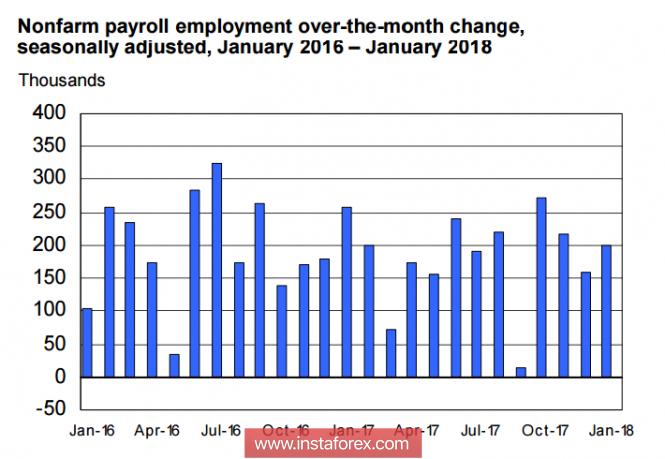

The pace of employment growth in January exceeded analysts' expectations. As published from the report of the Ministry of Labor in January, 200 thousand jobs were created. In addition, data for the month of December were revised upwards from 148 thousand to 160 thousand while the unemployment rate remained unchanged at 4.1%.

However, what's even more important is the growth in the average wage. Its growth in January was 0.3%, increasing year-on-year to 2.9%. This is the highest since June 2009.

For a long time, the Fed noted at its meetings that it expects inflation to increase. They are focusing on the "Philips rule", according to which the labor market recovery leads first to an increase in wages and then to an increase in inflation. This moment may have come. In any case, the markets have reacted in this vein. The S & P 500 index fell 2.1% to 2,762.13 points while the Dow Jones fell 665.75 points, this is the biggest drop in 9 years.

Why is there such a strong reaction? Obviously, the markets were frightened by the scenario in which the Fed, proceeding from high inflation growth rates, will raise rates this year not 3 times, but 4, which will lead to a rise in the cost of loans and, as a consequence, to a decrease in profits relative to the levels forecasted before.

How likely is this scenario? Judging by the reaction of the markets, it is quite possible, but if we proceed from the dynamics of the futures on the rate on CME, the reaction to the employment report may be excessive. The players do not yet see the serious danger of four rate increases. The market still believes in two increases in March and June and one more in September or December.

It has long been known that the Fed is not so much following market trends as trying to manage them. This is confirmed by a clear adherence to the earlier planned rate increase plan, which has been steadily growing for two years despite a number of serious shocks. It will most likely be the same this time with the plans for the rate intended to be left unchanged. The aggressive mood of the market will be paid off by comments of Fed officials on Monday. Immediately after the publication of the report, the head of the Federal Reserve Bank, Dallas Kaplan, said that the Fed is planning three increases this year and that the US economy, having received a "short-term push" from tax cuts, will slow down in 2019 and 2020.

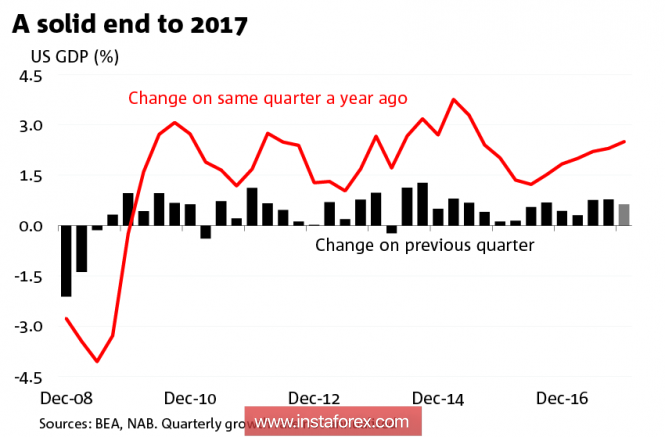

It is important to note that the excessive reaction of the markets to the employment report has strengthened along with a number of other indicators. GDP dynamics by the end of the year is on a solid growth trajectory. The GDPNow model from the Atlanta Federal Reserve Bank predicts a fantastic 5.4% growth for the first quarter, Markit and ISM indexes of business activity in January exceeded expectations, and the consumer confidence index from the University of Michigan rose again more than expected.

It is not expected for important macroeconomic data to be published this week. So, the markets will seek new levels of equilibrium. Attention will be directed to the rhetoric of the leadership of the Fed. There are quite a number of speeches planned. Since Trump has not yet appointed anyone to the post of vice chairman of the Fed, the most interesting event will be the speech of the head of the Federal Reserve Bank of New York, Dudley, who is currently considered the most influential member of the Cabinet.

The dollar, most likely, will try to develop success at the opening of trading on Monday. However, it is unlikely that the movement will be accented. Investors were not ready for strong movements on Friday. In particular, the CFTC report indicates that large players continued to get rid of long positions, preferring to buy franc and yen. Trades will most likely go into the lateral range in anticipation of the Fed's comments plus technical factors that require the completion of the correction of the dollar after a long period of decline will come to the forefront.

The material has been provided by InstaForex Company - www.instaforex.com