NZD/USD has been quite bullish recently which led the price to reside at the edge of 0.6720 resistance area with certain indecision currently. Ahead of the high impact US economic reports and events, the pair is going to trade with higher volatility. Clear momentum will be determined by the end of this week.

NZD has been performing quite positively amid recent economic reports which helped the currency to gain consistent momentum in the process against USD whereas USD has been dominating other majors in the market. Today New Zealand's Retail Sales report was published with a significant increase to 1.1% from the previous value of 0.3% which was expected to be at 0.4% and Core Retail Sales also increased to 1.4% from the previous value of 0.6% which was expected to be at 0.8%.

On the other side, ahead of the FOMC Meeting Minutes today and FED Chair Powell's speech on Friday this week, today US Existing Home Sales report is going to be published which is expected to increase to 5.40M from the previous figure of 5.38M and Crude Oil Inventories is expected to decrease to -1.6M from the previous figure of 6.8M. Trump has again targeted the FED for the hawkish stance on monetary policy. Besides, FED officials signaled their intention that 3 to 4 times rate hikes are yet to be done before the regulator takes a pause. This hawkish rhetoric is likely to encourage further gains of USD side in the future.

Meanwhile, NZD has the potential to push the price further higher against USD. However, upcoming US economic reports and events are expected to open the door for further gains of NZD in the process. Before the weekend, definite pressure in the market can be observed which will determine further momentum in the short term.

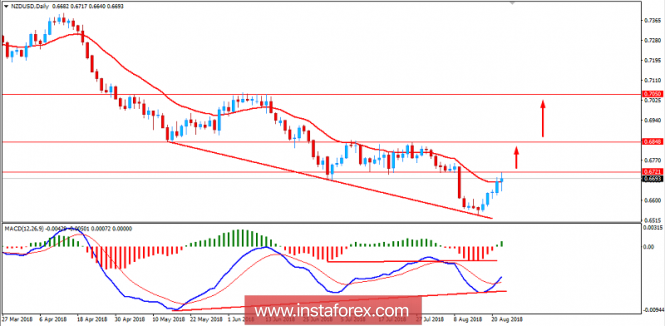

Now let us look at the technical view. The price is currently residing at the edge of 0.6720 area with an indecisive daily candle ahead of the FOMC Meeting Minutes and FED Chair's speech this week. Despite the positive economic data, NZD did not quite meet the expectation of impulsive bullish pressure against USD. A daily close above 0.6720 is expected to push the price higher towards 0.6850 and later towards 0.7050 area. Additionally, the bearish trend has already given birth to a Regular Bullish Divergence which is indicating further bullish momentum for the coming days. As the price remains above 0.65 area, the bullish bias is expected to continue.

SUPPORT: 0.65

RESISTANCE: 0.6720, 0.6850, 0.7050

BIAS: BEARISH

MOMENTUM: VOLATILE