The British pound was caught by the spirit from the height at which it managed to climb. Having reached the maximum mark since the referendum on the membership of the Albion in the EU, pound sterling fell sharply against the background of strong statistics on the US labor market and disappointing data on business activity in Britain. Unlike the GBP / USD, which gained 4.5% since the beginning of the year, the weighted pound exchange rate was marked by much more modest results. This circumstance suggests that one of the drivers of the growth of the analyzed pair was the weakness of the dollar. As soon as investors began to turn to the last person, pound sterling felt uncomfortable.

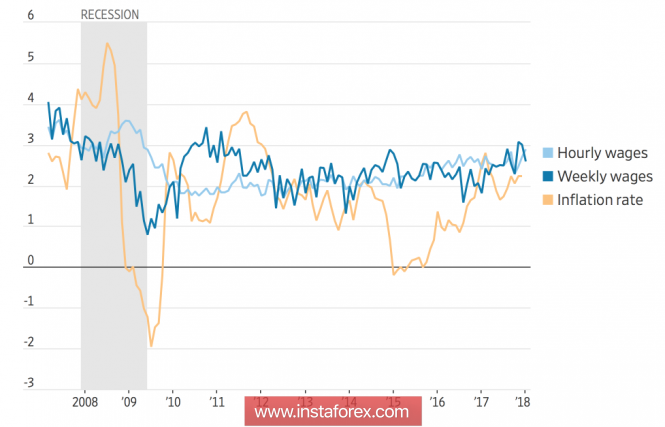

In January, employment growth outside the US agricultural sector (+200 thousand) exceeded the average in 2017 (+171 thousand), unemployment continues to feel comfortable near the 17-year lows, and average salaries accelerated to 2.9% y / y, the maximum mark for the last 8.5 years. Such statistics strengthen the risks of overclocking inflation, and in such conditions, the Fed simply must act aggressively. Much will depend on whether the January figures on labor remuneration are market noise or is it a trend? In my opinion, under the influence of fiscal incentives, wages will accelerate, which lays a solid foundation under the federal funds rate increase once a quarter.

Dynamics of inflation and average wages in the US

Source: Wall Street Journal.

It's another matter that the markets have not looked at the States at all recently. Investors perceive the negative as an excuse to sell the dollar, and the positive as a signal to accelerate not only the US, but the global economy. That, in turn, is seen as an argument in favor of the normalization of monetary policy by central banks-competitors of the Fed and, again, leads to the sale of the US dollar. In this regard, the increase in the probability of raising the BoE repo rate at the May meeting to 60% from 39% a month ago became a serious driver of the GBP / USD rally. This happened after Mark Carney said about the economy of the Foggy Albion passed by the day and expressed optimism about the prospects for growth of real incomes of the population.

Now, the Bank of England will have to prove its "hawkish" spirit. It turns out that the pound can continue the northern campaign. Although personally, I doubt that before the conclusion of the trade deal with the EU. The regulator will decide to indicate its desire to tighten monetary and credit policy. Moreover, data on business activity for January disappointed. The construction sector was especially upset, which not only did not go below the critical mark of 50, but also marked the worst growth in employment in the last 18 months. Thus, the BoE meeting on February 8 allows the pound sterling to claim the role of the most interesting currency of the week.

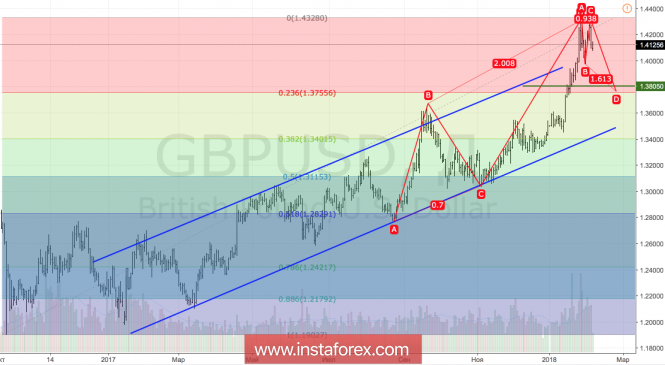

Technically, it will be important for the "bears" to update the correctional low near the psychologically important level of 1.4. If their attack succeeds, the AB = CD pattern will be activated, and the correction risks in the 1.3755-1.3805 direction will increase.

GBP / USD, daily chart