While oil in the thin Christmas market comfortably rests on its laurels near two-month highs, large banks and investment companies are not stingy with forecasts. The consensus assessment of Bloomberg experts suggests that the average price for Brent in 2020 will be $64.25 per barrel, for WTI - $58.5 per barrel. This is slightly lower than the current quotes for the North Sea and Texas varieties, but higher than their average in 2019.

Over the past month, oil added about 5% thanks to the willingness of China and the United States to sign a trade agreement under Phase 1 and OPEC+'s intentions to bring the total production cuts to 2.1 million bpd, which is equivalent to about 2% of the global supply of black gold . Russia believes that cooperation with Saudi Arabia and other cartel countries is effective and will continue as long as the market requires it. It is believed that a drop in Brent below $60 per barrel will lead to an increase in the cut from Riyadh, and an increase in North Sea quotes above this mark will increase oil supplies from the United States, Norway, Brazil and other countries outside the OPEC. Thus, we are talking about a certain red line around which Brent will prefer to trade in 2020.

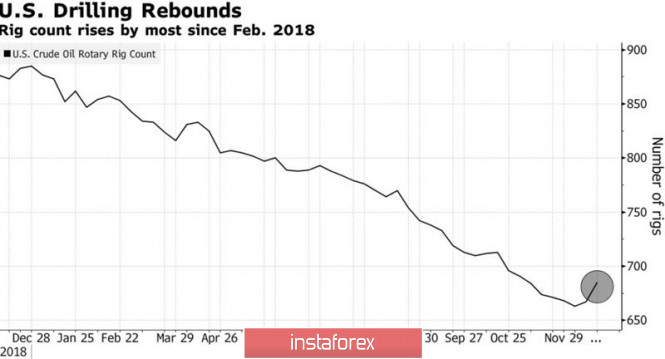

Goldman Sachs predicts that black gold will do better and raises its estimate of the average North Sea grade price from $60 to $63 per barrel. Judging by the decrease in the number of drilling rigs from Baker Hughes, US manufacturers are reducing investment in the industry, which should lead to a slowdown in production. Let me remind you that in November it exceeded 13 million bpd.

US Drilling Rig Dynamics

Speculators are also optimistic about the prospects for black gold. By the end of the week, by December 17, they increased their net longs by WTI by 19%, by Brent - by 6.6%. As a result, indicators are at their highest levels in more than seven months. In 2019, the Texas variety grows faster than the North Sea variety (+33.4% since the beginning of the year versus +23.6%), which has its own logical explanation. The US economy looks better than the rest of the world, and strong domestic demand is driving up prices. In 2020, the situation may change. Thanks to the restoration of the eurozone and China amid the end of the trade war, global demand will lend a helping hand to more expensive oil. As a result, the Brent-WTI spread risks expanding.

The dynamics of WTI and speculative positions

It is possible that a slowdown in US GDP will force the Federal Reserve to return to the idea of continuing the cycle of a preventive easing of monetary policy, which will inflict a blow on the positions of the US dollar. What is bad for the US currency is good for black gold, so a correction to the USD index in 2020 will raise the number of bulls in the oil market.

Technically, buyers of the North Sea grade managed to gain a foothold above the important level of $64 per barrel, and they are preparing to attack the resistance at $66.85-66.95. Success in this event will open an upward path for Brent in the direction of the target by 88.6% according to the Double Peak pattern.

The material has been provided by InstaForex Company - www.instaforex.com