EUR / USD

On Thursday, the expected correction of the euro on profit-taking by sellers occurred alongside the publication of Italy's positive indicators. Later this day, the slightly weaker forecasts of US inflation data will be release, which intensified this trend. In March, Italian Industrial Production added 1.2% (3.5% YoY vs. 2.5% YoY in February). In the US, the April CPI increased by 0.2% against the forecast of 0.3%, but retained an annual growth of 2.5%. The base CPI added 0.1% against the forecast of 0.2%, which maintained the index at its previous value on an annualized basis (2.1% YoY). The Core CPI is expected to grow by 2.2% YoY. The weekly report on the number of applications for US unemployment benefits showed 211 thousand against 219 thousand, and the released figure maintained a record low since 1969. The report on the federal budget execution for April showed a surplus of 214.3 billion dollars against the forecast of 201.2 billion dollars. Even the projected figure was the highest in the history of the United States, the published indicator exceeded this optimistic forecast. The US administration is scheduled to launch a media campaign on the success of Trump's reforms, even if the result was mainly from taxes for the past year.

Today, the euro area data does not come out. At 2:15 London time, ECB President Mario Draghi will speak on the topic of "The state of the Union: the 8th edition." Monetary policy (more precisely, its forecasts), probably will not be affected. In the US, the import prices for April will be issued, showing a forecast of 0.5% versus 0.0% in March. The US consumer confidence index from the University of Michigan in May is expected to drop slightly from 98.8 to 98.4.

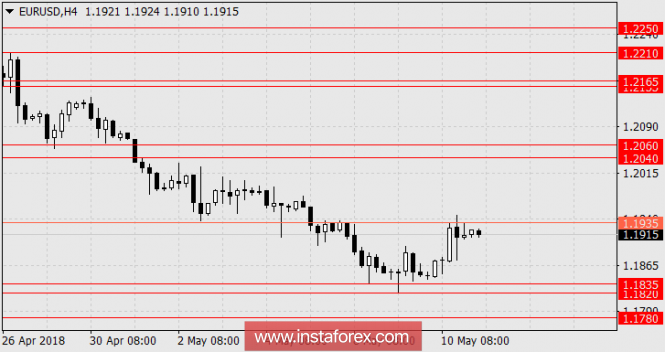

We are expecting for the decline of the single European currency to 1.1780.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com