GBP/USD has been quite bullish with the recent momentum in the long-term bearish trend which is expected to continue further lower in the coming days. As of the recent Trade War tensions, GBP has been struggling to gain momentum over USD having mixed economic report results in the process.

Recently, GBP has been quite positive with the economic report which did help the currency to gain certain momentum, but it is expected to be quite temporary with the sustainability. Today, GBP High Street Lending report is going to be published which is expected to have a slight decrease to 39.1k from the previous figure of 39.2k and CBI Realized Sales is also expected to decrease to 16 from the previous figure of 32.

On the other hand, ahead of the Core Durable Goods Orders and Advance GDP report this week, today, New Home Sales report is going to be published which is expected to decrease to 669k from the previous figure of 689k and Crude Oil Inventories report is also expected to decrease to -2.6M from the previous figure of 5.8M.

As of the current scenario, both GBP and USD are forecasted to struggle with the economic reports to be published today and upcoming reports this week. Though no specific decision can be taken in this corrective and indecisive phase, but USD is expected to have an upper hand over GBP having high impact economic reports yet to be published this week, whereas any positive outcome is expected to help USD gain further momentum in the process.

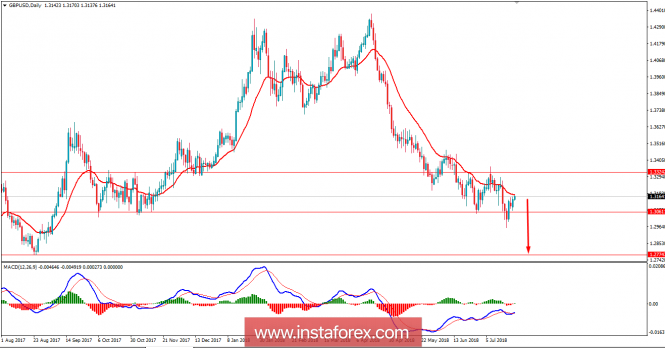

Now let us look at the technical view. The price is currently residing just above the support area of 1.3050 while having confluence with the dynamic level of 20 EMA holding the price as resistance to push lower in the coming days. As the price remains below the 1.3320 area with a daily close, the bearish bias is expected to continue with target towards 1.2750 in the future.

RESISTANCE: 1.3320

SUPPORT: 1.3050, 1.2750

BIAS: BEARISH

MOMENTUM: CORRECTIVE AND VOLATILE