The news that China is beginning to reduce the number of patients with coronavirus, as well as the real expectations of the local financial market of new measures to stimulate the national economy, have led to a sharp increase in stock indices throughout the Asia-Pacific region.

After last week's strongest sales, amidst panic in global markets, a sharp reversal took place on Friday due to the spread of the virus's crown around the world, which can be described as a very likely end to the correction in the stock markets and it really could be so. The coming week will confirm this argument or not.

There is a weakening of the US dollar against commodity currencies on the currency market on Monday, which is associated with a sharp recovery in prices for commodity assets and crude oil. The reason for this, as already mentioned above, is the strong growth in the first place of the Chinese stock indices, which are supported by the hopes that the growth of coronavirus diseases in the Middle Kingdom will decrease, and the state support for the national economy, on the contrary, will increase. At the time of writing, quotes of oil are growing by more than 3.0%, while futures on copper and other industrial metals add more than 1.0%.

We believe that if the correction in the markets is indeed over and the panic mood associated with the coronavirus gradually disappears, then we will witness a massive rebound in demand for risky assets. On the whole, we expect just such a reaction in the markets, unless, of course, some catastrophic news regarding the situation with this affliction comes again.

In addition, the growth of positive sentiment will lead to a rebound in equity markets in Europe and North America. On this wave, we expect a local increase in the Canadian, New Zealand and Australian dollars. At the same time, the demand for defensive assets will decline as well as the Japanese yen and Swiss franc. In turn, gold quotes may also be under pressure.

Regarding the single currency, we note that its upward momentum may continue, since the ECB has not yet given a clear and convincing signal about the decision to expand stimulus measures for the European economy, but on the contrary, the Fed is expected to lower its key interest rate at the March meeting. According to the dynamics of futures on rates on federal funds, almost one hundred percent of the market is confident that this will happen.

The probability of a local continuation of the growth of the euro / dollar pair also confirms the distribution of the net positions of the futures contracts for the pair, which indicates a decrease in the sentiment of Commitments of Traders (COT) of large investors (Large Traders). However, this decrease on February 25 is not so pronounced and looks more like a small profit fixation. The growth of the euro strengthened later, along with an increase in sentiment regarding cuts in interest rates by the Federal Reserve this month.

On the whole, assessing the prospects of the currency exchange market, we believe that the prospects for the dying of panic around the spread of coronavirus and the growth in the expectation of the Fed to lower interest rates amid strengthening stimulus measures by China for its economy will lead to a local weakening of the dollar, paired with an increase in demand for risky and commodity assets, which will be the basis for the end of the correction held last week.

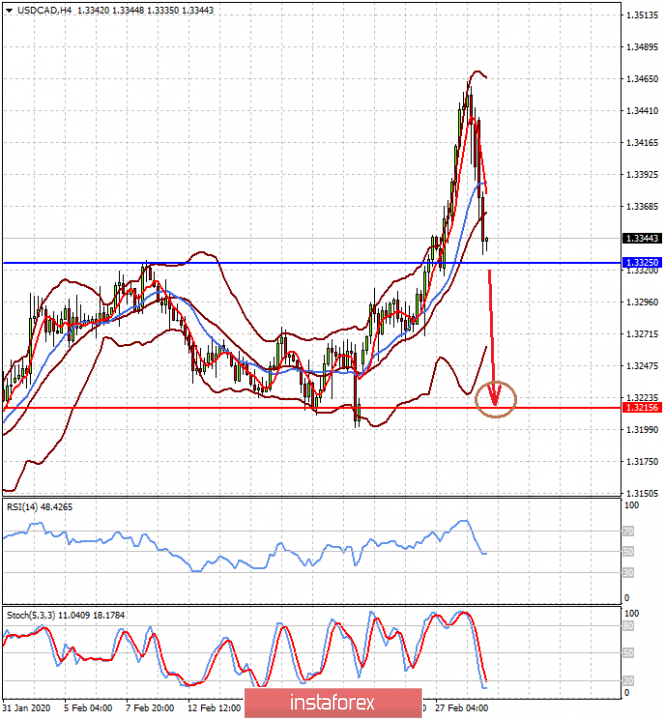

Forecast of the day:

The USD/CAD pair is trading above the level of 1.3325. Continued increase in crude oil prices against a generally favorable background in the markets may become the reason for the resumption of its decline to 1.3215 after the price breaks through the level of 1.3325.

The USD/JPY pair found support at the level of 107.40 and is recovering in the wake of rising demand for risk. We believe that maintaining such sentiments in the market and breaking through the level of 108.30 will lead to a local growth of the pair by 109.00.