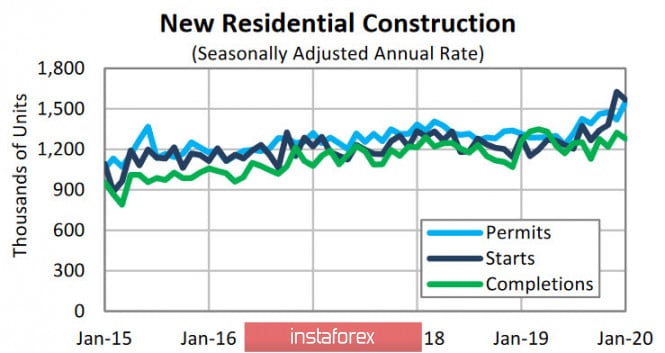

The dollar is growing across the entire spectrum of the currency exchange market on positive statistics and encouraging news about COVID-19. At the same time, production prices in January showed growth significantly above forecasts, while the construction market significantly increased its growth, building permits were issued in January by 9.2% more than a month earlier, easing the monetary policy of the Fed is recouped almost without a delay in time.

As for the coronavirus, the number of people recovered exceeded the number of cases for the first time since the start of the epidemic, according to reports from China. Market participants regarded this news as a signal that the spread of the virus was taken under control, a sharp reduction in danger led to large-scale sales of the Japanese yen and an increase in demand for commodity assets.

Asian exchanges on Thursday morning in a steady positive following the American ones, the positive was strengthened by the decision of the People's Bank of China to lower rates for first-class borrowers, markets expect stimulus measures to stop there. According to some reports, China is considering the possibility of direct cash injections to support the aviation industry, since the impact of the virus blocks companies' cash flows, many companies cut salaries and delay employee payments.

In addition, the probability of a rate cut at the September meeting is currently less than 30% after the publication of the minutes of the FOMC meeting; however, a certain advantage of dovish sentiment remains, but overall the assessment of the economic situation in the USA has become more positive. The risks of a trade war and harsh brexit were reduced, and geopolitical risks in the Middle East and coronavirus replaced them.

Particular attention was paid to the position of the Fed on repo operations, but the markets did not learn anything new. They will remain in effect at least until April, then their gradual reduction will begin, T-bills purchases will also begin to decline starting from the 2nd quarter. Apparently, the US presidential election will be approached in a stable development trend, but with minimal stimulating measures on the part of the Fed. If this scenario is implemented and does not lead to a deep correction in the markets, then the chances of Trump's victory will increase, and "what's good for Trump is good for the dollar."

In any case, the development of events is aimed at maintaining the trend for the dominance of the dollar. The correction time has not come yet.

EUR/USD

The euro is trying to start consolidation after a long decline, the lack of significant news forces players to take a break until Friday, when the PMI Markit for February will be published in the eurozone, Germany and France to assess the impact of coronavirus against the backdrop of the expected recovery after a tumultuous fourth quarter.

Moreover, the euro is in a state of free fall after the loss of support 1.0878, which is restrained except by the lack of correction and oversold. However, these are just technical factors, and fundamentally, the dollar looks much stronger and there are no reasons for a turn up.

Perhaps, the correction will be blocked near 1.0878, which is a good level for sales with the target of 1.0725, long-term target of 1.0338.

GBP/USD

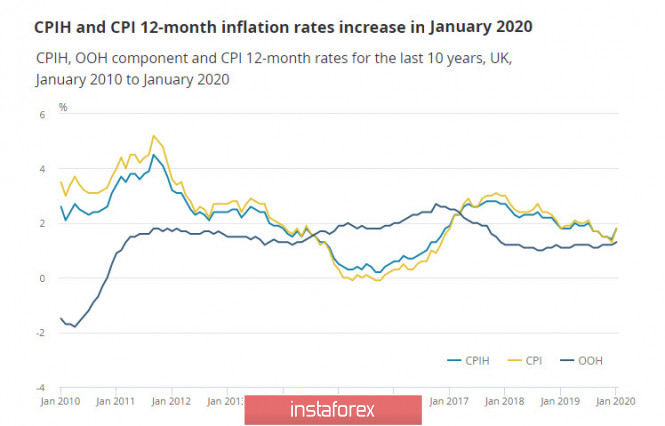

Consumer inflation in the UK surprised at 1.8% growth in January against the forecast of 1.6% and 1.3% a month earlier.

However, the pound did not respond to the publication, which could reduce the chances of adopting a stimulus package in March or at least the composition of this package. The reason probably lies in the fact that the increase in inflation is largely due to rising electricity prices, that is, it is a temporary factor.

At the moment, the pound is oriented not so much on macro statistics, but on expectations about future negotiations with the EU on a trade agreement. The UK is trying to reserve the right not to obey the common EU standards, while the European Union is determined to exert strong pressure on the pound.

These fears have already offset the positive effect of the appointment of Rishi Sunak to the post of Minister of Finance. The pound is aimed at testing support 1.2869, and if successful, the downward movement will increase. But since verbal interventions on the topic of future negotiations are likely at any time, caution must be exercised, since from a technical point of view, the pound has currently no direction. The resistance is at 1.3025 and further 1.3071, if you try to increase to the first of them, you can sell with an intermediate target of 1.2869.

The material has been provided by InstaForex Company - www.instaforex.com