The US employment report in February turned out to be unexpectedly strong and contained a further decline in the dollar, but the Fed is forced to respond to completely different factors. The collapse of the market will likely lead to a quick reaction of the majority of the Central Banks, which will be forced to introduce emergency measures. However, forecasts remain negative.

The main negative effect of the spread of COVID-19 has not shown itself yet; expectations on lowering the Fed rate at the March 18 meeting, since stopping the decline in inflationary expectations remains the main goal at this stage. The dollar will not be able to reverse the trend of weakening this week, the favorites will be traditional protective assets - gold, yen, franc and bonds.

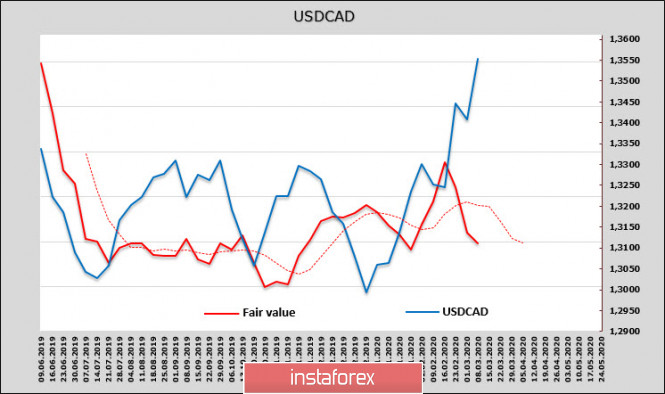

USD/CAD

The CFTC report turned out to be neutral for the Canadian currency in general, as the majority of long contracts decreased slightly, but still exists, and as a result, the estimated fair price is still significantly lower than the current one. This means a rather unexpected forecast for the CAD - despite the fact that the Canadian dollar is a recognized commodity currency, its reaction to the massive collapse of the market is surprisingly restrained.

Given that both the Bank of Canada and the Fed cut the rate almost simultaneously and by one amount, we must admit that the loonie does not look like a loser based on the results of the steps taken. The domestic indicators of the Canadian economy are noticeably better than those of the United States, the Ivey business activity index declined slightly in February to 54.1p, that is, it remains in a confident expansion zone, the average hourly wage growth is 4.33% y / y, which means that inflation expectations higher than in the USA.

Apparently, the market is starting to form the opinion that the Fed will act more aggressively this year than the Bank of Canada. The US dollar has noticeably weakened, Treasury yields have collapsed, stock market trends are negative, and the fact that yields in Canada are usually higher compared to the US suggests that the Canadian premium on the bond market will continue.

After USD/CAD went above the resistance line 1.3381, the trend became frankly bullish and technically attempts to develop growth are justified. At the same time, the estimated fair price is directed down and is at about 1.3120. Therefore, the chances of a technical correction look high and only the oil's collapse does not allow the Canadian currency to win back the massive weakening of the dollar.

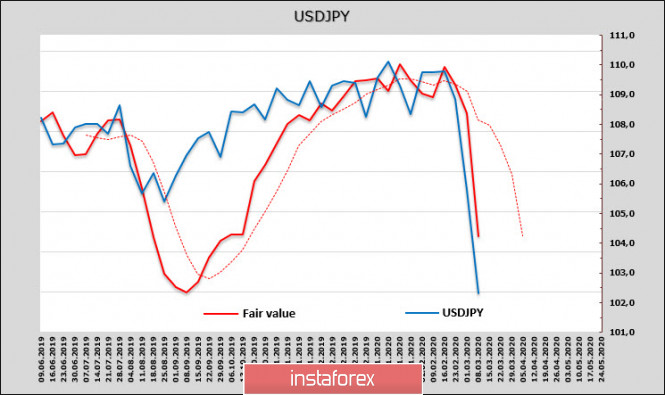

USD/JPY

The yen is an obvious favorite when paired with the dollar, as its protective currency status has finally come forward. The collapse of oil and stock indices makes commodity currencies vulnerable, while countries that depend on imports of raw materials get a clear win, and the yen reacts as it should with an increase. Despite the fact that quotes declined to the level of 101.20, the chances of the pair developing lower remain high, since the estimated price is also falling steadily down, and you can only rely on consolidation near the lows with a look on another wave down.

The situation is starting to put pressure on the Bank of Japan, and despite the fact that the measures taken by central banks in connection with the spread of coronavirus are temporary, we know that there is nothing more permanent than temporary measures. During the crisis of 2008/09, many "temporary" measures were also taken, which they did not manage to cancel.

The head of BoJ, Kuroda, made a speech on March 2. He promised to ensure sufficient liquidity and ensure stability in the financial markets through appropriate market operations and the purchase of assets. The conditions for a powerful monetary easing have already taken form, but they need to be formalized. In addition, the accelerating strengthening of the yen may require a quick reaction. As a result, one should expect the announcement of specific mitigation options by the meeting of the Bank of Japan on March 18-19. For example, expanding the purchase of ETFs, increasing lending to enterprises and expanding purchases of commercial bonds.

The yen is targeted at level 100, which may force the Bank of Japan to take decisive actions, for example, to intervene in order to restrain the strengthening of the yen. Meanwhile, correction to today's broken support level of 104.4 seems unlikely.

The material has been provided by InstaForex Company - www.instaforex.com