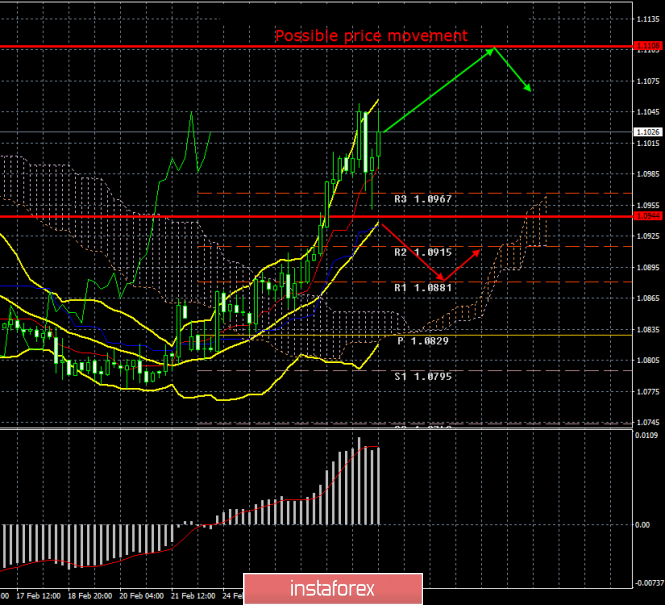

4-hour timeframe

Amplitude of the last 5 days (high-low): 67p - 60p - 54p - 127p - 102p.

Average volatility over the past 5 days: 82p (average).

After completing a completely crazy week for the EUR/USD pair, a number of reasonable questions arise that need answers. Firstly, initially the last week of February was considered corrective, following a three-week fall in the euro. Thus, the upward movement was expected, but at the end of the week it intensified too much and turned into a rather strong upward trend. Question: what next? Did the bulls reverse the trend in their favor or was the correction just too strong? Secondly, macroeconomic data last week (even though there were few of them), in fact, were ignored. It is also impossible to say that traders reacted to the fundamental background when they either got rid of the dollar, or invested in euros. Question: Are the markets ready to calm down and react logically to macroeconomic publications again? In fact, nothing has changed fundamentally for the euro/dollar currency pair. The euro is still weak, the dollar is still strong. Nothing has changed in the economies of the United States and the European Union, and the notorious coronavirus, which causes panic in the foreign exchange market, in the stock markets, has to do with both the United States and the EU. Thus, it cannot be concluded that the coronavirus has a greater negative impact on someone else's economy. Thus, we believe that nevertheless last week there was a correction. Since the euro continued to grow for six days, now we need a correction against the correction. Accordingly, in almost any case, in the new week we expect the euro's price to fall. This is evidenced by banal technical analysis. As before, we recommend that you do not try to guess the trend reversal points, but simply be prepared for a downward reversal in response to technical indicators.

However, technical techniques, but also the macroeconomic background should not be pushed aside. Last week traders paid almost no attention to reports and publications. However, firstly, there were very few of them, and secondly, they were insignificant (except for the report on orders for durable goods in the US). There will be plenty of important publications this week in both the United States and the European Union. Thus, it is unlikely that traders will be able to continue to ignore macroeconomic statistics.

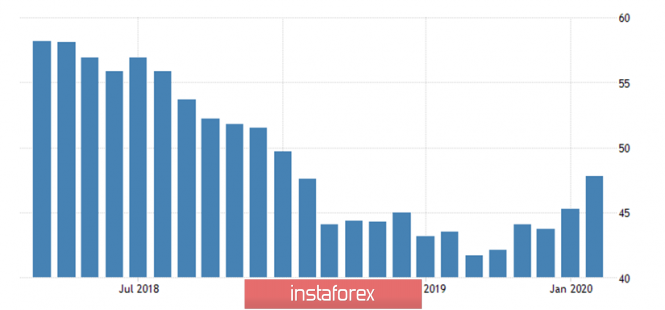

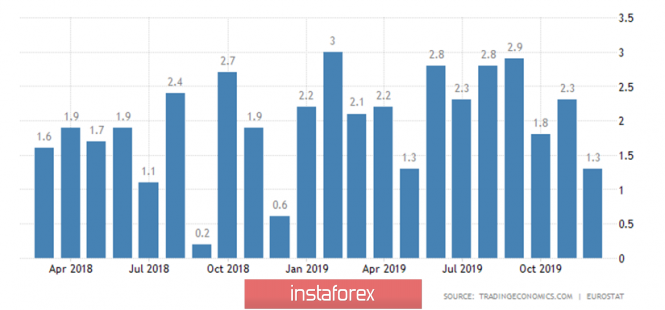

We will begin to consider events in chronological order. Germany will release the index of business activity in the manufacturing sector for February. A value of 45.3 was recorded in January, and preliminary data for February indicated an increase to 47.8. It is such forecasts that economists give as the final value of the second month of 2020. Most likely, the forecasts will come true, so the industrial sector may begin to show signs of recovery.

A similar index will be published in the European Union. According to preliminary values for February, the index rose to 49.1 and the same forecasts for the final value. Thus, the industrial sector may begin to show recovery in the eurozone. Accordingly, European data on Monday may please traders. However, both indicators are likely to remain below the level of 50.0, that is, a decline in the region will be recorded this time.

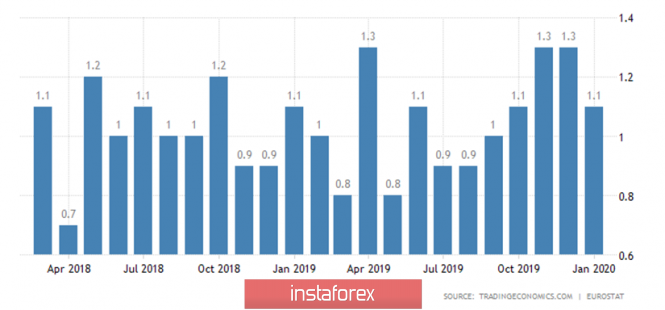

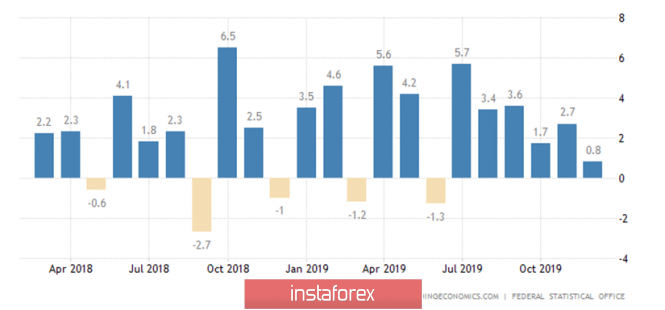

Significant data will be published in the European Union on Tuesday. First, the unemployment rate and producer price index, and then the basic consumer price index and the main CPI. Core inflation, according to various forecasts, will be in February from 1.1% to 1.2% yoy. That is, acceleration, if expected, is negligible. Recall that the base indicator does not take into account changes in food and energy prices. If you look at the chart above, over the past two years, core inflation has been constantly around 1%.

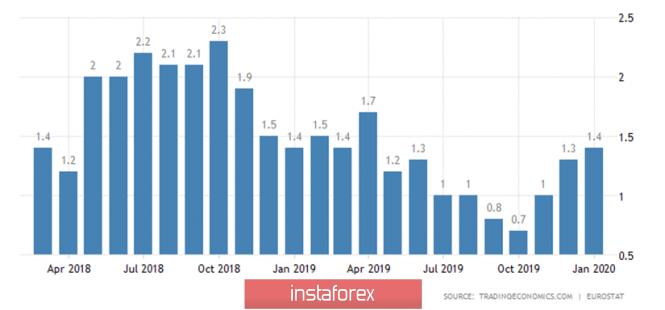

The main inflation indicator takes into account price changes in all categories of goods. In recent months, it began to accelerate, but forecasts for the month of February indicate a new slowdown to 1.2% - 1.3% y/y. Thus, this indicator will most likely remain at rather low values and is unlikely to support the European currency.

On Wednesday, March 4, Germany will publish a retail sales figure for January, which may accelerate slightly according to experts' forecasts to 1.2%-1.4% y/y.

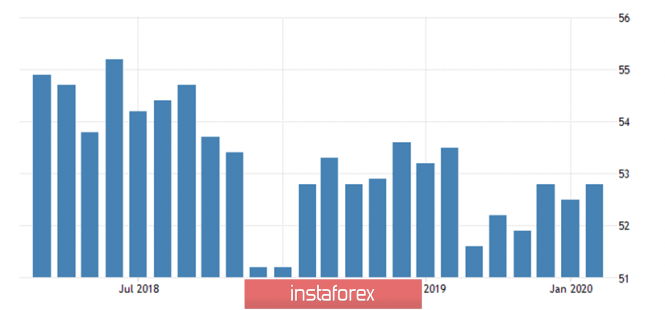

As well as the index of business activity in the services sector, which does not cause any concern among economists and traders, although it is projected with a slight decrease to 53.3. Over the past two years, the indicator has never dropped below the key level of 50.0, so the service sector is considered a stable sector of the economy.

In the eurozone, PMI will also be published for the service sector, which also does not cause any concern among traders, and is projected with a slight increase to 52.8.

Retail sales in the European Union may add from 1.1% to 1.4% in January, but overall will remain at the level of the previous month, December. No important publications are planned in the European Union on Thursday and Friday.

What can be said about this news package as a whole? The data is quite important, but after a strong six-day growth in the euro, traders will need very strong reports from the eurozone to continue to buy the euro. Thus, we believe that if the data on business activity in industry, inflation, as well as retail sales in the EU do not turn out to be significantly higher than forecast values, then market participants will not pay due attention to all European reports. Moreover, forecasts for some indicators predict growth, and for some - decrease. A technical correction is necessary for the pair and only very strong statistics from the EU or very weak from the USA will block the technical factors. Thus, we believe that the fall of the euro is more likely next week.

Trading recommendations:

The EUR/USD pair is still in an upward movement. Thus, now you can stay in long positions with the target level of volatility of 1.1108, however, the MACD indicator has already turned down, and the likelihood of the start of correction is very high. It will be possible to sell the pair with targets at 1.0881 and Senkou Span B line, when traders will be able to gain a foothold back below the critical line.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com