AUD/USD has been quite volatile, judging by the recent price action. However, the pair managed to push lower below 0.7050 area currently with impulsive momentum. Despite the recent economic headwinds faced by US after the recent rate hike, AUD failed to gain momentum over USD which indicates weakness of the currency in the process.

Though AUD has been quite successful with the gains against other currencies in the market, it is making efforts to gain over USD. After the mixed economic data on employment last week, AUD somehow managed to gain some momentum in the process but failed to sustain it. This week RBA Assistant Governor Debelle and Bullock spoke about the economic developments and expressed the hawkish view on the current economic structure which is expected to encourage growth in the future.

On the USD side, recently a series of macroeconomic data like Core Durable Goods Orders, Durable Goods Orders, and Trade Balance report was published with mixed scores. As a result, the US currency is trading with indecision. However, the borad-based strength of USD is ensured by the strong likelihood of another rate hike at the December policy meeting. Today US Advance GDP report is going to be published which is expected to decrease to 3.3% from the previous value of 4.2%, Advance GDP Price Index is expected to decrease to 2.1% from the previous value of 3.0%, and Revised UoM Consumer Sentiment is also expected to decrease to 98.9 from the previous figure of 99.0.

Meanwhile, upcoming US economic reports are expected to be quite downbeat, whereas AUD has been quite hawkish fundamentally. As per current bearish pressure in the market, certain negative readings on the USD side is expected to lead to certain weakness, thus propping up AUD gains the coming days. Ahead of macroeconomic reports from Australia and the US to be published next week, certain volatility may be observed in this pair.

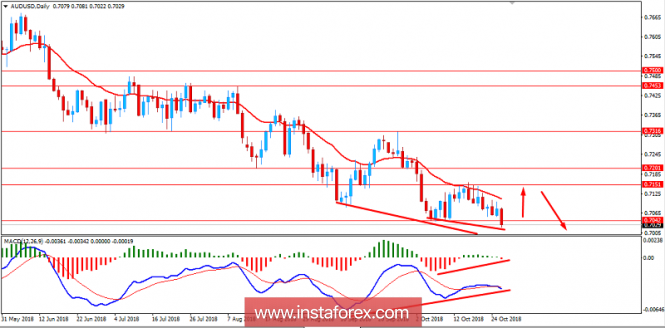

Now let us look at the technical view. The price is currently residing below 0.7050 which has not been confirmed yet to have a daily close below it ahead of a series of macroeconomic reports of today. The price recently formed a Bullish Divergence in the price which decreases the probability of further bearish momentum in the pair. As per current price formation, the price is expected to push up higher towards 0.7150-0.7200 area before continuing with the bearish trend in the future whereas a daily close above 0.7050 is required for better probability.

SUPPORT: 0.6850

RESISTANCE: 0.7050, 0.7150, 0.7200

BIAS: BEARISH

MOMENTUM: VOLATILE