To open long positions on EURUSD, you need:

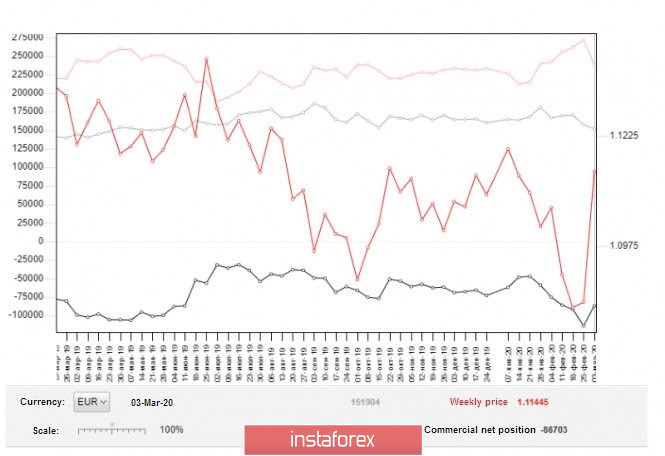

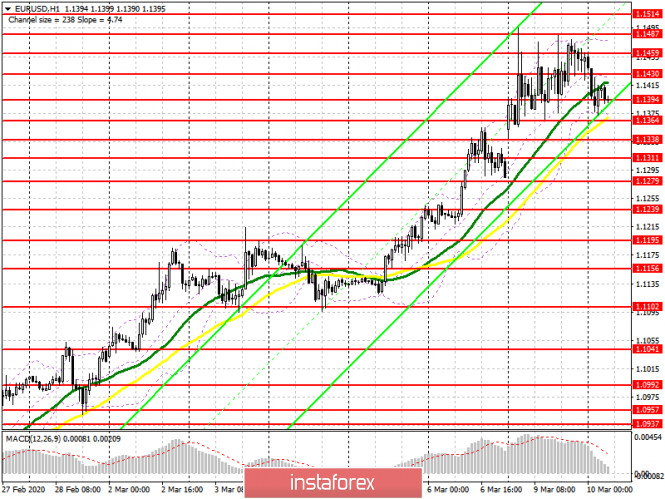

Yesterday's surge in volatility, which led to the update of the 15th figure, is gradually decreasing, as the market is preparing for an important meeting of the European Central Bank and waiting for the next decisions of the Federal Reserve System. In the COT report (Commitment of Traders) for March 3, a sharp reduction in short positions for the euro was noted, but there was no strong growth in long positions. On the contrary, they also decreased, which indicates the caution of traders after such a large rise in the pair at the end of last month. The reduction in short non-profit positions occurred from the level of 271,608 to 238,607, while long non-profit positions decreased from the level of 157,587 to 151,904. As a result, the non-profit net position has grown significantly from its negative level of -114,021 to -86,703. All this suggests that speculative players are reconsidering their forecasts for the euro and it is likely that the market will turn in the longer term. At the moment, the bulls need to form a false breakdown in the support area of 1.1364, which will be a signal to open new long positions in the expectation of returning and fixing above the resistance of 1.1430, which will lead to a repeated update of the highs of 1.1459 and 1.1487, where I recommend fixing the profits. If there is a further downward correction in the first half of the day, it is best to look at long positions after testing the lows of 1.1338 and 1.1311.

To open short positions on EURUSD, you need:

Sellers coped with active pressure from buyers of the euro and did not let the pair above the resistance of 1.1487. At the moment, the calculation will be based on data on the volume of industrial production in France and Italy and on the report on the GDP of the eurozone. Poor statistics are unlikely to significantly harm the euro, but fixing below the support of 1.1364 will lead to a larger downward correction in the area of the lows of 1.1338 and 1.1311, where I recommend fixing the profits, as larger buyers will start to act from there. In the scenario of a re-growth of the euro, the bears will expect to form a false breakdown in the resistance area of 1.1430, but it is best to open new short positions immediately for a rebound after returning to the upper limits of the side channel of 1.1459 and 1.1487. However, it is worth remembering that their breakthrough will lead to a new upward wave, so do not forget about stop orders.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 moving averages, but demand for the euro may return at any time.

Bollinger Bands

A break of the lower border of the indicator at 1.1364 will increase pressure on the euro. Growth will be limited by the upper level at 1.1480.

Description of indicators

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.