The US dollar is under strong pressure before the publication of the employment report for February. The decrease in the target range for the rate and interest on excess reserves of commercial banks did not lead to a massive collapse of the dollar, but changed its prospects. At the same time, the Fed resorted to such a remarkable step as an unscheduled meeting for the first time since the 2008 crisis, and although no new liquidity measures have been taken, they are expected in the near future.

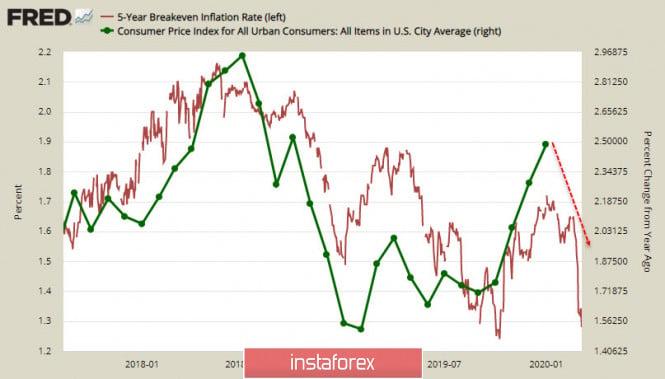

On the other hand, yields on inflation-protected Tips, 5-year-old Tips, have declined drastically, increasing the probability of a strong decline in consumer inflation in February.

Coronavirus is considered to be the reason, but in fact, the reality may look much worse - the virus is only an ideal disguise for emergency measures, and without which, it is impossible to delay the onset of a new global crisis.

In turn, the market will be searching for an answer to what additional measures should be taken to fight the recession until March 18, when the next scheduled meeting of the FOMC takes place. In the meantime, we must proceed from the fact that there are no reasons, neither economic or political, to get out of the panic that has confidently covered global markets.

EUR/USD

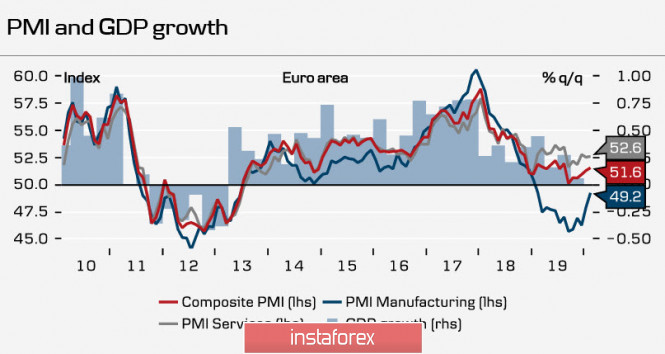

Despite the fact that the virus fully controls the news space and stock markets, it has not yet led to a slowdown in PMI in the eurozone. Moreover, production PMI in February increased to an annual maximum of 49.2. From this point of view, the situation in the eurozone compares favorably with the situation in the United States and especially in China, since the eurozone has already experienced a deep crisis in 2018/19, and the ECB has already taken a number of measures to stop it, while the Fed is just starting this way.

In this regard, the eurozone is in a winning position, as is the euro. The demand for it increased not only because the mass exodus from the carry trade began, where the euro acted as the funding currency, but also because the comparison of the extent of the ECB and the Fed's reaction to the beginning of a new one crisis is not in favor of the latter.

In particular, inflation in the eurozone remains low. Core inflation in February increased to 1.2%, while the expectations for the inflation in the US are significantly lower than the current official level as we can see from the dynamics of TIPS bond yields. Thus, we can assume that the data in February will show a noticeable decline.

Nevertheless, even if the ECB continues to move behind the Fed in terms of the scale of measures taken, it is obvious that such measures will still be taken. After several statements by the ECB leaders this week, it is highly possible that at the next meeting, they will announce their readiness to provide additional liquidity in any form.

A more accurate picture will be provided by today's CFTC report, but in the meantime, we must proceed from the fact that the probability of further growth of EUR/USD is decreasing. The euro reached a maximum of 1.1239 from December last year, and despite the fact that the impulse is still strong, consolidation is more likely in anticipation of a further direction. The nearest resistance is at 1.1335 / 50, while support is at 1.1120 and 1.1180. So today, the euro will wait for the US employment report and we will determine the further direction only after that.

GBP/USD

The pound continues to be a captive of political alignment, as declining oil and a general increase in panic prevent it from realizing the planned growth. Nevertheless, on the basis of the estimated fair price, it is above the level of 1.32 as of Friday morning, that is, the lack of growth is a consequence of the general pressure on commodity currencies and falling oil.

The nearest resistance is at 1.2970. Its passage is expected, after which it will not be possible to talk about an upward reversal, although the increased probability of this growth is possible. Moreover, the UK PMI indices remained practically unchanged in February, while the construction sector showed strong growth from 48.8p to 52.6p. Still, the situation regarding trade negotiations with the EU is still unclear. According to the Prime Minister's spokesman, the first week of discussions between the EU and the UK was "constructive". Next Wednesday, the government will announce the budget for 2020, the level of anxiety in financial circles and the prospects for a rate cut by the Bank of England will be judged by the degree of planned spending on the fight against coronavirus.

The material has been provided by InstaForex Company - www.instaforex.com