EUR/JPY has been quite impulsive with the recent bullish momentum since the bounce off the 124.50-125.50 support area with a daily close. Despite the recent Trade War tension, EURO has gained good momentum over JPY recently which is expected to fade away at the current market situation as series of optimistic JPY report is going to be published this week.

JPY has been struggling to meet the inflation target of 2% recently for which all the BOJ decisions are directed on the bias. As most of the countries are increasing rates, but BOJ is trying to sustain the previous rate until a sustainable growth is observed before the rate hike. Tomorrow, JPY Flash Manufacturing PMI report is going to be published which is expected to have a slight increase to 52.4 from the previous figure of 52.3 and on Friday, JPY National Core CPI report is expected to increase to 0.9% from the previous value of 0.8% and SPPI is expected to be unchanged at 1.2%.

On the other hand, being stuck with the BREXIT effect with UK, EURO has been quite on the top form for a few days now despite the recent volatility against JPY. European Union leaders are currently expecting an agreement sign with UK by November summit which is expected to empower the currency for the long-term, but currently, EURO is not on the total form to have definite strong long-term gains the process. EURO has been quite indecisive with the recent economic reports, but it somehow managed to meet the expectations leading to certain gains against JPY which are expected to be short lived. This week, on Thursday, ECB Monetary Policy Meeting Accounts report is going to be held which is expected to have neutral impact on the further EURO gains, whereas German Final GDP report to be published on Friday is also forecasted to have unchanged value of 0.5%, resting the market to further indecision in the process.

As of the current scenario, JPY is going quite strong with recent economic reports and achieving their fundamental targets in the process, whereas EURO is still struggling with the BREXIT and Trade War tensions. Though EURO gained good momentum recently, but JPY is expected to have an upper hand for the long-term gains in the process.

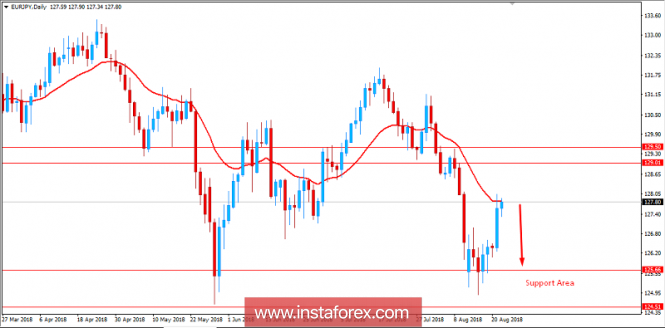

Now let us look at the technical view. The price is currently residing at the edge of dynamic level of 20 EMA resting at the 127.85 area from where the price is expected to push lower towards the support area of 124.50-125.50 in the coming days. The bias is still quite bearish and expected to remain unchanged as the price remains below the 129.50 area with a daily close.

SUPPORT: 124.50, 125.50

RESISTANCE: 129.00-50

BIAS: BEARISH

MOMENTUM: VOLATILE