NZD/USD has been quite impulsive with bearish moves today that is expected to lead to further bearish momentum in the pair. NZD used to be quite firm amid recent economic reports which helped the currency to gain momentum while USD was struggling for gains amid disappointing economic reports.

Today New Zealand's Building Approvals report was published with a decrease to -10.3% from the previous negative value of -8.2% and ANZ Business Confidence report was published with a significant decrease to -50.3 from the previous figure. of -44.9. Due to the worse-than-expected reports, NZD lost momentum impulsively today which may lead to further bearish pressure in the pair.

On the USD side, the Prelim GDP report was published with a better-than-expected reading yesterday with an increase to 4.2% from 4.1% growth in the first estimate which was expected to be at 4.0%. In this context, USD regained momentum and pressure it had over NZD. Today US Core PCE Price Index report is going to be published which is expected to increase to 0.2% from the previous value of 0.1%, Personal Spending is expected to be unchanged at 0.4%, Personal Income is expected to decrease to 0.3% from the previous value of 0.4%, and Unemployment Claims is expected to increase to 214k from the previous figure of 210k.

Meanwhile, USD is quite indecisive with the upcoming reports forecasts which is expected to lead to certain correction and volatility in the market, whereas NZD battered by downbeat economic reports is expected to help USD sustain the counter impulsive momentum it had today to continue a delcine in the coming days.

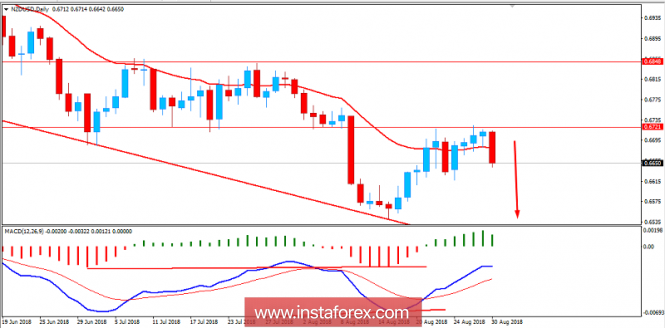

Now let us look at the technical view. After the recent bullish divergence formation in the pair, the price has pushed higher towards the resistance area of 0.6720 from where the price sank lower quite impulsively today. The price has breached below the dynamic level of 20 EMA as well. If the price closes below the dynamic level of 20 EMA amid the bearish pressure today, the price is expected to push lower towards 0.6550 support area in the coming days. As the price remains below 0.6720 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 0.6550

RESISTANCE: 0.6720

BIAS: BEARISH

MOMENTUM: IMPULSIVE and VOLATILE