USD/JPY has been quite impulsive with the bearish recently after having an impulsive non-volatile bullish momentum pushing the price above 113.00 area with the daily close. Having mixed economic reports, USD is currently struggling against JPY which is expected to have short-term pullbacks along the way.

Due to observance of Health-Sports day, today JPY does not have any impactful economic reports to be published, but tomorrow JPY Current Account report is going to be published which is expected to increase to 1.52T from the previous figure of 1.48T and Economic Watchers Sentiment is expected to decrease to 47.3 from the previous figure of 48.7.

On the USD side, for the observance of Columbus Day there are no economic reports or event to be held today but throughout the week certain highly impactful economic reports are expected to influence the USD gains over EURO in the process. On Wednesday, US PPI report is going to be published which is expected to increase to 0.2% from the previous value of -0.1%, and on Thursday US CPI report is going to be published which is expected to be unchanged at 0.2%.

As of the current scenario, USD is quite optimistic with the upcoming highly impactful economic reports, while JPY having mixed expectations may lead to short-term gains but having worse than expectation may lead to further USD gains in the process.

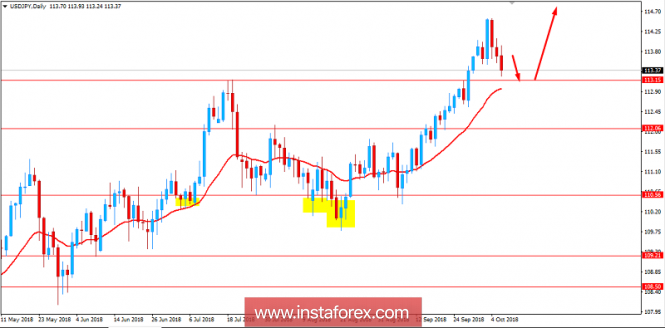

Now let us look at the technical view. The price is currently heading towards 113.00 area after having a strong breakout above the area recently. Though certain bearish momentum can be observed, the trend is still bullish, and having the dynamic level of 20 EMA below the price to hold it as support is expected to lead to further bullish momentum with the target towards 114.50 to 115.00 area in the coming days. As the price remains above 112.00 area, the bullish bias is expected to continue.

SUPPORT: 112.00, 113.00

RESISTANCE: 114.50, 115.00

BIAS: BULLISH

MOMENTUM: VOLATILE