Published on Thursday, data on consumer inflation in the US proved to be a good reason for fixing the previously received profits. However, it should be noted that they did state the fact of the presence of inflationary pressure, which remained in annual terms.

According to the presented data, the CPI, in annual terms, rose by 2.5%, which was in line with the growth forecast of 2.5% against the increase of 2.4% a year earlier. The monthly indicator for the month of April added only 0.2%, while an increase of 0.3% was expected. In March, the decrease was 0.1%. The base value of the consumer price index (CPI) kept the growth dynamics at 2.1% year by year, while it was assumed that the index will grow by 2.2%. Last month, the indicator slowed down its growth rate and added 0.1%, while the increase was expected to be the same as in March, by 0.2%.

After the publication of data on the currency markets, the dollar began to decline. Most noticeably, it fell against the commodity currencies including the Russian ruble, the Canadian dollar, and the Norwegian krone, which is primarily explained by the strong growth in crude oil prices on the wave of the US withdrawal from the nuclear deal with Iran. This became a harbinger of the restoration of old economic and political sanctions in relation to this country and the declaration of new ones.

Prices for crude oil rose to the highs in 2014, and if the escalation of tension continues, then we can expect a probable continuation of the price increase. However, their further growth can be restrained by the promises of Saudi Arabia to fill the shortage of Iranian oil in the world market. In addition, at the OPEC + summit, which is expected to take place this month, it may be decided either to end the pact aimed at reducing oil production, or to start a smooth increase in production.

Back to the dollar, despite the fact that he it was under pressure on Thursday, we believe that after a corrective decline in this position will improve and it will resume growth, since the probability of another rate hike in June is extremely high.

Forecast of the day:

The EURUSD pair is consolidating below the level of 1.1940 after local growth on profit taking. It is likely that today it will remain in the range, if not overcome the mark of 1.1940, then it is possible to continue local growth.

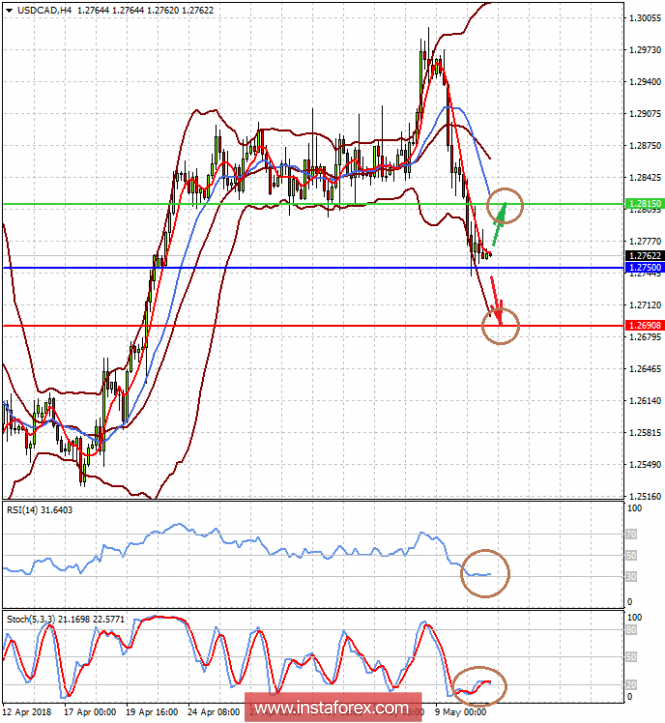

The USDCAD pair also consolidates above the 1.2750 mark. In the focus of the market is the dynamics of oil prices. If they start to adjust, we should expect the pair to rebound to 1.2815. However, the resumption of growth will lead to a drop in price to 1.2690 after overcoming the level of 1.2750.