EUR/JPY is currently residing at the edge of 129.50 area from where it is expected to push higher again with the target towards 132.00 area in the future. JPY having straight gains since it bounced off the 132.00 area was expected to inject more bearish momentum in the pair whereas the current formation is indecisive.

As of the recent ECB Press Conference, EURO is expected to lose some momentum as the interest rates are expected to remain unchanged till Summer 2019 and Brexit impact as well as Trade War tension. Ahead of the series of economic reports to be published this week on EURO, today EURO Spanish Flash CPI report was published with slight decrease to 2.2% which was expected to be unchanged at 2.3% and German Prelim CPI report is yet to be published which is expected to show an increase to 0.4% from the previous value of 0.1%.

Today JPY Retail Sales report is published with an increase to 1.8% from the previous value of 0.6% which was expected to be at 1.7%. Despite the significant growth on the Retail Sales, JPY failed to sustain the momentum whereas EUR is currently quite impulsive with the bullish momentum.

As of the current scenario, ahead of the BOJ Policy Rate tomorrow, the pair is expected to be quite volatile but a daily close today will provide the required information for the upcoming momentum in the market whereas the JPY Unemployment Rate, BOJ Policy Rate and Monetary Policy Statement tomorrow is expected to have greater impact on the gains over JPY in the process.

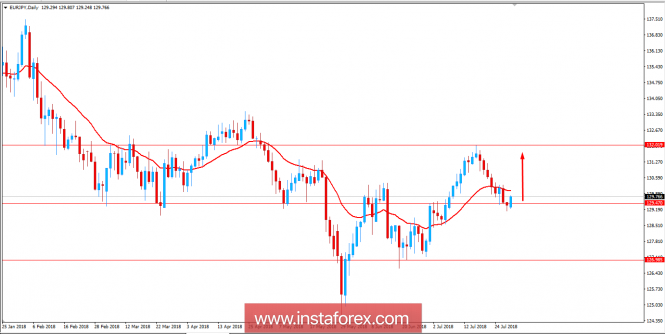

Now let us look at the technical view. The price has been bearish with straight daily candles pushing the price towards 129.50 area but today the impulsive bullish pressure has already engulfed a portion of previous bearish pressure which if closed above 129.50 with an impulsive bullish candle is expected to inject more bulls in the market resulting further bullish pressure in the market with target towards 132.00 area. As the price remains above 129.50 area, the bullish bias is expected to continue.

SUPPORT: 129.50

RESISTANCE: 132.00

BIAS: BULLISH

MOMENTUM: VOLATILE AND IMPULSIVE