EUR/GBP has been impulsive amid the bearish pressure recently which made the price proceed down below 0.9050 area towards the dynamic level of 20 EMA. EUR has been dominating GBP since the price broke above 0.8850 area with a daily close whereas certain bearish pressure was quite uncommon in the process.

The reason for such impulsive bearish pressure in the pair is that the exhaustion of the EUR buyers after persistently downbeat economic data, published recently. So, German GfK Consumer Climate report was published with a decrease to 10.5 which was expected to be unchanged at 10.6, French Consumer Spending also decreased to 0.1% which was also expected to be unchanged at 0.3%, and French Prelim GDP was published unchanged as expected at 0.2%. Moreover, today German Import Prices report was published with a decrease to -0.2% from the previous value of 0.5% which was expected to be at 0.0%.

On the GBP side, today M4 Money Supply report was published with a significant increase to 0.9% from the previous value of -0.3% which was expected to be at 0.2%, Mortgage Approvals remained unchanged at 65k and Net Lending to Individuals decreased to 4.0B from the previous figure of 5.4B which was expected to increase to 5.5B.

Meanwhile, GBP has been quite firm in light of economic reports published today, whereas EUR is still struggling. Though EUR has been the dominating currency in the pair, certain volatility is expected in the pair in the coming days which might lead to certain GBP gains in the process. However, it is expected to be short-lived if the eurozone publishes better-than-expected economic data in the short term.

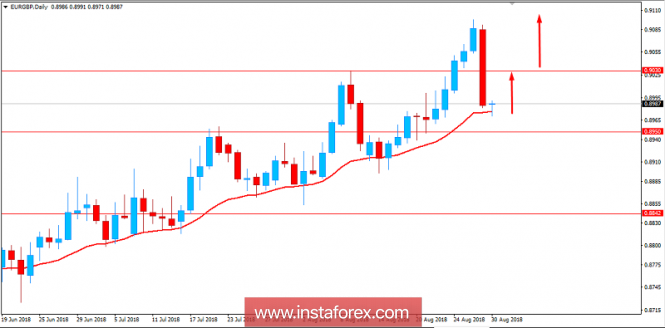

Now let us look at the technical view. The price is currently residing at the edge of dynamic level 20 EMA which has been quite successful holding the price higher for a several times earlier. Recent bearish momentum was quite impulsive which engulfed the previous bullish price actions. Nevertheless, as the price remains above the dynamic level of 20 EMA and 0.8950 with a daily close, the bullish bias is expected to continue further with a target towards 0.9050 and later towards 0.9250 area in the future.

SUPPORT: 0.8950, 0.8850

RESISTANCE: 0.9050, 0.9250

BIAS: BULLISH

MOMENTUM: NON-VOLATILE