EUR/AUD has been quite impressive in the bearish bias which is widely expected to come to an end in the short term. AUD has been the dominant currency in the pair since Australia's Employment Change report was published with a significant increase, whereas EUR is still struggling in light of the ECB indecision on its monetary policy plans.

Today, the eurozone's retail PMI report was published with an increase to 51.7 from the previous figure of 48.6 which did not help the currency to sustain its bullish momentum it gained yesterday with certain impulsiveness.

On the other hand, today Australia's GDP report was published with an increase to 1.0% from the previous value of 0.5% which was expected to be at 0.9%. Such 100% increase in GDP helped AUD to gain good momentum over EUR that is expected to lead to further AUD gains in the coming days.

As for the current scenario, AUD is fundamentally quite strong in comparison to EUR, so AUD is going to keep momentum. Though recent economic reports from the eurozone are helping its currency to recover quite well, upcoming AUD gains might act quite slow in comparison to the earlier moves. However, AUD is still quite ahead of EUR and expected to continue dominating further in the nearest days.

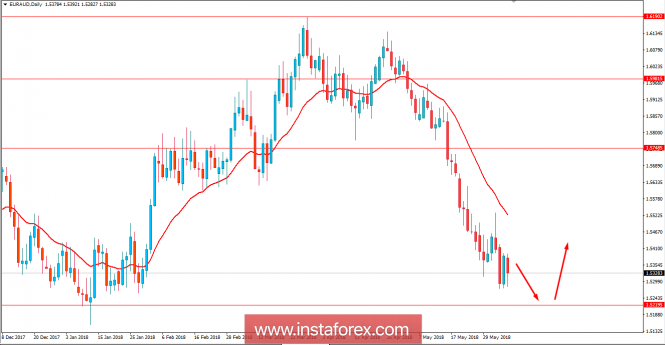

Now let us look at the technical view. The price is currently quite bearish which is expected to push the price further downward in the coming days. Though yesterday's bullish candle confused the market sentiment for a while, the current market structure says that the price is likely to push lower towards 1.52 area before showing any bullish intervention in the process.