Eurozone

Following the ECB meeting on Thursday, it kept the current monetary policy of zero-rate loan rate and a depositary rate of -0.4% unchanged. Actually, the meeting was held in strict accordance with expectations, and therefore, the foreign exchange market reacted calmly to the results.

The asset repurchase program is retained at least until September 2018, and there were no statements that could indicate an extension of the program's operation for a longer period. At the next press conference, Mario Draghi has delivered exactly the words that the market was waiting for him, focusing on the pace of the economic growth. According to him, the main threat is because of the external factors, in particular, Draghi singled out "protection risks". It's easy to see that Draghi was referring to the growing confrontation with the US on customs regulation and market openness between the closest allies.

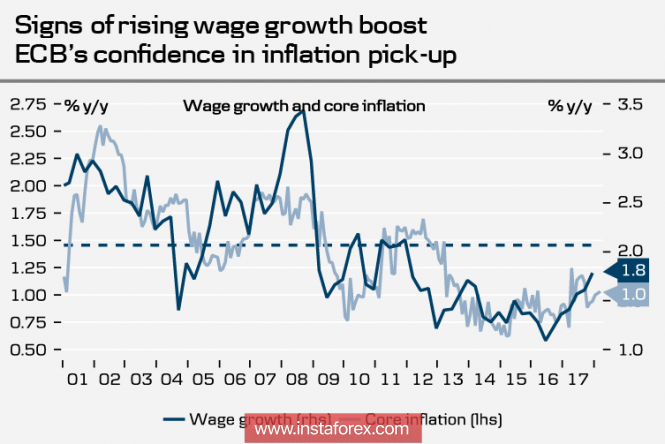

There is also a positive trend in wage growth, which increases the ECB's confidence in the growth of inflation.

At the same time, it should be noted that the growth of inflation will be based largely on the growth of prices for energy carriers, in particular, oil and with a certain lag - natural gas, which will reduce the competitiveness of the European economy. If current trends continue, then an expensive oil will provide an incentive for the development of the American economy and cause a flow of capital from the eurozone overseas. A trend that is dominant if one considers the prospects for the euro.

As a result of the day, the quotation of the EUR/USD pair fell to 1.21 and the prospect of updating the annual minimum became even more pronounced. For today, trades on the main currency pair will also go down with the possibility of the price to fall below the 200-day average, which runs at 1.2144.

United Kingdom

After the confidence of investors about the rate increase at the meeting of the Bank of England in May had seriously weakened by the statement of Mark Carney, the players began to pay attention to macroeconomic indicators, which lately seem to be unconvincing.

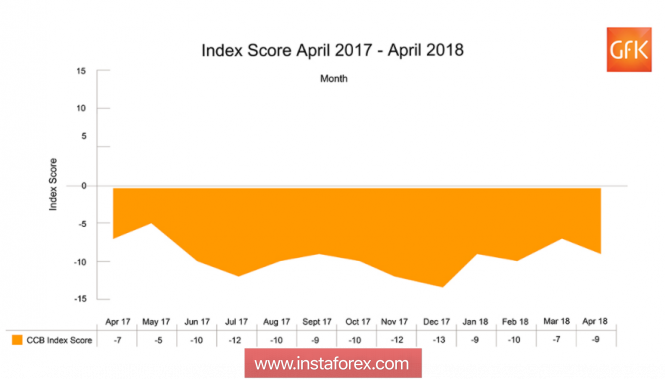

CBI notes a decrease in sales in retail trade by 2% in April, after which a decrease of 8%from a month earlier indicates the development of negative sentiment. The dynamics of industrial orders are negative as the index was 4p in April. The slowdown has been observed for the 5th month in a row. Production of cars in 1 square decreased by 6.3%, and the consumer confidence index from Gfk has firmly entrenched into the negative territory.

Today, the first preliminary estimate of GDP growth rates of 1 sq. M will be published but the forecasts are rather pessimistic. A 1.4% growth is expected on an annual basis, Real results may be worse given the prevalence of negative changes in recent months.

The Brexit situation has again played with new colors, wherein contradictions are growing in the British establishment. As you know, Teresa May intends to withdraw from the customs union with the European Union but the Upper House of the British Parliament decided to challenge her decision and plans to hold a vote on this matter in May. Internal contradictions weakened the position of the UK and exerted additional pressure on the pound.

Despite the fact that the pound is still in the uptrend, its power is in question. The next few days are spent under the sign of the dollar dominance. Meanwhile, the GBP / USD rate can already test the support of 1.3710 in the near future.

Oil

The price of oil is weaker, responding to EIA and API data on reserves. Published on Thursday, the EIA report showed an increase in crude oil reserves of 2.2 million barrels, while a decrease of 2.04 million is expected. However, quotations remained near the highs reached on the eve. The concept of "expensive oil" fits perfectly into the plan for reforming the American economy, since it allows to increase the loading of the industrial sector, and everything goes to the fact that the trend will continue. There is a risk of a correction to $ 70 per barrel in the coming days, but the overall trend remains growing.

The material has been provided by InstaForex Company - www.instaforex.com