Yesterday, the European currency managed to recover its positions against the US dollar against the background of weak fundamental data, which were published in the US economy. The speech of the Fed Chairman did not lead to the resumption of demand for the US dollar, as it was mainly dealt with trade conflicts and fiscal policy.

According to the US Department of Commerce, the number of bookmarks for new homes in the US in June this year at one point fell very sharply. This is directly related to the fall in the volume of construction of houses.

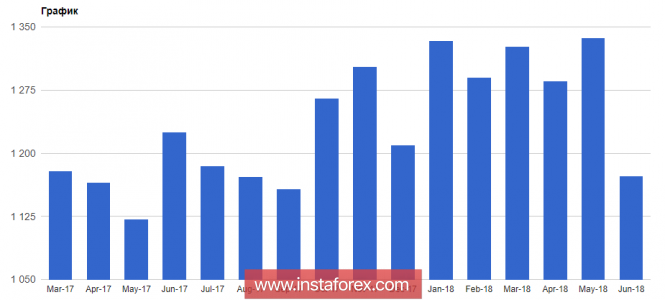

According to the report, the number of mortgages of new homes in June 2018 decreased by 12.3% and amounted to 1.173 million homes per year, while in May there was an increase in bookmarks by 4.8%. The number of construction permits decreased by 2.2% compared to May and amounted to 1.273 million per year. Economists, though predicted a decrease in the number of bookmarks, but only 2.2%. The increase in the number of permits was expected at 2.2%.

As I noted above, a serious reduction in construction activity in all segments of housing construction led to such a sharp decline in the indicator.

Yesterday it also became known that the economic adviser to US President Donald Trump is preparing new measures to stimulate GDP growth. According to Larry Kudlow, additional measures of fiscal stimulus may lead to an annual GDP growth of about 4%. Kudlow also did not rule out the possibility of a short-term fall in budget revenues after a recent tax reform.

The presidential adviser, like many of his colleagues, criticized the president's actions with regard to the protective duties in foreign trade with a number of countries, especially with China. In his opinion, China should reduce its import duties and weaken other trade barriers in order to build a dialogue.

Data from the Association of US Mortgage Banks did not have an impact on the market. According to the MBA report, the market index for the week from July 7 to July 13 fell by 2.5% to 363.3. The index of acquisitions for the week from July 7 to July 13 fell by -5.2% to 247.9. The refinancing index for the same period increased by 2.2%, to 979.6.

As for the technical picture of EUR / USD, the breakthrough in support of 1.1600 will lead to increased pressure on risky assets and the renewal of the monthly monthly lows of 1.1570 and 1.1520, which will radically change the alignment of forces in favor of US dollar buyers and form a serious downward price channel in the trading instrument. If buyers hold above 1.1600, then there is a chance of "transferring" the trade into a wide lateral range with an upper resistance level of 1.1720.

The material has been provided by InstaForex Company - www.instaforex.com