4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - down.

CCI: -66.8690

Nothing changed for the EUR/USD currency pair. The pair's quotes are still moving down at a slow pace, often with minimal volatility, and still without the slightest hint of an upward correction. Before the current downward trend, the pair faced a situation for several months in a row when there were all reasons and grounds for continuing the depreciation of the euro against the dollar. However, this did not happen since the bears simply refused new sales at the minimum for 2 years of the pair's value. Now, bears update three-year lows every day and have no problems. All trend indicators are directed downwards. There were no macroeconomic publications in the European Union and the United States that could have drawn attention to yesterday. Only the minutes of the last Fed meeting were published late in the evening. An event with a "loud" name, which rarely causes any reaction from traders. It happened this time as well and it can be seen from the currency pair chart.

As we said yesterday, there was nothing very important or interesting in the minutes of the last meeting. After a detailed study of the document, the main conclusion that can be drawn is that the members of the monetary committee disagreed about the consequences of the policy of low-interest rates. Some Fed officials believe that low rates have a beneficial effect on the US economy, while others fear negative consequences and vulnerability of the financial system. As a result, the regulator will continue to rely on indicators of inflation and the level of employment of the population when making decisions about changing the parameters of monetary policy. Also, the Fed added language regarding the "coronavirus" to its final release, considering it a factor that increases uncertainty for the global economy. In general, the Fed representatives note stability, economic growth, low unemployment and a good state of the labor market.

If we consider the report in more detail, then the following becomes clear. The Fed still does not believe that the trade conflict between the United States and China is completely over. It is feared that the signing of the "second phase" will be delayed for a long time, respectively, the negative effects will continue to affect the US economy. Fed officials also believe that inflation "above 2%" will emphasize the "symmetry" of the target level. GDP forecasts for 2020 and 2021 in the United States have been raised on the background of reaching an agreement in the "first phase" with Beijing. The Fed's monetary committee also believes that unemployment will continue to decline in the future. Also, the Fed allows for possible intervention to reduce risks to financial stability but does not give any signals that it may happen soon.

In general, from our point of view, it is absolutely a passing protocol of the Fed, which does not contain any new information. On Thursday, February 20, again no important macroeconomic information is expected from either the EU or the US. The calendar contains only minor releases, such as the consumer confidence index in Germany or the level of consumer confidence in the European Union. However, these indicators are not very interesting for market participants. Thus, we do not believe that the volatility of the currency pair will change in the course of tomorrow, and traders will begin to change their preferences in trading. By all indications, tomorrow we will have a trading day that is no different from the previous. Of course, the correction can still start at any time, however, we still believe that it is more likely to start if the pair's quotes reach a strong support level, near which a large number of pending purchase orders are located. The next more or less significant macroeconomic publications are scheduled for Friday.

From a technical point of view, the last two bars are colored purple by the Heiken Ashi indicator. That is, we can formally talk about the beginning of a correction, however, there is no correction, and the pair has moved away from local lows by "as much as" 30 points. Thus, we recommend that traders focus more on the moving average line, which is located close to the price and gradually decreases. As long as the price is below it, the downward trend persists.

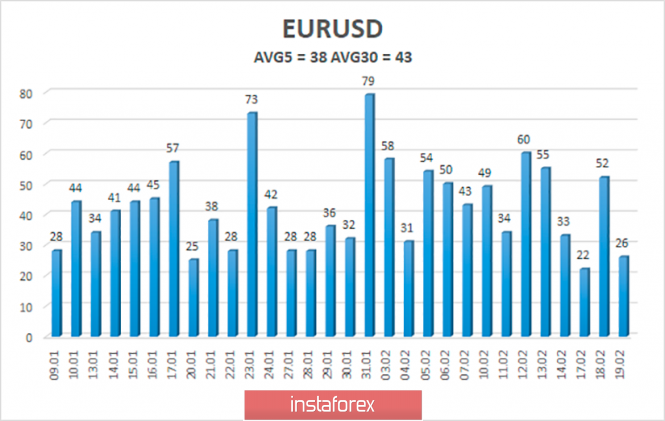

The average volatility of the euro/dollar currency pair has decreased again and is now only 38 points. For the last three days, the pair can not exceed the mark of 33 points per day. On Thursday, therefore, we expect movement between the borders of the volatility corridor of 1.0765-1.0841. The fundamental background will be extremely weak again, so it is unlikely to expect a rise in volatility on Thursday.

Nearest support levels:

S1 - 1.0742

S2 - 1.0681

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0803

R2 - 1.0864

R3 - 1.0925

Trading recommendations:

The euro/dollar pair continues its calm and extremely weak downward movement. Thus, sales of the European currency with the targets of 1.0765 and 1.0742 remain relevant now, which can be kept open until the Heiken Ashi indicator turns up. You can also keep sell positions open until the move is completed. It is recommended to buy the EUR/USD pair not earlier than fixing the price above the moving average line with the first target of the Murray level of "3/8" - 1.0925.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com