in January this year. If the figures are worse than the forecasts of economists, the demand for the euro and the pound will lessen. Nevertheless, you should pay attention to the fact that big players can use this to fix profit after the growth recorded from February 20, which may lead to the decline of EUR / USD amidst bad reports.

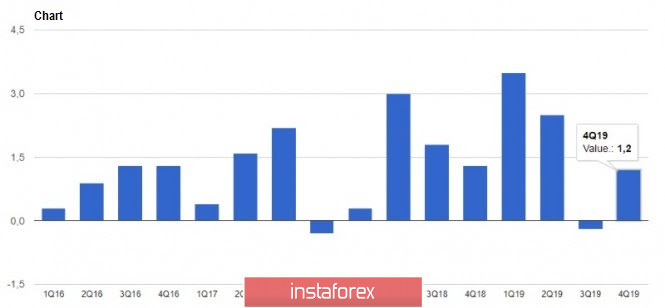

The pressure that the dollar felt yesterday was caused by the data on the US labor productivity in the 4th quarter of this year, which has increased less significantly than expected. The US Department of Labor reported that labor productivity outside of US agriculture increased by only 1.2% per annum in the 4th quarter of 2019, as compared to its data on the 3rd quarter. Initially, an increase of 1.4% was reported, and economists had expected a growth of 1.3%. Now, given the revision of the indicator, we can classify US 'economic growth this year as weak, because compared to the same period in 2018, productivity in the 4th quarter increased by 1.8%. As for labor costs, they have grown less actively, as the indicator was also revised downwards to 0.9% per annum, while earlier reports showed an increase of 1.4%.

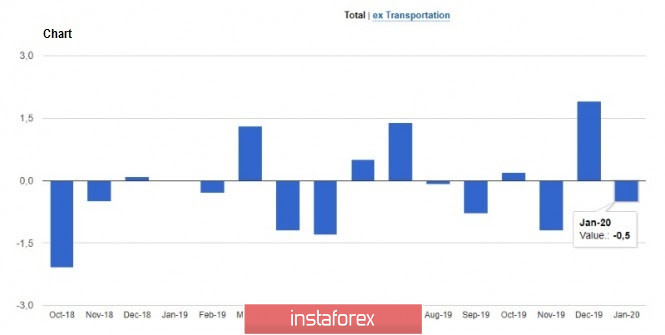

Weak orders on manufactured goods in the US also point to the sector's continued problems caused by the spread of the coronavirus. Weak orders on manufactured goods in the US also point to the sector's continued problems caused by the spread of the coronavirus. Though the situation was not felt in January, the report of the US Department of Commerce indicated that compared to the previous month, orders were reduced by 0.5%. The major decline was observed in defense products, although if we exclude this indicator in the calculations, orders have increased by 1.3%. At the same time, against a preliminary estimate of 1.8%, data for December was revised up to 1.9%.

Meanwhile, the Fed's speeches failed to calm the markets. Robert Kaplan said that the stock market is still at a relatively elevated level, and its volatility is expected to continue. As for the Fed's decisions, he said that it is too early to judge the outcome of the meeting in March, but lowering the rates only because of the threat of the spread of the coronavirus is not part of the Fed's plans.

In addition, John Williams, another fed official, noted that even though the coronavirus is an emerging risk for the economy, the US economic fundamentals remain at a fairly strong level, and that the start of 2020 is marked by a good momentum. According to him, the Fed is closely monitoring the economy and the financial markets, and they are ready to act as necessary.

As for the technical picture of the EUR / USD pair, the breakdown of the resistance level at 1.1240 will open the way to the new highs at the 13th figure, where the activity of the bulls will once again decrease. Do not forget though about the profit-taking that will likely happen, when the report on the number of employees in the non-agricultural sector of the United States is released. If risk assets decline, you can expect support in the area of 1.1190 and 1.1155.

The material has been provided by InstaForex Company - www.instaforex.com