Russia's decision to turn down the deal's extension to reduce oil production under the OPEC + agreement caused a real blow in the financial markets. Such a violent reaction in response to generally an insignificant event indicates that global markets have reached a division point. Thus, the containment of a rapidly developing crisis is becoming unlikely.

The most obvious reason is a clear threat to the US oil and gas industry, which accounts for 7.6% of GDP. A sharp decline in the trade balance will be superimposed on the progressive budget crisis. According to the US Congressional Budget Committee, the budget deficit amounted to $ 625 billion for the first 5 months of fiscal year 2020, and there will be nothing to cover the deficit with the Trump government.

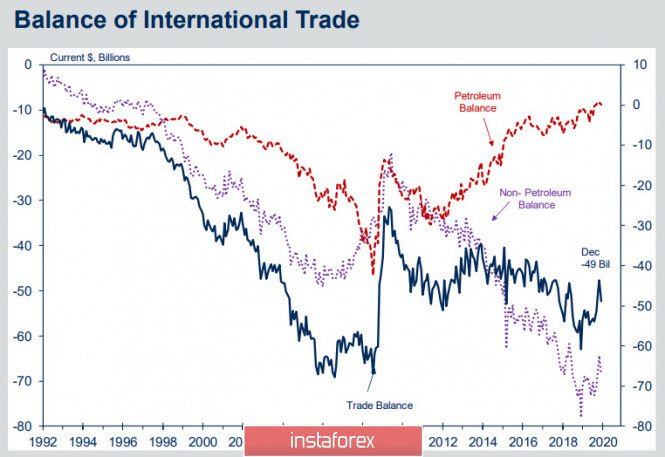

There is certainly some truth in such an interpretation. As can be understood from the graph below, the negative trade balance of the United States, by the 2008 crisis, increased to $ 70 billion per month. Following this, the negative balance decreased noticeably by 2010 after Obama began an attempt to implement a plan to create competitive advantages for producers in the USA at the expense of cheap energy resources.

In 2012, there was a separation of real US production from hydrocarbon consumption. While domestic production was growing rapidly, the trade balance for other types of goods and services continued to decline further into negative. It is clear that the trade balance will go deep down and update records for 2006/08 if a drop in oil prices leads to massive bankruptcies of oil shale companies.

The situation repeated with the exception of one "but" - the Fed has run out of legitimate tools to influence the situation. The traditional methods have been used up – three waves of quantitative easing remained hanging on the balance sheet of the Fed, lowering the rate by half a percent will not give the desired effect.

The Fed's reaction to the collapse of the markets followed quickly - the New York Federal Reserve made a special statement even before the start of the working day, from which it follows that overnight liquidity will be increased from 100 to 150 billion, weekly repo operations from 20 up to 45 billion. It will be possible to reduce the volatility, but it is unlikely to stop the decline.

EUR/USD

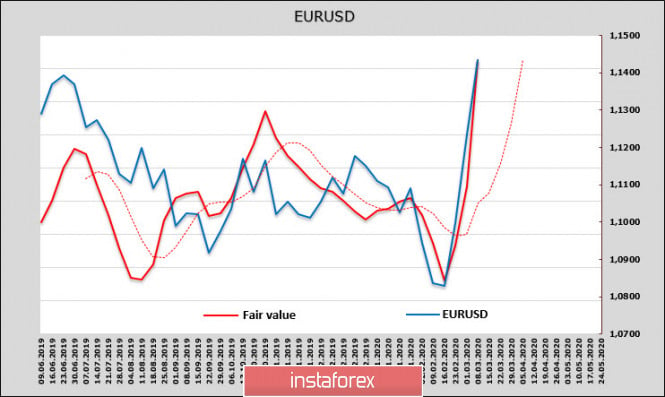

The euro reached a 12-month high, as panic sales led to a mass exodus from the carry trade, net shorts on CME. According to the CFTC Friday's report, it drop 3.4 billion, and the estimated price at the opening of the US market on Monday is almost the same with spot.

All this despite the fact that the Sentix indicator of investor confidence fell in March from 5.2p to -17.1p, which reflects a clear increase in panic regarding the prospects for the European economy. The euro growth was supported, among other things, by a positive report on industrial production in Germany, in January the growth was 3%, year-on-year the decline slowed from -5.3% to -1.3%.

Despite the obvious overboughtness of the euro, as follows from the chart, the impulse is very strong and, apparently, reflects not so much the strength of the euro as the growing danger to the dollar. Overbought may cause a correction, but deep correction requires strong steps on the part of the US financial authorities. In the meantime, we need to proceed from the fact that EUR/USD will try to develop success and will strive for 1.1570 in the long term.

GBP/USD

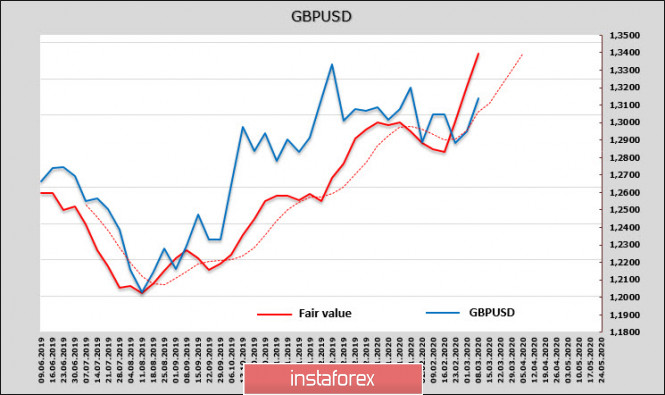

The pound is not growing as clearly as the euro. Nevertheless, it managed to get to the calculated level of 1.32 on Monday, which we designated as the possible target in the previous review. At the same time, the estimated price went to 1.34, and now, the benchmark is shifting to this level. The impulse is still strong, so a reversal is unlikely.

Volatility may increase on Wednesday when several quite important releases are published. Unlike the Fed, an emergency meeting of the Bank of England is not yet expected, although everything may be – the yield on 10-year bonds declined today to 0.072%, i.e. more than 50% relative to Friday's level. Strong bond demand may reflect an unrealized distrust of the pound.

The probability of the decline of the nearest resistance 1.3200 and 1.3266 looks high in the coming days.

The material has been provided by InstaForex Company - www.instaforex.com