The upward impulse of the AUD/USD pair lost its strength, and the price gradually began to slide down. Such a price pullback was quite expected, if we recall the reasons for the strengthening of the Australian dollar. The "aussie" rose on the news about the resolution of the political crisis, when as a result of the "palace coup" the government was headed by former Treasurer Scott Morrison.

As a rule, political fundamental factors have a short-term effect - traders reacted with optimism to the fact that the crisis in the government has not been delayed and has not affected the work of the state apparatus. Against this background, the AUD/USD jumped during the day from 0.7240 to the middle of the 73rd figure. But the euphoria did not last long – today the pair is testing the 72nd level again, switching to other fundamental factors.

First of all, copper disappointed: in August, the cost of a ton of this raw material for the first time this year fell below six thousand dollars. For comparison, in June, a ton of copper was estimated at $7275. Although it was an annual price peak, it was followed by a bearish trend that continues to this day. Supply continues to exceed demand, especially against the backdrop of tightening environmental requirements in China and a slowdown in the construction sector.

In addition, copper is reacting to news of the world's largest mining company BHP Billiton Ltd. The Chilean industrial giant was on the verge of stopping due to threats of workers ' strike. However, according to the latest data, the trade unions still managed to negotiate with employers to increase wages, so the company continues to operate normally. Copper, in turn, continued to decline amid oversupply in the commodity market.

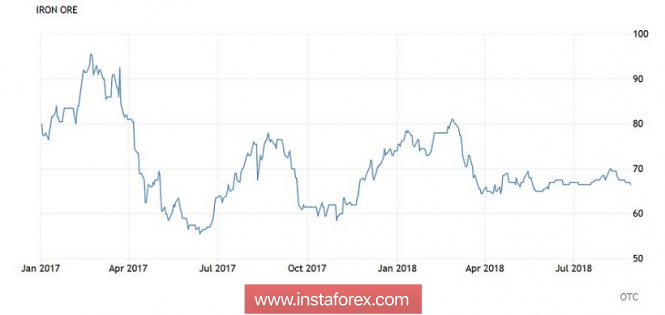

Iron ore, which is also of strategic importance to the Australian economy, is losing in value, trading at around $66. Although in this case, the price "low" was formed in June-July, when the price approached 60 dollars. But in any case, the current value can not satisfy traders, because at the beginning of the year a ton of this raw material was estimated at 75-80 dollars.

Thus, the aussie could not keep the height against the background of the decline in the commodity market - while other fundamental factors have either neutral or negative impact. Thus, the position of the Reserve Bank of Australia, although it is "dovish" in nature, but still allows traders to expect an increase in the rate next year: at least the preliminary plans of the central bank are such. While, for example, The Central Bank of New Zealand has shifted the timing of a possible increase in 2020. Therefore, the policy of the RBA is largely predictable, and the wait-and-see position of the regulator does not affect the dynamics of the pair.

Considering the prospects of the AUD/USD pair, it is necessary to evaluate the prospects of the quoted currency- the US dollar. Earlier this week, the market increased demand for risky currencies with the simultaneous selling of the US dollar after the conclusion of a trade deal between the US and Mexico. Today, the situation has changed somewhat: among traders, pessimism about the prospects of resolving other trade and political conflicts prevailed. After all, China, Turkey, Canada, the EU, Russia and Iran remain on the agenda. Each case, of course, has its own situation – but in general, the tangle of conflicts maintains nervousness in the markets.

Against this background, the US dollar is in no hurry to give up its positions, although it is under some pressure due to vague prospects of the Fed's tightening of monetary policy. Paired with the Australian dollar, the greenback was able to seize the initiative as soon as the growth momentum of the "aussie" weakened. This suggests that the US dollar will soon play the "first violin" in the pair, focusing on US events and the dynamics of the commodity market. In particular, today we should pay attention to the release of data on the growth of the US economy in the second quarter. A revised assessment will be published on Wednesday. According to initial data, the figure rose by 4.1%. The forecast of the revised estimate suggests that the indicator will decrease to 4%. But if the real figures exceed the expectations of experts, the AUD/USD pair will get an additional reason for its further decline.

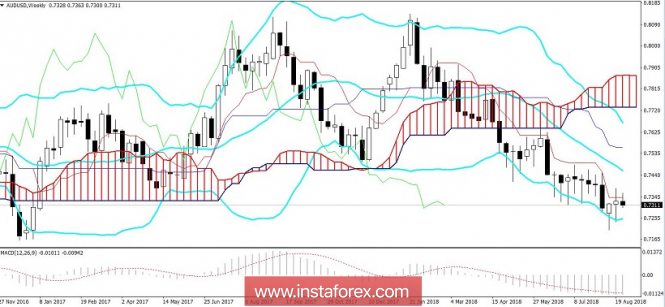

From the technical point of view, the situation is as follows. On the weekly chart, the Ichimoku Kinko Hyo indicator almost formed a bearish "Parade of lines" signal, while the price was fixed between the middle and lower lines of the Bollinger Bands indicator. All this indicates a high probability of further decline to the main support level of 0.7250 (the lower line of the Bollinger Bands indicator on W1). The resistance level is 0.7340 (Tenkan-sen line on the same timeframe). Most likely, the pair will trade in this range in the medium term. Overcoming one of the boundaries of the price "fork" depends more on the dynamics of the US currency than on the Australian dollar.

The material has been provided by InstaForex Company - www.instaforex.com