EUR / USD

The euro continues to recover from the 12-month lows achieved in the first half of August. The immediate reason for the reversal is the practical result of the talks between Trump and the European Commission Chairman Juncker held in late July, which resulted in a joint statement that the parties will now focus on improving transatlantic trade relations.

The market initially took this statement with suspicion, but further events showed that the agreement would work, and therefore, the tariff restrictions on steel and aluminum would be reassessed, an agreement on the freezing of unilateral actions began to act, and even rumors arose about the possibility of resuming negotiations on the transatlantic issue partnership.

Thus, one of the main factors in the recovery of the euro is political, as for the macroeconomic parameters, they are also in favor of the euro, albeit with reservations. Of the minuses, is expected to slow the growth of GDP in the eurozone, as the indicators indicate a deterioration of the business climate in Germany.

On the other hand, the dynamics of inflation looks stable, for three months in a row, it has been growing and in July, it reached the level of 2.1%, which actually exceeds the target level of the ECB. Until recently, it was explained, first of all, by rising energy prices, but in summer another factor began to act: rising prices for products of the scripture, which was contributed by the drought.

Secondary inflation factors also look confident. The growth of the labor market in the euro area leads to an increase in wages, which has a positive impact on core inflation.

Thus, the probability of seeing a tightening of monetary policy by the end of the year has grown significantly. It is clear that the ECB does not plan raising rates at this stage, however, the asset buy-back program is curtailed, and access to liquidity will become more complicated.

Thus, the current growth of the euro is a correction of the overestimated fears of traders caused by the trade war, the Fed's policy and the rapid growth of the US economy. The dollar appreciated quite objectively, but now we must proceed from the fact that the eurozone shows its own drivers, which will help strengthen the euro.

Today, the currency pair EUR / USD is aiming for growth, the immediate goal is the previous high of 1.1628. In case of its confident passage, it is necessary to focus on the next, more important goal of 1.1750.

GBP / USD

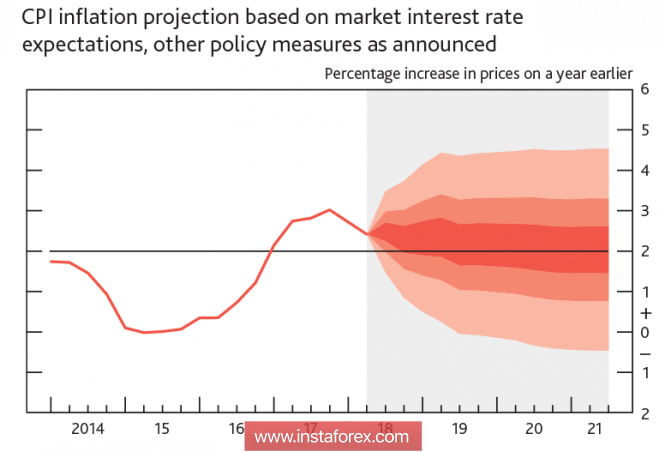

Despite the fact that the Bank of England unanimously raised the rate by a quarter of a percent at the last meeting, its confidence is doubtful. In fact, all inflation forecasts are based on options for the development of the situation with Brexit, as they will lead to serious changes in the volume of trade, both in GDP and labor migration.

In the quarterly inflation report, the forecast is cautious and does not differ much from the May one, however, the cloud of inflation probabilities, however, is shifting to 2%, that is, the weak pound factor has completed its action, and it is difficult to justify tightening of monetary policy in conditions of lower consumer prices, especially at weak rates of GDP growth. This is the fundamental difference in the situation in the UK from the eurozone.

The government's Brexit plan, presented in the summer, was met with skepticism, and few believe that it will be adopted at the summit in October. These expectations will put pressure on the pound, as they increase the danger of a tough exit from the EU.

There are a number of other negative factors for the pound. Uncertainty leads to a decline in investment in business, as the labor market may be squeezed due to a tough resolution of the issue on migrants, which in turn will reduce the purchasing power of the population. In these circumstances, the Bank of England will not go on reducing the government bond stock, which was previously purchased in the amount of 435 billion pounds, and, thus, will lag behind the ECB and the Fed in the dynamics of reducing the balance. This factor will continue to put pressure on the pound in the long term.

Nevertheless, for the next day, the currency pair GBP / USD can take advantage of a favorable conjuncture and win back part of the losses. The nearest target is 1.2955, in case it does not stand, the target will move to the level of 1.3050.

The material has been provided by InstaForex Company - www.instaforex.com