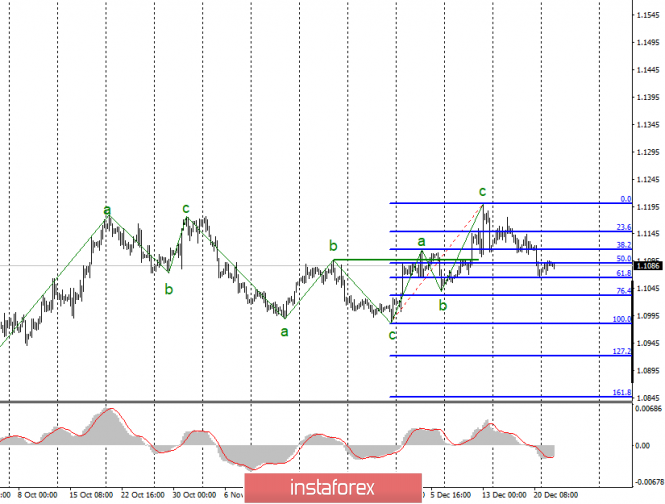

EUR/USD

The EUR/USD pair ended with the loss of several base points on December 24. The current wave marking remains the same, because for the remaining time after the release of a review made on Tuesday with low market activity, no changes just happened. Thus, the pair is in some way stuck between the levels of 50.0% and 61.8% according to the Fibonacci and maintains excellent chances for the continuation of the fall within the framework of the new downward trend section.

Fundamental component:

Christmas is celebrated around the world on Wednesday, so markets are closed and will only open on Thursday morning. For obvious reasons, no news and economic reports on Wednesday, December 25, are listed in the news calendar.

General conclusions and recommendations:

The euro-dollar pair, presumably, completed the construction of the upward trend section. Thus, I would recommend selling the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci. An unsuccessful attempt to break through the 50.0% level may lead to the completion of the quotes withdrawal from the achieved lows and the resumption of the construction of the downward wave.

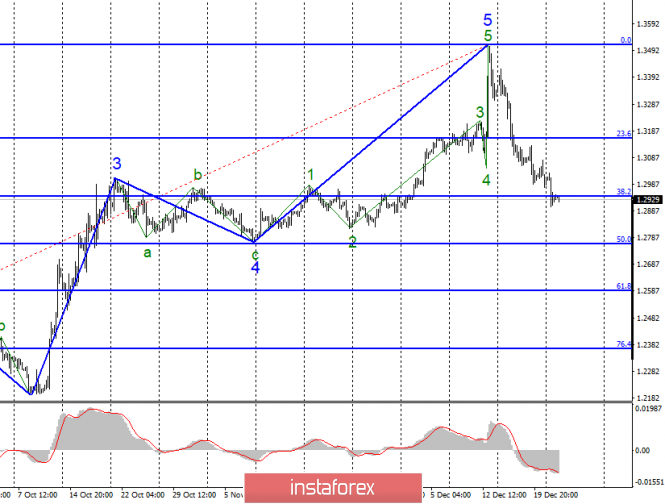

GBP/USD

The GBP/USD pair increased by 20 basis points on December 24, but, nevertheless, remains within the framework of constructing the alleged wave 1, or a, of a new downward section of the trend. At the very least, the departure of quotes from the lows reached by 20-30 points is clearly not enough to ascertain the completion of the downward wave of about 500-600 points. However, a successful attempt to break through the 38.2% level in itself still suggests the readiness of the instrument to build a correctional wave.

Fundamental component:

For obvious reasons, today there is no news background for the GBP/USD instrument. Until the end of the week, no news or reports from the UK or the US are listed in the news calendar.

General conclusions and recommendations:

The pound/dollar tool continues to build a new downward trend. I recommend continuing to sell the instrument with targets near 1.2764, which corresponds to the 50.0% Fibonacci level, but now after a successful attempt to break through the 38.2% Fibonacci level from above. Now there is a chance of building a corrective upward wave.

The material has been provided by InstaForex Company - www.instaforex.com