Fed Chairman Jerome Powell, speaking in the House of Representatives of the US Congress, said that public debt is growing much faster than GDP. This rather important recognition characterizes the current state of the American economy as best as possible. A sure recovery of the labor market and an increase in inflation should signal the growth of real incomes of the population but in practice, this is far from the case. Reforms have not yet produced the necessary effect and it is not known whether it will give, as more and more experts predict the onset of a new recession in 2019 or even at the end of this year.

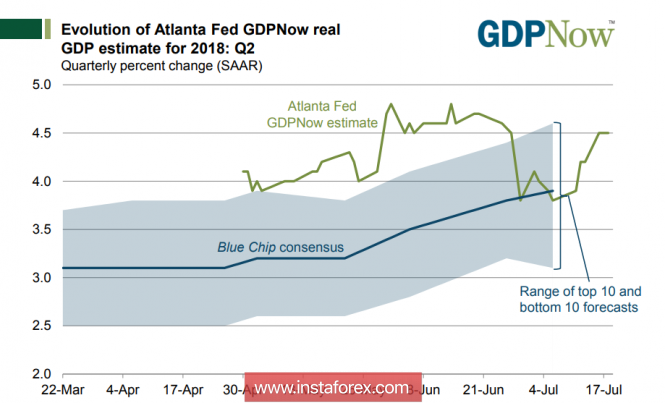

Even more indicative is that the GDPNow model from the Atlanta Federal Reserve Bank which predicts that GDP growth in the second quarter will be at 4.5% while the latest data on retail trade, industrial production, and housing construction are all positive. The latter is surprising. The number of new buildings in June decreased by 12.3%, the dynamics of construction permits are negative, all the figures are worse than in May, and not better than the forecasts of experts.

In other words, a 4.5% GDP growth is insufficient to cover the growth of debt. This is a serious problem that could provoke correction of the dollar under other conditions. It is unlikely to have a long-term effect under current conditions. Despite the fact that Powell was very cautious in assessing the actions of the Fed and pointed out that the pace of normalization should be gradual, the markets still rated his speech as hawkish. The probability of a twofold increase in the current year's rate of the CME futures markets is currently estimated at almost 70%, although Powell did not exceed 55% a day before his speech. In essence, Powell did not say anything new, repeating his previous statements about the need for a gradual rate hike, and Congressmen were primarily interested in what is being done to equalize the yield curve and how tariff policy affects the economy.

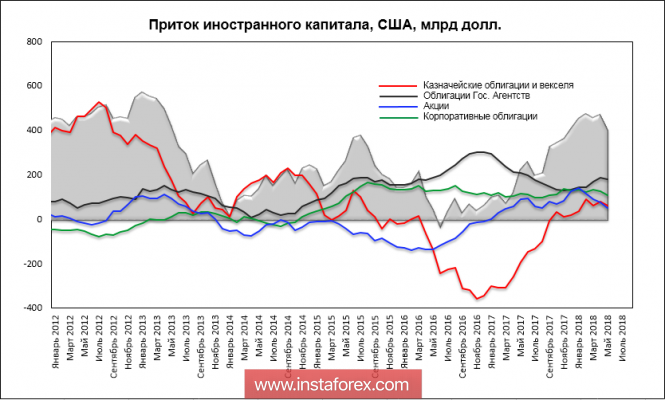

News tapes are filled with reports that Russia withdrew from the list of the largest holders of US bonds, reducing the amount of investments in May to $ 14.5 billion, which is the lowest level since 2007. This factor could be assessed as a political step, if not for the trend. According to the published report of the Treasury, the total inflow of foreign capital into the US is at a minimum over the past 6 months, with the largest decline in government bonds, as well as in the stock markets.

Factors contributing to the strengthening of the dollar, in fact, are not strong enough to confidently support the bullish momentum. Reducing the balance of the Fed will inevitably lead to a reduction in the monetary base, which, combined with the increase in costs for servicing loans, can increase the value of the US currency. At the same time, the opposite trend is also noticeable, the players free in their choice are not in a hurry to enter into dollar assets, because the real state of the American economy does not look convincing, and they prefer to look for alternative markets.

Thursday, in terms of macroeconomic data, will be calm. Attention will be on the publication of the index of business activity in the manufacturing sector from the Federal Reserve Bank of Philadelphia, which will predict the trend of ISM in July.

The dollar, most likely, will spend the day in the side range. The short-term rally against the yen subsides after the Bank of Japan has suspended purchases of long-term T-bills this morning in order to match the yield curve, but it is unlikely that such a step will be sufficient to reduce USDJPY. The level of 113.39 may be tested at the end of the day. The GBPUSD pair, after disappointing data on inflation and reducing the probability of a rate hike by the Bank of England in August, can test 1.3050. The euro looks more confident and, most likely, will spend the day in the sideways range with the support for 1.1602 probably holding up at the end of the day, but attempts by the bears to test it are quite possible.

The material has been provided by InstaForex Company - www.instaforex.com