Dear colleagues.

For the of EUR / USD pair, the continuation of the movement downward is expected after the breakdown of 1.1613. The price is in the active zones for the development of momentum. For the GBP / USD pair, the continuation of the development of the downward structure from July 16 is expected after the breakdown of 1.3031. For the USD / CHF pair, the price is in the correction zone from the medium-term initial conditions for the bottom on July 13. The 0.9957 level is the key resistance. For the USD / JPY pair, we expect the movement towards the level of 113.40. For the of EUR / JPY pair, the goals remained unchanged but the price forms the potential for the bottom of July 17. For the GBP / JPY pair, the formation of a downward structure from July 16 to continue downward movement is possible after the breakdown of 146.69.

The forecast for July 19:

Analytical review of currency pairs in the scale of H1:

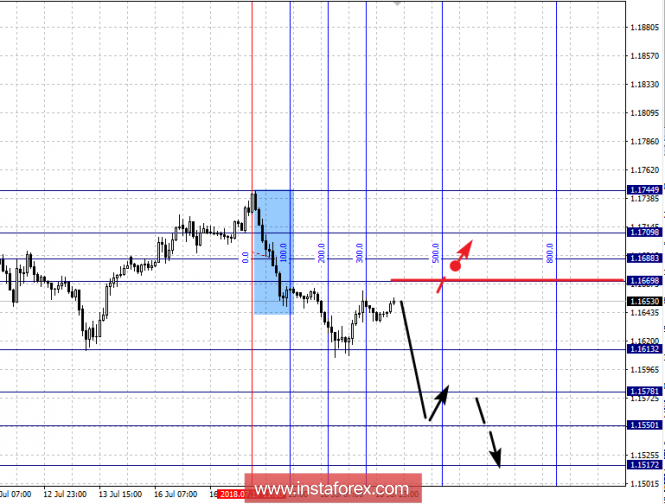

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1744, 1.1709, 1.1688, 1.1669, 1.1613, 1.1578, 1.1550 and 1.1517. Here, we follow the downward structure of July 17. The continuation of the downward movement is expected after the breakdown of 1.1613. In this case, the target is 1.1578. In the area of 1.1578 - 1.1550 is short-term downward movement, as well as the consolidation of the price. The potential value for the bottom is the level of 1.1517. Upon reaching this level, we expect a pullback upward.

Short-term upward movement is possible in the area of 1.1669 - 1.1688. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1709. This level is the key support for the downward structure.

The main trend is the downward structure of July 17.

Trading recommendations:

Buy: 1.1670 Take profit: 1.1686

Buy 1.1690 Take profit: 1.1707

Sell: 1.1611 Take profit: 1.1580

Sell: 1.1576 Take profit: 1.1555

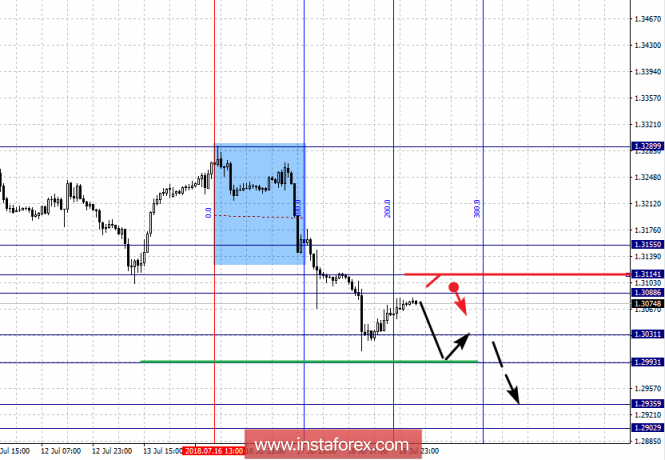

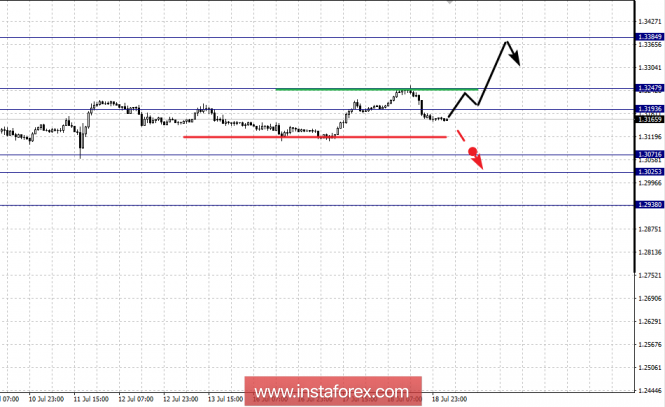

For the GBP / USD pair, the key levels on the H1 scale are 1.3155, 1.3114, 1.3088, 1.3031, 1.2993, 1.2935 and 1.2902. Here, we continue to follow the downward structure of July 16. Short-term downtrend is expected in the area of 1.3031 - 1.2993. The breakdown of the last value should be accompanied by a pronounced movement towards the level of 1.2935. The potential value for the bottom is the level of 1.2902. Upon reaching this level, we expect the consolidation of the price.

Short-term uptrend is possible in the area of 1.3088 - 1.3114. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3155. This level is the key support for the bottom.

The main trend is the downward structure of July 16.

Trading recommendations:

Buy: 1.3088 Take profit: 1.3112

Buy: 1.3116 Take profit: 1.3150

Sell: 1.3030 Take profit: 1.2995

Sell: 1.2990 Take profit: 1.2937

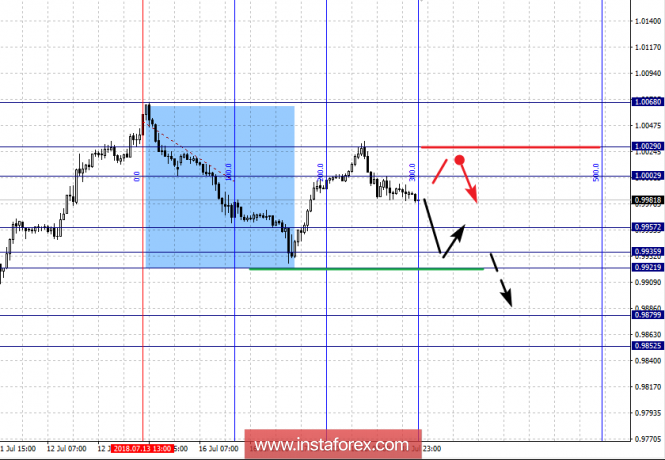

For the USD / CHF pair, the key levels on the scale of H1 are: 1.0029, 1.0002, 0.9987, 0.9957, 0.9935, 0.9921, 0.9879 and 0.9852. Here, we follow the formation of a downward structure from July 13. At the moment, the price is in deep correction. The continuation of the downward movement is expected after the breakdown of 0.9957. In this case, the target is 0.9935. Near this level is the consolidation of the price. Passing the price of the noise range of 0.9935 - 0.9921 should be accompanied by a pronounced movement towards the level of 0.9879. The potential value for the bottom is the level of 0.9852. The probable date of reaching it is July 18 - 19. Upon reaching this level, we expect a rollback upward.

Short-term upward movement is possible in the range of 1.0002 - 1.0029. Hence, we expect a key down turn. The breakdown at the level of 1.0030 will lead to an upward tendency with the target here at 1.0068.

The main trend is the formation of a downward structure from July 13.

Trading recommendations:

Buy: 1.0002 Take profit: 1.0030

Buy: 1.0032 Take profit: 1.0065

Sell: 0.9955 Take profit: 0.9937

Sell: 0.9918 Take profit: 0.9882

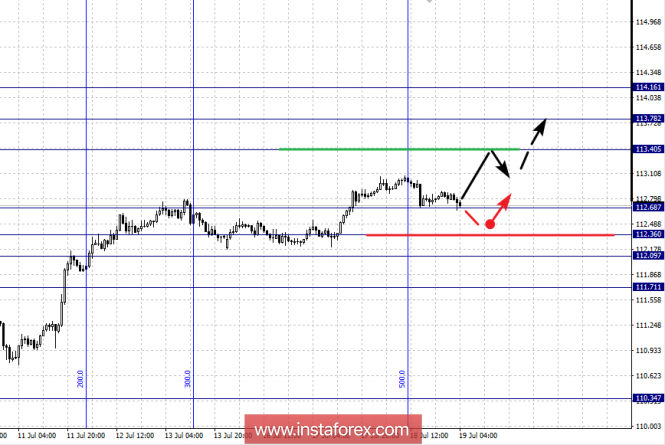

For the USD / JPY pair, the key levels on a scale are: 114.16, 113.78, 113.40, 112.68, 112.36, 112.09 and 111.71. Here, we expect the movement towards 113.40. In the area of 113.40 - 113.78 is short-term upward movement. The potential value for the top is level 114.16. Upon reaching this level, we expect a pullback downwards.

Departure towards correction is possible after the breakdown of 112.65. Here, the first target is 112.36. Short-term downward movement is possible in the area of 112.36 - 112.09. The breakdown of the last value will lead to the development of the downward structure. In this case, the potential target is 111.71.

The main trend is the upward structure of July 9.

Trading recommendations:

Buy: 113.42 Take profit: 113.76

Buy: 113.80 Take profit: 114.14

Sell: 112.65 Take profit: 112.38

Sell: 112.05 Take profit: 111.75

For the CAD / USD pair, the key levels on the H1 scale are: 1.3384, 1.3247, 1.3193, 1.3071, 1.3025 and 1.2938. Here, the situation is still in an equilibrium state. Short-term upward movement is expected in the area of 1.3193 - 1.3247. The breakdown of the last value should lead to the formation of initial conditions for the upward cycle. Here, the potential target is 1.3384.

Short-term downward movement is possible in the area of 1.3071 - 1.3025. The breakdown of the latter value will lead to the formation of a potential for downward movement. Here, the target is 1.2938.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 1.3250 Take profit: 1.3380

Buy: Take profit:

Sell: 1.3025 Take profit: 1.2940

Sell: Take profit:

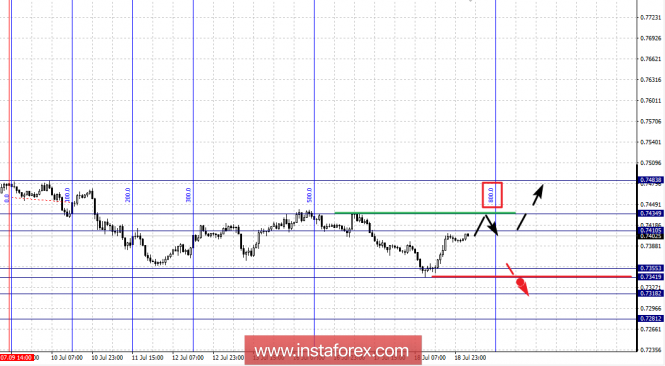

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7434, 0.7410, 0.7355, 0.7341, 0.7318 and 0.7281. Here, we follow a small downward cycle from July 9. At the moment, the price is in correction. The continuation of the downward movement is expected after passing through the noise range of 0.7355 - 0.7341. In this case, the target is 0.7318. The potential value for the top is the level of 0.7281 (the probable date of reaching is July 13).

Short-term upward movement is possible in the area of 0.7410 - 0.7434. The breakdown of the last value will lead to the development of the an upward structure. Here, the potential target is 0.7483.

The main trend is the downward cycle from July 9, the correction stage.

Trading recommendations:

Buy: 0.7436 Take profit: 0.7465

Buy: 0.7411 Take profit: 0.7432

Sell: 0.7340 Take profit: 0.7320

Sell: 0.7316 Take profit: 0.7284

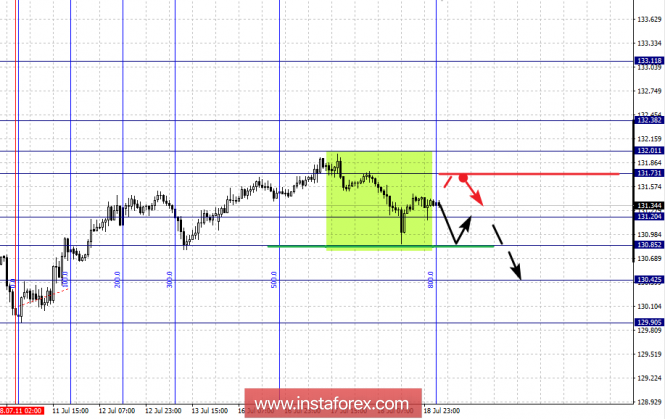

For the of EUR / JPY pair, the key levels on the scale of H1 are: 133.11, 132.38, 132.01, 131.73, 131.20, 130.85 and 130.42. Here, we follow the local upward structure of July 11. Mainly, we expect the departure towards correction. Short-term upward movement is expected in the area of 131.73 - 132.01. The breakdown of the last value will allow us to expect movement towards the 132.38 level. Near this is the consolidation level, and hence, there is a high probability of withdrawal into correction. The potential value for the top is the level of 133.11, the probable date of reaching it is July 17 - 18. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 131.20 - 130.85. The breakdown of the last value will lead to in-depth correction. Here, the target is 130.42. This level is the key support for the upward structure of July 11.

The main trend is a local structure for the top of 11 July.

Trading recommendations:

Buy: 131.73 Take profit: 131.00

Buy: 132.05 Take profit: 132.35

Sell: 131.15 Take profit: 130.90

Sell: 130.80 Take profit: 130.45

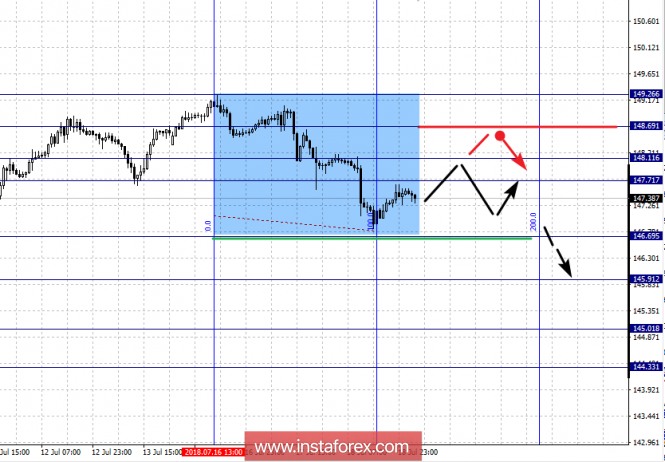

For the GBP / JPY pair, the key levels on the scale of H1 are: 148.69, 148.11, 147.71, 146.69, 145.91, 145.01 and 144.33. Here, we follow the formation of a downward structure from July 16. The continuation of the downward movement is expected after the breakdown of 146.69. In this case, the target is 145.91. Near this level is the consolidation of the price. The breakdown of 145.91 should be accompanied by a pronounced downward movement. Here, the target is 145.01. The potential value for the bottom is the level of 144.33. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 147.71 - 148.11. The breakdown of the last value will lead to in-depth correction. Here, the target is 148.69. This level is the key support for the downward structure.

The main trend is the formation of a downward structure from July 16.

Trading recommendations:

Buy: 147.71 Take profit: 148.05

Buy: 148.15 Take profit: 148.65

Sell: 146.65 Take profit: 146.00

Sell: 145.00 Take profit: 144.40

The material has been provided by InstaForex Company - www.instaforex.com