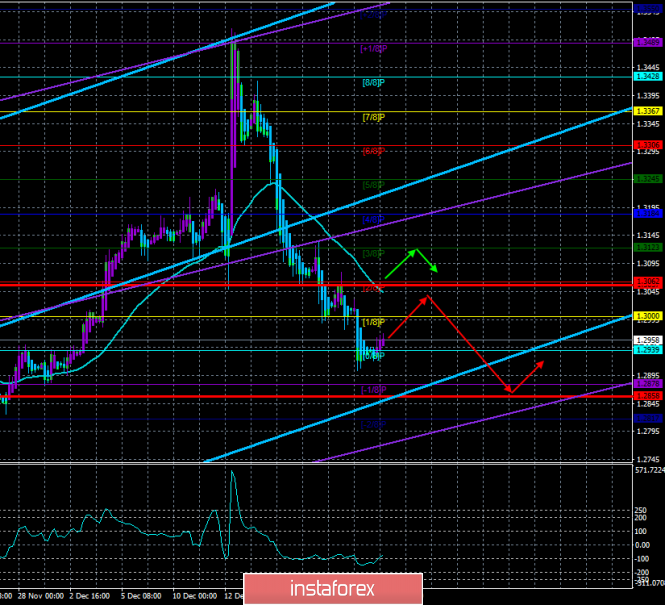

4-hour timeframe

Technical details:

Higher linear regression channel: direction - up.

Lower linear regression channel: direction - up.

Moving average (20; smoothed) - down.

CCI: -78.6140

The British currency began to be corrected on Tuesday, December 24, and all international currency and stock exchanges are closed on Wednesday. Thus, trading will not be carried out until Thursday, and we can only speculate and philosophize about the prospects of the pound sterling, about the various political events and plans of the British government is not the future.

We have repeatedly said that the prospects for the pound remain very dim for a number of reasons, including economic, political, and the "Boris Johnson factor". Thus, until the fundamental background for the British currency changes from absolutely negative to at least neutral, it makes no sense to wait for a serious and reasonable strengthening of the pound. Yes, traders may note that over the past few months the pound also had no reason to grow, however, the currency has grown to $1.35, however, we are now talking exclusively about the reasonable movement of the pair in one direction or another, that is about that movement that can be worked out without relying on luck. Even during the period of its strengthening, the pound initially grew, then for about a month was in a flat, then it increased again. That is, there was no stability. Based on this, we believe that in 2020, the British currency will face approximately the same picture.

The main thing for the UK and the pound is now to go through the first stage of a "divorce" with the European Union. After January 31, the question "will there be a second referendum?" Or "will we just leave the European Union?" Will not be asked. After January 31, the "divorce" process will be officially launched. And the prospects for the pound after January 31 will depend solely on progress in the negotiations between Boris Johnson, representatives of his government and the EU negotiation group led by Michel Barnier. What can you say now, at the end of 2019, about these negotiations? Only that they will be extremely complex, and therefore potentially could fail. We do not believe that absolutely no agreement will be reached. Most likely, a "surface agreement" will be concluded, which will highlight the main points and points of further coexistence of Britain and the European Union. That is, the most important and basic aspects relating, for example, to trade. The remaining, not so pressing issues will already be discussed after 2020. Thus, although most political scientists and experts are inclined to believe that it will not be possible to conclude a deal in 11 months, we believe that perhaps not everything is so bad and there are still some chances for success. However, in any case, it will be necessary to watch the progress of the negotiations and judge the advancement of the parties precisely by this information.

Thus, in 2020 we are waiting for the renewal of multi-year lows of the pound/dollar pair, and how far the pound will go down will depend on the promotion of trade negotiations with the European Union. Technically, the upward trend that has been observed in recent months is already broken, now the bears just need to develop success, based on weak macroeconomic statistics from the UK and uncertainties in future relations between Britain and the EU.

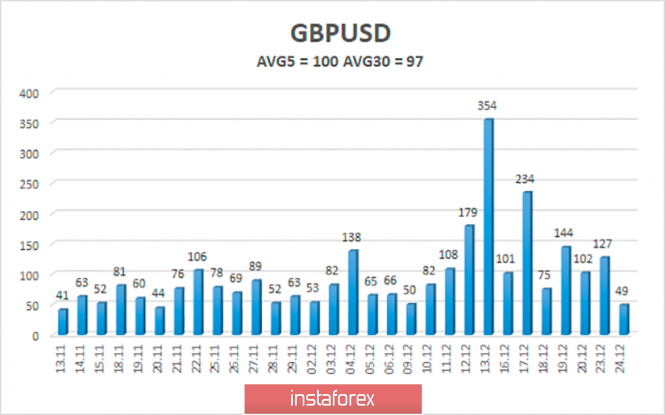

The average volatility of the pound/dollar is exactly 100 points over the past five days, remaining at a fairly high level. According to the current level of volatility, the working channel on December 25 and 26 is limited by the levels of 1.2858 and 1.3060. The pair has currently started to adjust, and volatility may continue to decline in the Christmas and New Year weeks.

Nearest support levels:

S1 - 1.2939

S2 - 1.2878

S3 - 1.2817

The nearest resistance levels:

R1 - 1,3000

R2 - 1.3062

R3 - 1.3123

Trading recommendations:

The GBP/USD pair began a round of upward correction. Thus, traders are advised to sell the British currency with the nearest targets of 1.2878 and 1.2858 after the Heiken Ashi indicator reverses back down, but with extreme caution. It is recommended that you return to purchases of the pound/dollar pair no earlier than re-consolidation above the moving average line, however, while such a scenario is not expected.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanations for illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear channel is the violet lines of unidirectional movement.

CCI - blue line in the indicator regression window.

Moving average (20; smoothed) - a blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com