Hello! At the end of the outgoing year, it is customary to take stock and create plans for the future. I will not depart from this tradition and I will summarize and outline the prospects for the dynamics of the US dollar and its antagonist EURUSD.

Formally, with respect to a basket of foreign currencies, the dollar ends 2019 with a positive trend of about three percent, which can be written in its asset. However, in the second half of the year, a situation emerged in the FOREX market that suggests a depreciation of the US dollar next year, or at least in the first half of 2020. The nature of the foreign exchange market is such that traders are more interested in periods from a few days to a quarter, but today we can say with some certainty that the dollar has survived its climax at the end of September 2019 and by the end of December has almost formed a trend reversal to pull down quotes .

The vast majority of traders determine the trend using graphical analysis in trading terminals, in our case InstaForex will be such a terminal, and if we approach the definition of a trend from the point of view of technical analysis, the medium-term trend of the US dollar is really broken.

Technical analysis is pretty straightforward to understand, but many traders are confused about definitions. I apologize to those who are fluent in this tool, but I consider it necessary to repeat some of the postulates: an upward trend is a series of consecutively increasing lows and highs; a downward trend is a series of successively lowering highs and lows; the trend will continue until we get the opposite.

Based on the tenets of the trend dynamics, for its reversal, it is necessary to violate the conditions of the previous trend, i.e., for the US dollar, which is in an upward trend, it is necessary to violate the conditions for increasing key lows and highs. However, what extreme can be considered key? Let's figure it out, because it is very important! But for this we will need to understand some fundamental market concepts.

Forex is a market with a small time horizon. Unlike the oil market, the highest depth of the foreign exchange market is six months. Theoretically, one can speak of longer periods, but, unfortunately, there is no liquidity or the rate will be very far from what is desired. Therefore, the optimal period for which transactions can be made is one quarter.

If we talk about trading time frames, then the quarter is reflected in the daily period. A transaction opened on a period of one day, with a high degree of probability will be in the market from one to four months. Accordingly, a transaction opened on a four-hour period (H4) will be in the market for one to four weeks, and a transaction opened on an hourly time (H1) will be conducted in the market from one day to one week. Based on these parameters, it is possible to determine the key extreme for each half. For the daily chart, the key points will be monthly and quarterly extremes. For a four-hour time period, weekly and monthly highs and lows will be key, and for an hourly time, day and weekly tipping points will be key.

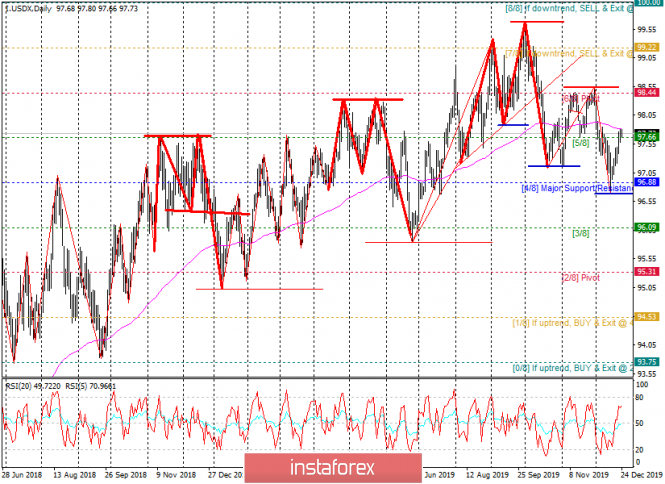

To determine the fracture of the medium-term trend, let's look at the daily chart of the US dollar index (Fig. 1). As follows from the definition of the trend, at the moment, the dollar (USDX) has broken the upward trend, originating in the spring of 2018, dropping below the low of September at 97.90 and October at 97.15. This implies a further decline in the dollar against a basket of foreign currencies at least until the dollar index reaches the November 98.50 high. Another confirmation that the dollar has changed its direction is its location below the level of the semi-annual moving average line with a period of 120. Technical analysis shows that the immediate goals of the US dollar decline will be levels 96.90 and 96.15.

Figure 1: U.S. Dollar trend broken

However, we, as traders, are not very interested in the dollar index, we need to know what will happen to the EURUSD. Everything is very simple here. Since the US dollar index is 58% euro, the EURUSD is the opposite of the dollar index. The current index value is 97.70, and the current EURUSD value is 1.1080. Assuming a decline in the dollar to levels 96.90 and 96.15, this means that the euro during the first quarter of 2020 could grow by 0.8 and 1.5%. Let's see what happens with the euro. A 1.5% increase in EURUSD implies an increase to 1.1230, which is quite realistic in a wide range (Fig. 2).

Fig. 2: Prospects for the dynamics of EURUSD

Consider the dynamics of the EURUSD rate in the four-hour half, which determines the prospects for a period of up to one month. Here we can see a series of successively rising lows and highs, which indicates an increasing trend, which is in full accordance with the US dollar rate in the daily half and suggests the completion of the corrective growth of the dollar that it experienced from December 12. Thus, the current technical picture implies the potential possibility of buying the euro against the US dollar with a target at 1.1230.

The disadvantages of this purchase will be a negative swap and the need to maintain a position during the New Year holidays when liquidity in the FOREX market decreases, which means unpredictable price spikes are possible, which complicates the installation of a stop order to consolidate losses.

From a fundamental point of view, the decline in the dollar and the growth of the euro are locally supported by the growth of oil quotes. In addition, in the future, until March 2020, with almost one hundred percent certainty, one can assume the unchanged policy of central banks, which maintains the current status quo, according to which the exchange rate will change in a narrow range. Thus, with a 95% probability, by the end of March 2020, the EURUSD quote will remain in the range 1.0925 - 1.1535, which corresponds to the band in the parameters of 2019.

The material has been provided by InstaForex Company - www.instaforex.com