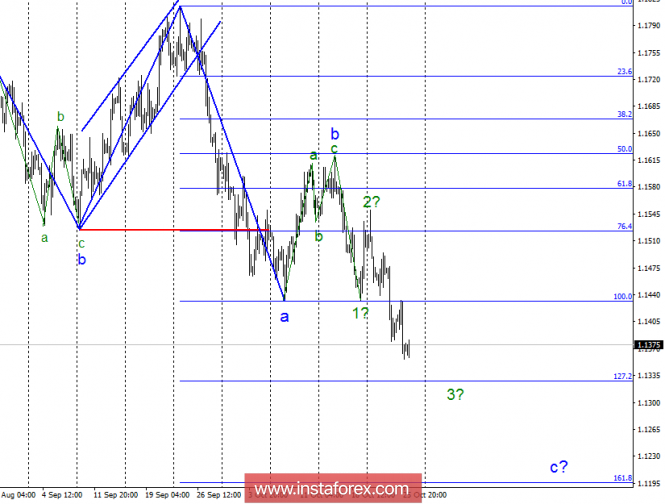

Wave counting analysis:

In the course of trading on Thursday, the EUR / USD currency pair lost another 20 basis points more and thus remained within the framework of the construction of the supposed wave 3, c. If this is indeed the case, the decline in quotations will continue with targets that are near the level of 127.2% on the Fibonacci grid, built according to the size of the estimated wave b. An unsuccessful attempt to break through the mark of 127.2% can lead to a departure of quotes from the lows reached and even to the completion of the construction of wave 3, c.

The objectives for the option with sales:

1.1327 - 127.2% of Fibonacci

1.1194 - 161.8% of Fibonacci

The objectives for the option with purchases:

1.1522 - 76.4% of Fibonacci

General conclusions and trading recommendations:

The currency pair continues to build wave 3, c. Thus, now I recommend to continue selling the pair with targets located near the estimated mark of 1.1327, which equates to 127.2% of Fibonacci. Wave c can take a fairly long view, but an unsuccessful attempt to break through the mark of 1.1327 can lead to the beginning of wave 4 construction.

The material has been provided by InstaForex Company - www.instaforex.com