As expected, the pound continued to lose ground yesterday. However, this was somewhat strange, since it completely ignored the British statistics, and everything happened solely against the background of US statistics. Although the overall result fits into the logic of the existing market dynamics.

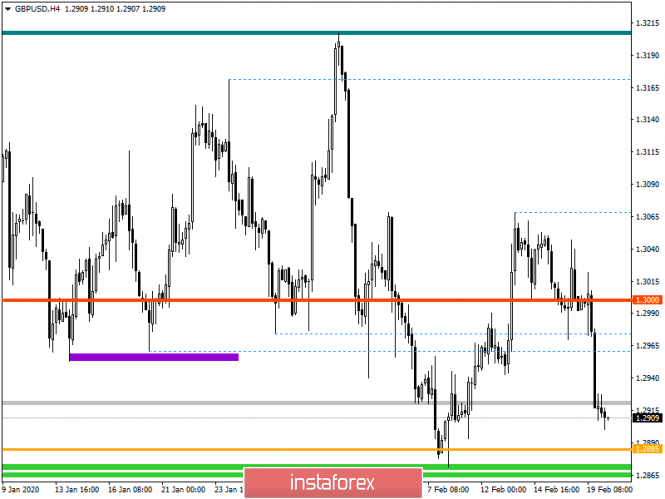

Nevertheless, the absence of market reaction to inflation in the United Kingdom from 1.3% to 1.8% is surprising. Moreover, they predicted growth to 1.4%. In such a reaction of the market, or rather its absence, the general mood of market participants to further strengthen the dollar can be clearly seen. After all, only US data are taken into account. Although, a noticeable increase in inflation removes all sorts of questions regarding the further actions of the Bank of England, which, most likely, will not lower the refinancing rate until the middle of the year.

Inflation (UK):

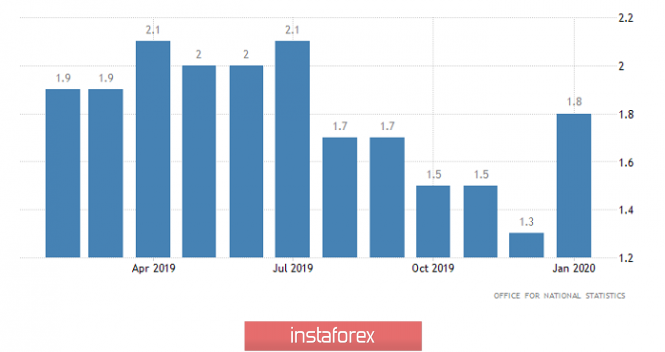

US data seriously inspired investors, and they continued to buy dollars with renewed vigor. The main news was data on producer prices, whose growth rates accelerated from 1.3% to 2.1%. But they were waiting for acceleration to only 1.7%. This indicator is inflationary, which means inflation will continue to grow. Consequently, the Federal Reserve has more and more reasons to think about the possibility of increasing its refinancing rate. So the optimism of market participants is quite justified.

Manufacturer Prices (United States):

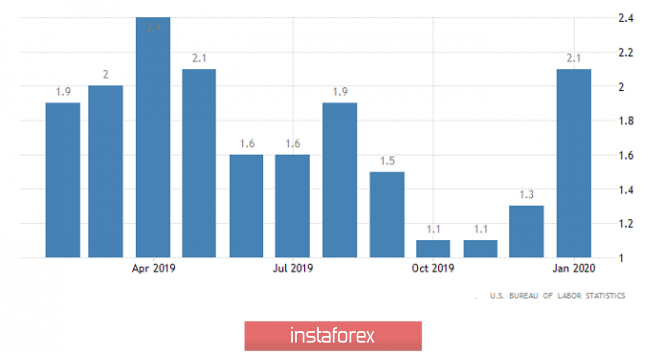

But not only data on producer prices turned out to be better than forecasts. The same fate befell the data on the construction. In particular, the number of new construction projects decreased by 3.6%, but the fact is that they expected a reduction of as much as 17.7%. In addition, the number of issued building permits increased by 9.2%, instead of 2.2%, which means that in the near future, the volume of construction will increase.

Number of New Construction Projects (United States):

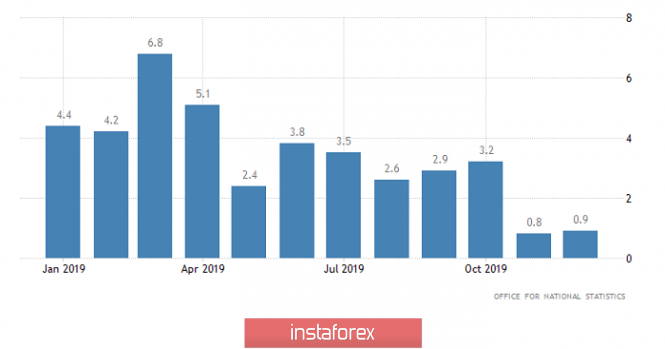

UK data on retail sales will be released today, the growth rate of which should slow down from 0.9% to 0.5%. But fortunately for the pound, the market has recently ignored any data other than the US one, so the decline in retail sales will not affect the pound.

Retail Sales (UK):

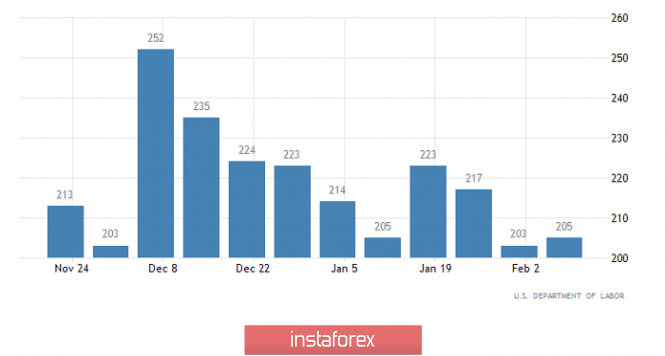

But US data, which are only of interest to market participants, are likely to lead to a weakening dollar. Which has long been obvious. A temporary rebound is needed. The total increase in the number of applications for unemployment benefits, by 17 thousand, may be the reason for a local correction. Moreover, an increase in the number of both primary and repeated applications for unemployment benefits is expected. In particular, the number of initial applications should increase by 10 thousand, and the number of repeated ones by another 7 thousand.

Number of Initial Jobless Claims (United States):

In terms of technical analysis, we see the acceleration of quotes in a downward direction, after several days of being suspended within the psychological level of 1.3000. In fact, such an outcome could be expected, since we have a fracture of the clock component, where the level of 1.3000 is no longer a stumbling block.

Considering the trading chart in general terms, we see that the quote went down to the support area on February 10, which means that the recent correction has been worked out.

It is likely to assume that if the pattern coincides, the 1.2880/1.2900 area may again play the role of a support, slowing down the quote and forming a technical pullback. In the form of an alternative scenario, it is worth considering the preservation of a downward mood, but in this case we should see the price being consolidated below 1.2880.

From the point of view of a comprehensive indicator analysis, we see a sell signal with respect to all the main technical tools. The signal was created based on a recent impulse move.