Dear colleagues.

For the EUR / USD pair, the resumption of the upward movement is expected after the breakdown of 1.1701. The level of 1.1615 is the key support. For the GBP / USD pair, the price is in correction. The continuation of the upward movement is expected after the breakdown of 1.3167. For the USD / CHF pair, the price is still in correction. The level of 0.9998 is the key support for the downward structure from July 13. For the USD / JPY pair, the continuation of the movement downwards is expected after passing the price of the noise range at 110.84 - 110.60. For the EUR / JPY pair, we expect a correction and a registration of the upstream structure after the breakdown of 129.77. For the GBP / JPY pair, we also expect the departure towards the correction zone from the downward trend and the formation of the potential for the top.

The forecast for July 30:

Analytical review of currency pairs in the scale of H1:

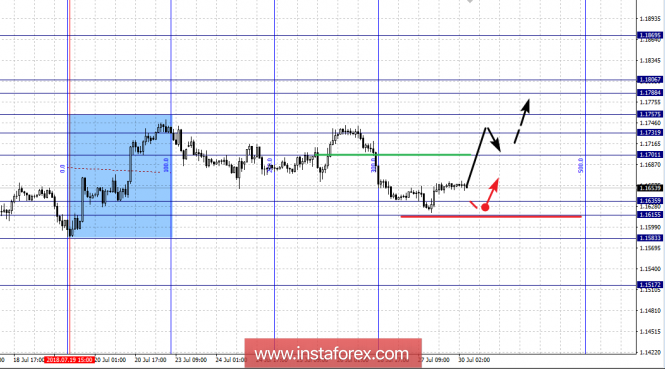

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1869, 1.1806, 1.1788, 1.1757, 1.1731, 1.1701, 1.1635, 1.1615 and 1.1583. Here, the price is in deep correction from the upward structure on July 19. In order to cancel this structure, passing the price of the noise range of 1.1635 - 1.1615 is required. In this case, the first potential target for the bottom is 1.1583. The continuation of the upward movement is expected after the breakdown of 1.1701. Here, the first target is 1.1731. In the area of 1.1731 - 1.1757 is short-term upward movement. The breakdown of 1.1757 will allow us to count on the expressed movement towards the level of 1.1788. In the area of 1.1788 - 1.1806 is the consolidation of the price. The potential value for the top is the level of 1.1869 (the more probable date is July 27), the movement towards which is expected after the breakdown of 1.1806.

The main trend is the upward structure of July 19, a deep correction.

Trading recommendations:

Buy: 1.1701 Take profit: 1.1730

Buy 1.1735 Take profit: 1.1755

Sell: 1.1653 Take profit: 1.1585

Sell: Take profit:

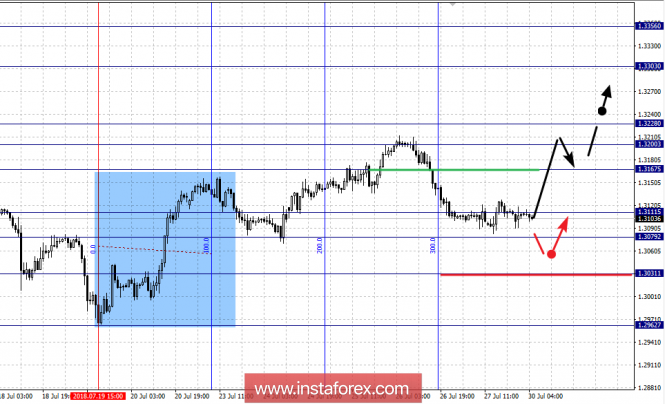

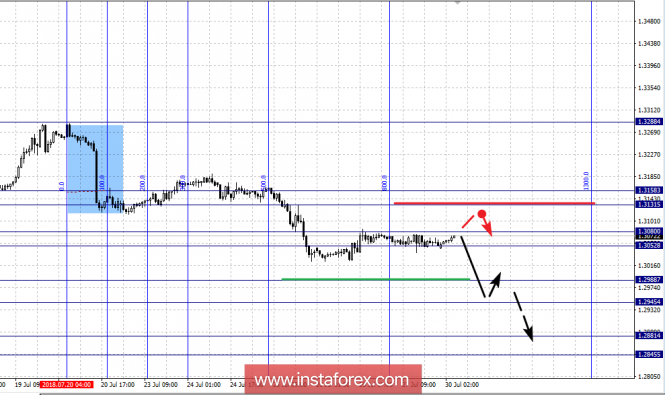

For the GBP / USD pair, the key levels on the H1 scale are 1.3356, 1.3303, 1.3228, 1.3200, 1.3167, 1.3111, 1.3079 and 1.3031. Here, we follow the development of the upward structure of July 19. At the moment, the price is in the corrective area. The continuation of the upward movement is expected after the breakdown of 1.3167. In this case, the first target is 1.3200. Passing the price of the noise range of 1.3200 - 1.3228 should be accompanied by a pronounced upward movement. Here, the target is 1.3303. Near this level is the consolidation of the price. The potential value for the top is the level of 1.3356. The probable achievement is July 26 - 27.

Short-term downward movement is possible in the area of 1.3111 - 1.3079. The breakdown of the latter value will lead to the formation of a downward structure. In this case, the target is 1.3031.

The main trend is the upward structure from July 19, the correction stage.

Trading recommendations:

Buy: 1.3167 Take profit: 1.3200

Buy: 1.3200 Take profit: 1.3226

Sell: 1.3110 Take profit: 1.3080

Sell: 1.3076 Take profit: 1.3031

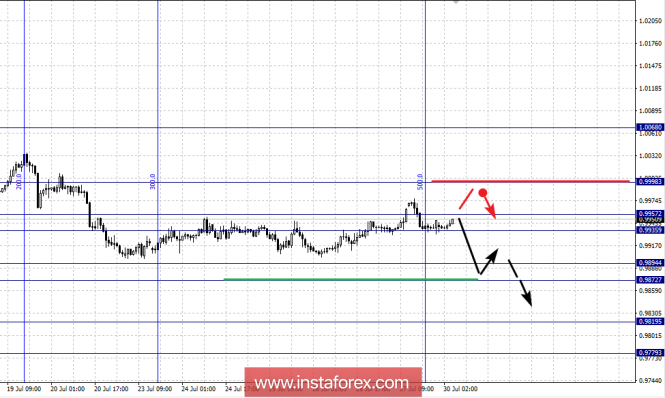

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9998, 0.9957, 0.9935, 0.9894, 0.9872, 0.9819 and 0.9779. Here, we continue to follow the downward structure of July 13 as the main one. The continuation of the downward movement is expected after passing through the noise range of 0.9894 - 0.9872. In this case, the target is 0.9819. The potential value for the bottom is the level of 0.9779. Upon reaching this level, we expect a rollback to the top.

Consolidated upward movement is possible in the range of 0.9935 - 0.9957. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9998. This level is the key support for the downward structure from July 13. Passing the price will lead to the development of the an upward trend. In this case, the potential goal is 1.0068.

The main trend is the downward structure from July 13, the correction stage.

Trading recommendations:

Buy: 0.9960 Take profit: 0.9995

Buy: 1.0000 Take profit: 1.0060

Sell: 0.9870 Take profit: 0.9822

Sell: 0.9817 Take profit: 0.9782

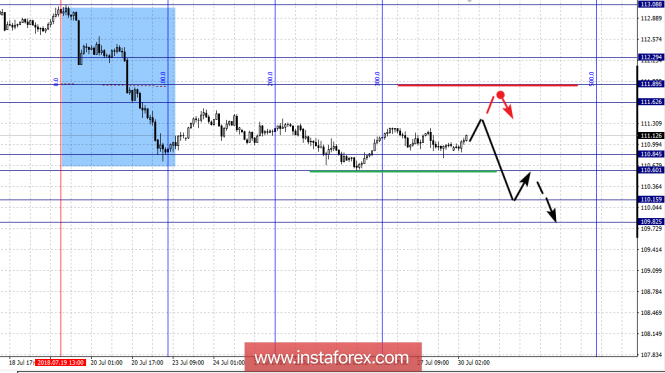

For the USD / JPY pair, the key levels on a scale are: 111.80, 111.42, 111.21, 110.84, 110.60, 110.15 and 109.82. Here, we follow the formation of the medium-term downward movement of July 19. The continuation of the movement downwards is possible after passing the price of the noise range at 110.84 - 110.60. In this case, the target is 110.15. Upon reaching this level, we expect the consolidation of the price. The potential value for the bottom is the level of 109.82, from which we expect a rollback to the top.

Short-term upward movement is possible in the area of 111.62 - 111.89. The breakdown of the last value will lead to in-depth correction. Here, the target is 112.29. This level is the key support for the downward structure from July 19.

The main trend is the formation of the medium-term structure of July 19.

Trading recommendations:

Buy: 111.62 Take profit: 111.87

Buy: 111.92 Take profit: 112.26

Sell: 110.58 Take profit: 110.17

Sell: 110.13 Take profit: 109.84

For the CAD / USD pair, the key levels on the H1 scale are: 1.3158, 1.3131, 1.3080, 1.3052, 1.2988, 1.2945, 1.2881 and 1.2845. Here, for the subsequent development of a downward trend, we expect the formulation of local initial conditions. Short-term downward movement is possible in the range of 1.2988 - 1.2945. We consider the level of 1.2881 to be a potential value for the downward trend. After it, consolidation is possible, and also a rollback to the top. At the moment, the price is in the final in the 8th time zone for the downward structure from July 20.

Short-term upward movement is possible in the area of 1.3052 - 1.3080. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3131. The range of 1.3131 - 1.3158 is the key support for the top.

The main trend is the downward structure from July 20, the correction stage.

Trading recommendations:

Buy: Take profit:

Buy: 1.3085 Take profit: 1.3130

Sell: 1.2985 Take profit: 1.2945

Sell: 1.2942 Take profit: 1.2884

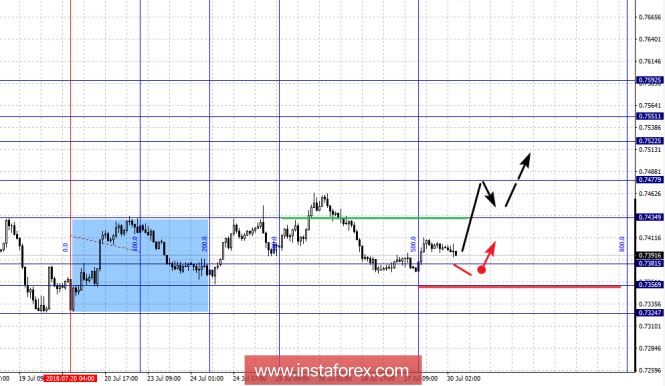

For the AUD / USD pair, the key levels on the H1 scale are: 0.7592, 0.7551, 0.7522, 0.7477, 0.7434, 0.7410, 0.7381, 0.7356 and 0.7324. Here, we follow the development of the upward structure of July 20. The continuation of the upward movement is expected after the breakdown of 0.7434. In this case, the first target is 0.7477. Near this level is the consolidation of the price. The breakdown of 0.7477 will allow us to count on the movement towards 0.7522. In the area of 0.7522 - 0.7551 is short-term upward movement as well as the consolidation of the price. The potential value for the top is the level of 0.7592. After reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 0.7381 - 0.7356. The breakdown of the last value will lead to the development of a downward structure. Here, the first target is 0.7324.

The main trend is the upward structure from July 20, the correction stage.

Trading recommendations:

Buy: 0.7436 Take profit: 0.7475

Buy: 0.7480 Take profit: 0.7520

Sell: 0.7378 Take profit: 0.7358

Sell: 0.7354 Take profit: 0.7326

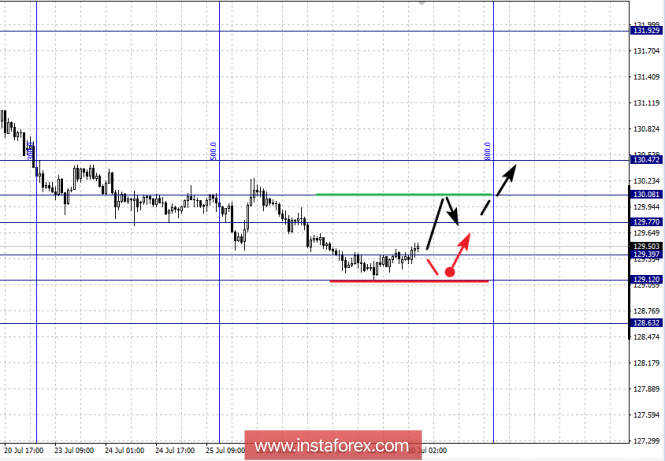

For the EUR / JPY pair, the key levels on the scale of H1 are: 130.47, 130.08, 129.77, 129.39, 129.12 and 128.63. Here, we follow the development of the downward movement of July 17, we are currently waiting for a correction. Consolidated movement is expected in the range of 129.39 - 129.12. The breakdown of the last value will allow us to count on the movement towards the potential target of 128.63. From this level, we expect a rollback and the development of the upward structure.

Short-term upward movement is possible in the area of 129.77 - 130.08. The breakdown of the last value will lead to in-depth correction and the formation of initial conditions for the top. In this case, the potential target is 130.47.

The main trend is a downward structure from July 17. We expect a departure towards correction and the formation of an upward structure.

Trading recommendations:

Buy: 129.77 Take profit: 130.05

Buy: 130.12 Take profit: 130.40

Sell: Take profit:

Sell: 129.08 Take profit: 128.65

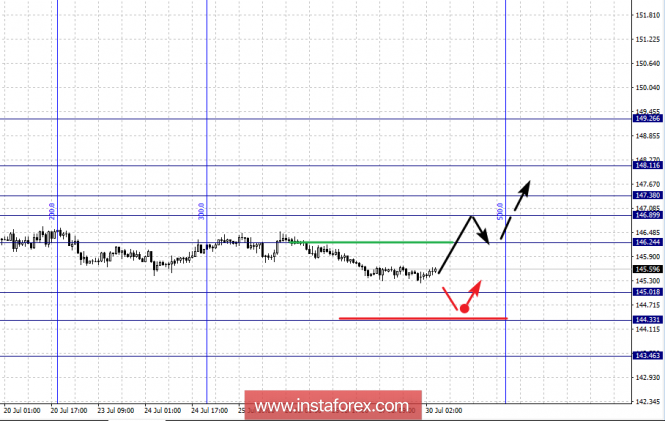

For the GBP / JPY pair, the key levels on the scale of H1 are: 148.11, 147.37, 146.89, 146.24, 145.01, 144.33 and 143.46. Here, we continue to follow the downward structure from July 16. Currently, we expect a correction. In area of 145.01 - 144.33 we expect short-term downward movement, as well as the consolidation of the price. The potential value for the bottom is the level of 143.46. The movement towards this level is expected after the breakdown of 144.30.

We expect the correction to continue after the breakdown at 146.24. In this case, the first target is 146.89. Short-term upward movement is possible in the area of 146.90 - 147.37. The breakdown of the last value will lead to the development of the an upward structure. Here, the first potential target is 148.11.

The main trend is a downward structure from July 16. We expect a correction.

Trading recommendations:

Buy: 146.30 Take profit: 146.85

Buy: 146.90 Take profit: 147.35

Sell: 145.00 Take profit: 144.45

Sell: 144.25 Take profit: 143.55

The material has been provided by InstaForex Company - www.instaforex.com