AUD/USD has been quite non-volatile and impulsive with the bearish gains recently which lead the price to fall from 0.7750 to 0.7550 support area without any bullish interference along the way. AUD started to lose momentum against USD since the last week's worse Employment Change report was published along with an unchanged Unemployment Rate report. This week AUD failed to provide extra push with the economic reports to regain its momentum with counter pressure in the market. This week AUD CPI report was published with decrease to 0.4% from the previous value of 0.6% and Trimmed Mean CPI report was published with an increase to 0.5% as expected from the previous value of 0.4%. Though the result was quite mixed in nature but was not sufficient to provide the required momentum for AUD to push the price higher against AUD. Today AUD PPI report was published with slightly better than expected value of 0.5% though decreasing from the previous value of 0.6% which was expected to decrease to 0.4%. On the other hand, having series of positive economic reports recently USD managed to sustain its bearish momentum in the pair leading to extensive gains against AUD. Today USD Advance GDP report is going to be published which is expected to decrease to 2.0% from the previous value of 2.9%, Advance GDP Price Index report is expected to decrease to 2.2% from the previous value of 2.3% and Employment Cost Index is expected to increase to 0.7% from the previous value of 0.6%. Moreover, Revised UoM Consumer Sentiment is expected to have a slight increase to 98.0 from the previous figure of 97.8 and Revised UoM Inflation Expectation is expected to increase as well from the previous value of 2.7%. As of the current scenario, USD economic reports forecasts are not quite optimistic this time whereas AUD having a positive economic report today expected to show some bullish momentum in the pair whereas USD may lose some grounds in the process of corrective retracement. To sum up, AUD is expected to gain certain bullish momentum in the pair for the coming days before USD takes charge again to push the price much lower in the future.

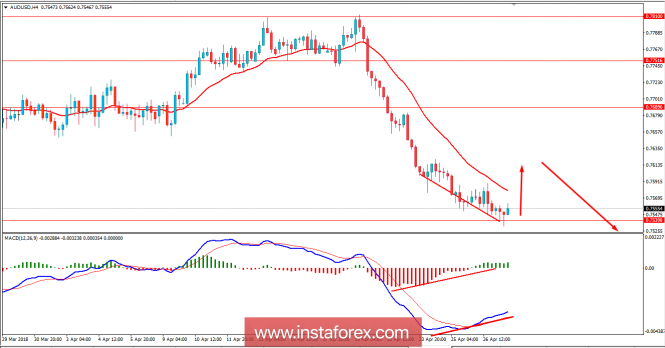

Now let us look at the technical view. The price is currently residing at the edge of 0.7550 support area from where it is expected to push higher towards 0.7800-50 area before showing any bearish impulsive price action in the coming days. AUDUSD having Bullish Divergence in place, the bullish retracement is expected to be quite imminent. As the price remains below 0.7750 with a daily close, a further bearish pressure is expected.