AUD/JPY is currently corrective itself in a volatile inside the mid-range between 82.00 to 84.50 area from where it is expected to push higher in the coming days. This week, AUD failed to provide extra push with the economic reports to regain its momentum with counter pressure in the market. This week, AUD CPI report was published with a decrease to 0.4% from the previous value of 0.6% and Trimmed Mean CPI report was published with an increase to 0.5%, as expected, from the previous value of 0.4%. Though the result was quite mixed in nature, but was not sufficient to provide the required momentum for AUD to push the price higher against JPY. Today, AUD PPI report was published with slightly better than expected value of 0.5% though decreasing from the previous value of 0.6% which was expected to decrease to 0.4%. On the JPY side, it gained certain momentum over AUD after having unchanged BOJ Policy Rate at -0.10% today. The BOJ Policy Statement has been quite hawkish with the increase in certain sectors which is expected to play a vital role in the economy development in the coming days. As of the current scenario, AUD is expected to gain certain momentum against JPY, but the corrective price action and volatile structure is going to persist further in the coming days until a strong high impact economic report on either side helps to gain impulsive momentum with definite non-volatile trend pressure.

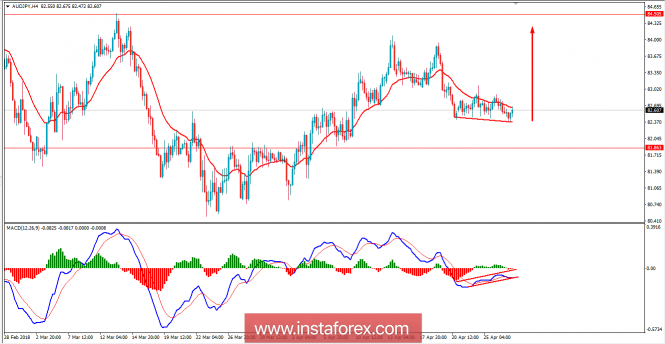

Now let us look at the technical view. The price has formed a bullish divergence recently which is expected to push the price higher in the coming days. Though the price is currently residing inside a corrective volatile range, but after violating the dynamic level of 20 EMA resistance, it is expected to push higher towards the 84.50 price area in the future. As the price remains above the 82.00 area with a daily close, further bullish pressure is expected to continue.