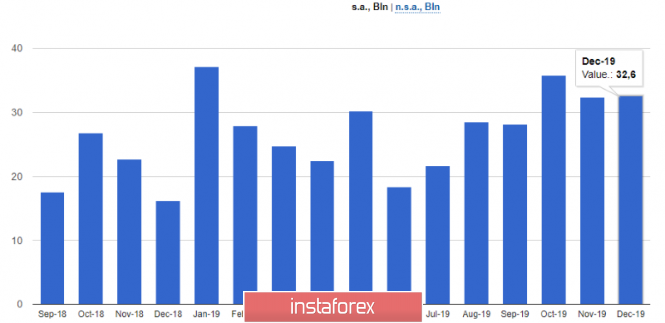

A slight increase in the eurozone balance of payments current account surplus to 33 billion euros in December 2019 did not greatly help exhausted buyers of risky assets to regain at least part of their positions following the fall that has been observed since the beginning of this year. Let me remind you that the positive balance of the current account of the balance of payments of the eurozone amounted to 32 billion euros in November 2019.

All attention will be shifted to the minutes of the January meeting of the US Federal Reserve today, which are unlikely to make any significant changes to the market, since traders will not find anything new in them. The Fed will publish the minutes, but the central bank's current approach to interest rates will remain unchanged. Let me remind you that in January, the Fed leaders voted to keep the key rate unchanged, in the range of 1.5% -1.75%. Before that, it was possible to observe three lows throughout 2019.

It is possible that the emphasis in the minutes will be shifted to the likelihood of coronavirus affecting both the global economy and the trade conflict between the United States and China, a truce on which was reached at the end of last year. Last week, during his speech, Fed Chairman Jerome Powell touched on this problem, saying that the central bank is closely monitoring the situation and is ready to act as necessary, which is more likely to lead to lower interest rates than to raise them. However, this did not have any effect on the US dollar.

The technical picture of the EURUSD pair remained unchanged. All that European bulls can count on is the pair's return to the resistance area of 1.0830, since it will only be possible to talk about a larger increase to the area of the highs of 1.0860 and 1.0890 above this range. If the pressure on the trading instrument continues further, update of the lows 1.0740 and 1.0680 is not ruled out.

GBPUSD

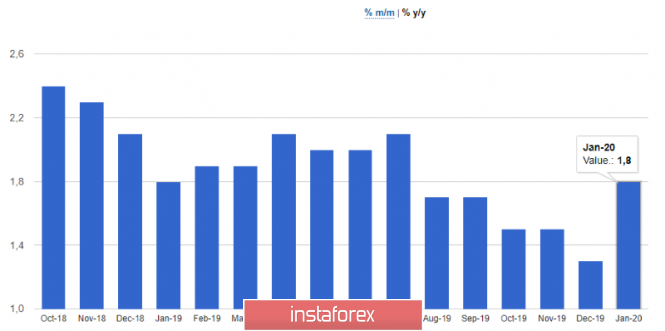

The British pound rose on the news that annual inflation was higher than expected, which reduces the likelihood of lowering the Bank of England key interest rate. However, buyers of the pound have not yet managed to break above the quite important level of resistance.

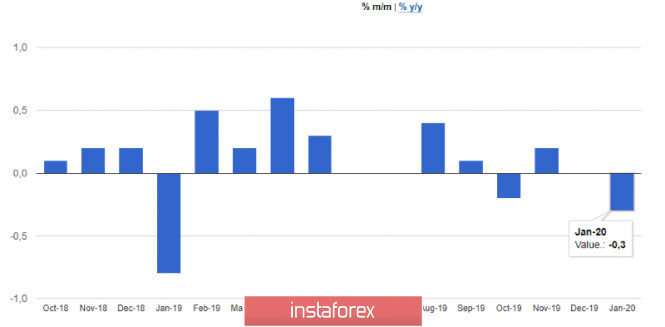

According to the report, the UK consumer price index increased by 1.8% in January 2020 compared to the same period of the previous year after rising by 1.3% in December. Economists had expected inflation to rise by only 1.6%. Let me remind you that the BoE's target level is about 2.0%. But core inflation, which does not take into account volatile categories, jumped to 1.6% in January against 1.4% in December, which indicates a very likely upward trend in domestic inflation in the coming months.

Given that the BoE's monetary policy committee is not so keen on lowering interest rates, such indicators will allow it to push the likelihood of a slightly softening policy change.

As for monthly indicators, according to the UK National Bureau of Statistics, the consumer price index fell by 0.3% in January 2020 compared to December, when inflation remained unchanged. Economists had expected a decline of 0.4%. The retail price index fell 0.4% after rising 0.3% in December, and the purchasing price index rose 0.9% after a similar increase in December 2019.

As for the technical picture of the GBPUSD pair, the struggle for the important level 1.3010 continues. Only a breakthrough of this range will allow buyers of the pound to expect a return to the upper boundary of the side channel 1.3060, and its breakdown will open a direct path to the highs of 1.3100 and 1.3140. If the bears prove to be stronger and break below the support of 1.2970, then, most likely, only the lows of 1.2925 and 1.2870 will have to catch the pound.

The material has been provided by InstaForex Company - www.instaforex.com