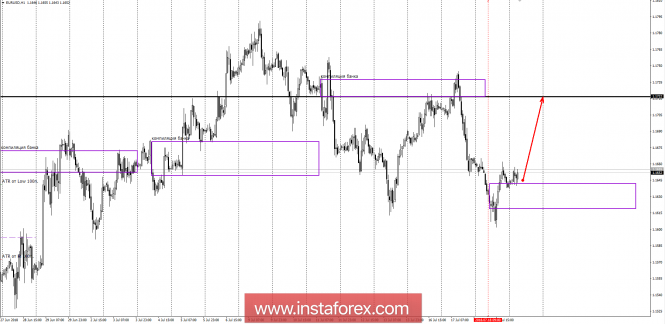

From the point of view of the location of the last three zones of bank compilation, a medium-term accumulation zone is formed on the pair. This indicates the need to fix any transactions on weekly and monthly extremes.

Yesterday, the next zone of bank compilation was formed, which makes it possible to determine the priority for the second half of the current week. Closure of trades occurred within the zone, which indicates the flat nature of the movement. Fastening above the zone will give an opportunity to buy. The purpose of purchases will be the compilation zone last week, within which there was an increase in supply.

Working in the flat suggests partial fixation when reaching the level of 1.1722. The rest of the purchases should be transferred to breakeven and be closed in case of repeated occurrence of demand.

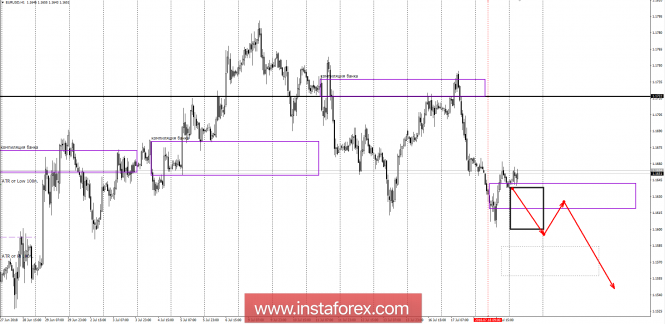

To continue the downward movement, today's closing of the American session is required below the zone of bank compilation. This will open the way for a fall to the June low. Sales from current marks are not profitable, since it is difficult to determine the location of the stop-loss, and the profit potential may be limited to the last week's minimum. In confirming the sales, we will have to wait for the closure of today's US session below the compilation zone.

The daytime CP is the daytime control zone. The zone formed by important data from the futures market that change several times a year.

The weekly CP is the weekly control zone. The zone formed by marks from important futures market which change several times a year.

The monthly CP is the monthly control zone. The zone is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com