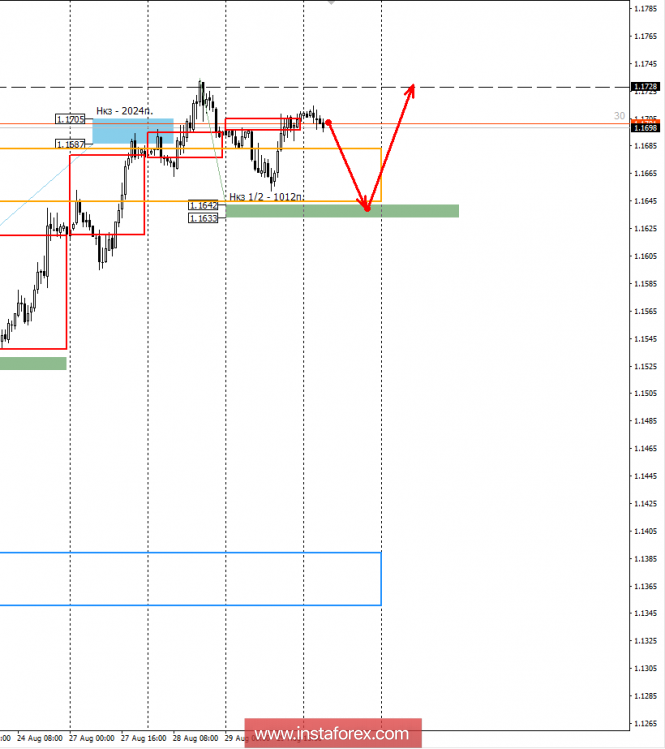

The third day of the pair is trading above the monthly short-term fault of August, which indicates a high probability of a corrective downward movement. The probability of return within the limits of a monthly fault is 90%.

The current plan should take into account the finding of a price higher than the monthly short-term, which increases the likelihood of a downward model formation to 90%. The fall may be small, however, purchases from current marks will not be profitable, since the pair is at the highs of the current month. For sales there is not yet a pattern that has been formed, which means that it is necessary to be out of the market until a signal is received to open the deal. The defining support is the NCP 1/2 1.1642-1.1633. While the pair is trading above this zone, it is unprofitable to make sales.

Work within the local flat is possible, but requires careful decision-making, since finding a price within a monthly short-term fault can be a strong incentive to form a deep corrective model.

An alternative growth option is likely to sell 30%, which does not allow buying from current levels, since the risks will be overstated. Any growth before the end of the month from current marks will lead to a decrease in the short term and a return of the price within the limits of the monthly short-term. Do not forget that next week will expire options contracts, which will increase volatility and will allow the implementation of one of the models in a short time.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com